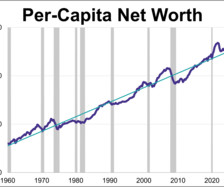

CoreLogic: 1.1 million Homeowners with Negative Equity in Q4 2024

Calculated Risk

MARCH 13, 2025

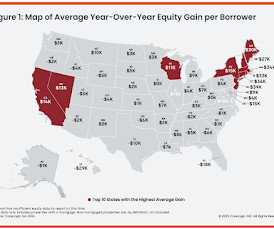

From CoreLogic: CoreLogic: Borrowers Gained Over $280B in Home Equity in 2024 CoreLogic. today released the Homeowner Equity Report (HER) for the fourth quarter of 2024. Nationwide, borrower equity increased by $281.9 billion, or 1.7% year-over-year. The report shows that U.S. homeowners with mortgages (which account for roughly 61% of all properties) saw home equity increase by about $4,100 between Q4 2023 and Q4 2024, which is less than the gain of $6,000 in Q3 2023.

Let's personalize your content