Fee Compression Hasn’t Played Out, But Margin Compression Is Real

Wealth Management

SEPTEMBER 13, 2024

Additional services can justify fees to clients, but RIA owners must also prove those services benefit their bottom lines.

Wealth Management

SEPTEMBER 13, 2024

Additional services can justify fees to clients, but RIA owners must also prove those services benefit their bottom lines.

Abnormal Returns

SEPTEMBER 13, 2024

Listening The 'Acquired' podcast is selling out arenas with the help of Zuck. (nytimes.com) Podcast 'historians' aren't bound by anything resembling the truth. (theatlantic.com) Economy Jack Forehand and Matt Zeigler talk with Ed Yardeni about the potential for a 'Roaring 20's.' (youtube.com) James Pethokoukis talks American dynamism with Katherine Boyle who is a general partner at VC giant Andreessen Horowitz.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 13, 2024

In other news, Betterment rebrands advisor unit, Janney builds a new portfolio construction tool and other announcements.

Nerd's Eye View

SEPTEMBER 13, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the SEC this week fined 4 RIAs for violations of its marketing rule related to their claims that they offered 'conflict-free' financial advice. Which means that while many fee-only RIAs use the reduced conflicts that come with the fee-only model (as opposed to firms that receive compensation from commissions and other sources) as a key marketing talking point, the fact rem

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

SEPTEMBER 13, 2024

More marketing is not the solution to organic growth for most advisors.

Calculated Risk

SEPTEMBER 13, 2024

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in August A brief excerpt: NOTE: The tables for active listings, new listings and closed sales all include a comparison to August 2019 for each local market (some 2019 data is not available). This is the second look at several early reporting local markets in August.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 13, 2024

From BofA: Since our last weekly publication, our 3Q GDP tracking estimate remains unchanged at 2.3% q/q saar while our 2Q GDP tracking estimate went down two-tenths to 2.8% q/q saar. [Sept 13th estimate] emphasis added From Goldman: We lowered our Q3 GDP forecast to 2.5% (qoq ar) [Sept 10th estimate] And from the Atlanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.5 percent on September 9, up from 2.1 percent on S

Wealth Management

SEPTEMBER 13, 2024

Why entrust such a big-ticket financial item solely to the whims of a teenager?

The Big Picture

SEPTEMBER 13, 2024

This week, we speak with David Rubenstein , Co-Founder and Co-Chairman of The Carlyle Group , which manages over $426 billion is private equity, credit and venture funds. Prior to forming the firm in 1987, David practiced law and served as Deputy Assistant to the President for Domestic Policy, as well as Chief Counsel to the U.S. Senate Judiciary Committee’s Subcommittee on Constitutional Amendments.

A Wealth of Common Sense

SEPTEMBER 13, 2024

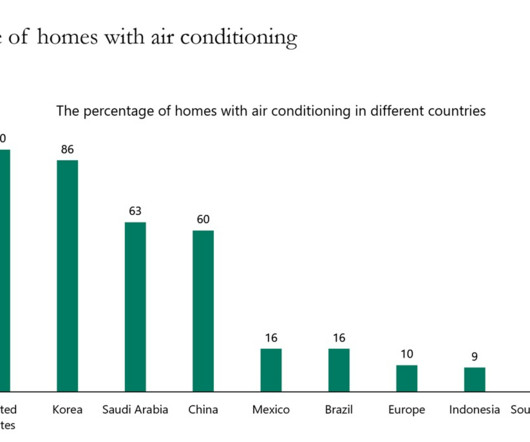

Mario Draghi, the former Jerome Powell of the European Union, was tasked with writing a detailed report on the economic competitiveness (or lack thereof) in Europe. His findings are striking. Here are some facts and figures that stood out: Across different metrics, a wide gap in GDP has opened up between the EU and the US, driven mainly by a more pronounced slowdown in productivity growth in Europe.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

SEPTEMBER 13, 2024

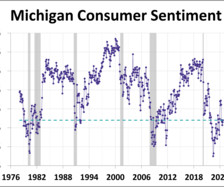

Consumer sentiment rose to its highest reading since May 2024, according to the preliminary September report for the Michigan Consumer Sentiment Index. The index rose 1.1 points (1.6%) from August's final reading to 69.0. The latest reading was above the forecast of 68.3.

Truemind Capital

SEPTEMBER 13, 2024

I met a client whose father passed away recently. He had no idea of where the investments were made by his father. After a lot of trouble, he could access a few details from his father’s email inbox and WhatsApp messages. The investments were all over the place and he was not even sure if all the assets were accounted for. Check out these mind-boggling numbers from India : – Despite tech initiatives and public awareness campaigns, the unclaimed monies held by public and private secto

Trade Brains

SEPTEMBER 13, 2024

The Indian equities market is heavily impacted by Foreign Institutional Investors (FIIs) and Foreign Portfolio Investors (FPIs). They are currently investing billions, which affects the mood of the market and stock prices. Stocks frequently respond favorably to FII investments, driving up prices. As FPIs look for possibilities in India’s expanding economy, this trend keeps going.

Advisor Perspectives

SEPTEMBER 13, 2024

How are bull and bear markets defined and how should you approach them as an investor?

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Random Roger's Retirement Planning

SEPTEMBER 13, 2024

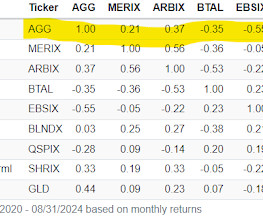

Dan Solin wrote an article for Advisor Perspectives titled It's Increasingly Difficult To Defend Your Complex Portfolio. Dan is a big fish but there are still things in the article that we can dig into and push back on. With regard to complexity, generally I hope that long time and frequent blog readers will recall my preference for a lot of simplicity hedged with a little bit of complexity.

Advisor Perspectives

SEPTEMBER 13, 2024

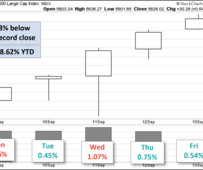

The S&P 500 finished the week ending September 13 up 4.02% from last Friday. The index is currently 0.73% off its record close from July 16th, 2024 and is now up 18.62% year-to-date.

NAIFA Advisor Today

SEPTEMBER 13, 2024

On September 5th, the city of Fargo was home to the second annual Building Business Together (BBT) conference hosted by E4 Insurance Services. The event brought together a dynamic mix of industry professionals, thought leaders, and esteemed guests. This year's BBT conference also marked the milestone celebration of their newly awarded title, Financial Security Champion of the Year , bestowed by NAIFA.

Advisor Perspectives

SEPTEMBER 13, 2024

Investors are using their massive cash piles to lock in attractive yields in global bond markets, helping to limit losses in the asset class, according to Mohamed El-Erian.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Carson Wealth

SEPTEMBER 13, 2024

Seasonal market volatility is here. Historically, September is the worst month of the year for the stock market. Carson Group’s Chief Market Strategist Ryan Detrick and VP, Global Macro Strategist Sonu Varghese share their insights about what investors can expect. Highlights include: September and October tend to see market volatility during presidential elections The Fed is adjusting policy now that inflation is under control, but employment risks have started We’re likely to see a Fed

Advisor Perspectives

SEPTEMBER 13, 2024

The Federal Reserve is likely to lower interest rates by a quarter-point next week and at each of the two meetings that follow, according to economists surveyed by Bloomberg News.

Trade Brains

SEPTEMBER 13, 2024

Arkade Developers Limited Company is coming up with an IPO size of Rs. 410 crore. The entire amount will be a fresh issue. The IPO will open on 16th September 2024 and close on 19th September 2024. It will be listed on the exchange on 24th September 2024. In this article, we will look at the Arkade Developers IPO 2024 and analyze its strengths and weaknesses.

Advisor Perspectives

SEPTEMBER 13, 2024

In a niche corner of the bond market, an almost $140 billion wave of maturing debt is poised to lend momentum to what is already one of Wall Street’s hottest hedge fund trades.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Validea

SEPTEMBER 13, 2024

Validea’s Peter Lynch strategy is based on the investment philosophy of legendary fund manager Peter Lynch, who ran Fidelity’s Magellan Fund from 1977 to 1990. The strategy focuses on identifying companies with strong growth potential at reasonable prices, often referred to as “growth at a reasonable price” or GARP investing.

Advisor Perspectives

SEPTEMBER 13, 2024

The single-stock ETF frenzy is going global, with a new bid to launch products that give US traders a way to bet directly on overseas companies — without fretting about currency risk.

Validea

SEPTEMBER 13, 2024

Below is our trend following update for September of 2024. Our trend following system uses multiple moving averages to identify the long-term trend in a variety of equity indexes, asset classes, sectors and investment styles. All the major asset classes and equity indexes remain in uptrends with the exception of commodities. All sectors remain in uptrends according to our system.

Advisor Perspectives

SEPTEMBER 13, 2024

As we approach the end of 2024, the latest Consumer Price Index (CPI) report from the Bureau of Labor Statistics (BLS) has provided us with critical insights into the health of the U.S. economy, particularly concerning inflation.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Validea

SEPTEMBER 13, 2024

Small-cap value investing has been a market beating strategy over the long-term, despite its struggles in recent years. This approach focuses on smaller companies (typically with market capitalizations between $300 million and $2 billion) that are undervalued relative to their fundamentals. There are several reasons why this strategy has proven effective over time: Information inefficiency: Smaller companies are often overlooked by large institutional investors and receive less analyst coverage.

Advisor Perspectives

SEPTEMBER 13, 2024

Earlier this year, the Federal Reserve seemed to have time on its side. Payrolls were growing at a healthy clip and the unemployment rate hovered near a five-decade low. Even though there were signs that inflation was licked, there didn’t appear to be much harm in keeping interest rates elevated for a while longer — just in case.

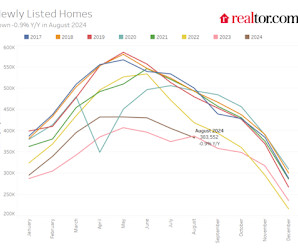

Calculated Risk

SEPTEMBER 13, 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-September 2024 A brief excerpt: This 2-part overview for mid-September provides a snapshot of the current housing market. I always focus first on inventory, since inventory usually tells the tale ! Here is a graph of new listing from Realtor.com’s August 2024 Monthly Housing Market Trends Report showing new listings were down 0.9% year-over-year in August.

Advisor Perspectives

SEPTEMBER 13, 2024

Balanced risks to inflation and employment indicate it’s time for the Fed to normalize interest rates, enhancing a positive backdrop for bonds.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content