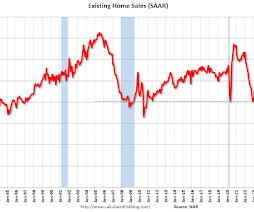

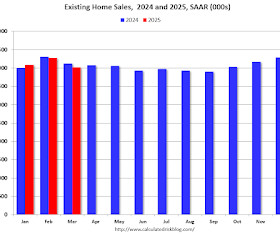

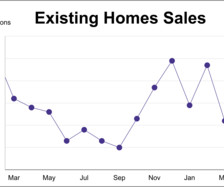

NAR: Existing-Home Sales Decreased to 4.02 million SAAR in March; Down 2.4% YoY

Calculated Risk

APRIL 24, 2025

From the NAR: Existing-Home Sales Receded 5.9% in March Existing-home sales descended in March, according to the National Association of REALTORS. Sales slid in all four major U.S. regions. Year-over-year, sales dropped in the Midwest and South, increased in the West and were unchanged in the Northeast. Total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops fell 5.9% from February to a seasonally adjusted annual rate of 4.02 millio

Let's personalize your content