Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Wealth Management

JULY 2, 2025

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. Gen X, or those currently aged between 45 and 60 years, will receive nearly $13.9 trillion annually.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

Yardley Wealth Management

DECEMBER 17, 2024

Understanding the Current Economic Landscape Before diving into goal-setting, it’s crucial to acknowledge the economic environment we’re navigating. Interest rates remain a significant factor in financial planning, affecting everything from mortgage rates to investment returns.

WiserAdvisor

JUNE 16, 2025

One impulsive decision or economic downturn can turn the tables over. exposes you to localized risks that can come from changing political regimes, new tax laws, economic downturns, inflationary periods, and more. You would require tax planning, investment management, legal assistance, and more.

Tobias Financial

AUGUST 5, 2025

During our latest Quarterly Market Update Webinar, our Portfolio Manager, Charles “Chad” NeSmith, CFA, CFP®, and Wealth Advisor, Franklin Gay, CFP®, EA , reviewed recent market activity and provided insights into how the legislation, along with broader economic trends, may shape financial planning strategies in the months ahead.

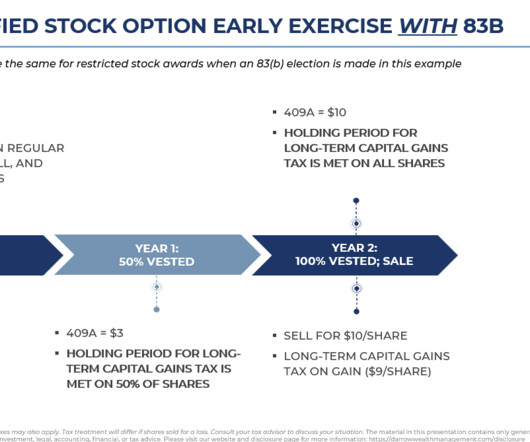

Darrow Wealth Management

APRIL 23, 2025

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. It’s usually a key part of pre-IPO tax planning and exit strategies. Company’s growth prospects. Your shares still need to vest.

Carson Wealth

JUNE 27, 2025

In addition to common types of insurance such as auto, property, and life insurance, you might consider kidnap and ransom insurance, insurance for luxury items, customized liability coverage that can extend coverage limits for other policies, business and succession planning insurance, etc. Tax planning. Tax planning is crucial.

Carson Wealth

FEBRUARY 4, 2025

While most taxpayers dont need to worry about estate and gift taxes, having significant assets can make them a challenge. Also, like most UHNW individuals, you may have income from several sources like investments, real estate, and business interests that may require special tax planning. In fact, in 1963, the top rate was 91%.

Harness Wealth

APRIL 28, 2025

This article explores the distinctions between K-1 and 1099 reporting, explaining their impact on tax planning, basis calculations, filing deadlines, and strategies to optimize your after-tax returns from alternative investments.

Wealth Management

JUNE 11, 2025

Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning. Resourceful agents will figure this out.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. To qualify for tax-free treatment under IRC Section 368 , attention to detail is essential.

Harness Wealth

AUGUST 6, 2025

based research expenses that now qualify for immediate tax write-offs) represent a fundamental shift in business tax planning. This seemingly straightforward change requires tax advisors to conduct comprehensive reviews of client entity structures.

Midstream Marketing

NOVEMBER 6, 2024

Share economic signs and how they might affect your investment strategies. Retirement Planning: Give tips on how to save for retirement. Tax Planning: Help clients learn smart tax strategies. Here are some ideas for content themes: Market Trends and Analysis: Describe what is going on in the market.

Harness Wealth

FEBRUARY 4, 2025

Credit funds also tend to have longer holding periods and unique tax considerations. Risks: Credit risk, interest rate fluctuations, illiquidity, economic downturn exposure, and reliance on the fund manager’s expertise. How Are Alternative Investments Taxed? This article is a product of Harness Tax LLC.

Harness Wealth

JULY 31, 2025

In 2025, the agency’s strategic deployment of artificial intelligence represents a fundamental shift in how tax compliance will be monitored and enforced, with over 68 AI-related projects already transforming everything from routine audits to complex investigations.

Harness Wealth

MAY 2, 2025

The Tax Cuts and Jobs Act (TCJA)the 2017 tax code overhaul designed to boost economic growthis set to expire on December 31, 2025. Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect.

Harness Wealth

JULY 14, 2025

While software options can cost anywhere up to $100 for individual returns (with many being free), professional tax preparers charge anywhere from $200 to $600 or more, making software an economically attractive choice for many taxpayers.

Abnormal Returns

JULY 23, 2025

podcast.moneywithkatie.com) BBB What the BBB leaves the same, tax planning-wise. defector.com) How to take advantage of your 0% capital gains tax bracket. (rationalreminder.libsyn.com) Katie Gatti Tassin talks the future of retirement with Jonathan Grimm, author of "The Future Poor." morningstar.com) How Trump Accounts work.

Zoe Financial

MAY 23, 2023

Economic Data: Leading Economic Index (LEI) fell 0.6% Nasdaq was up even more, 3% for the week, for the week (it is now up 21% year to date). What’s going on beneath the surface? April jobs number was strong. Large technology companies went up. The AI story – disruptive new technology. in April. FOMC minutes.

Harness Wealth

MAY 14, 2025

By exploring these nuances, you can better appreciate the tax advantages and responsibilities that come with running a Co-op. Understanding Co-op Taxes Key Tax Deductions and Credits Tax planning tips for a Co-op Final Thoughts on Understanding Co-op Taxes Partner with Harness for Expert Tax Support What Is a Cooperative (Co-op)?

Zoe Financial

JUNE 5, 2023

Economic Data: Last week we saw the debt ceiling resolution in Washington, great news. The Stock Market: The S&P 500 was up 1.8% for the week. May was fairly flat at 0.4%, but year-to-date at 11.5%. Nasdaq was up 2% for the week and is now up more than 26% year-to-date. May’s payrolls number came in better than expected.

James Hendries

SEPTEMBER 7, 2022

1 Yet many economic indicators, notably employment, remain strong. recessions and expansions are officially measured and declared by the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER), a private nonpartisan organization that began dating business cycles in 1929. Strong Employment.

Zoe Financial

DECEMBER 5, 2023

Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Economies and markets fluctuate.

International College of Financial Planning

SEPTEMBER 7, 2024

At its core, the CFP® Fast Track equips you with the expertise to offer sound financial advice, specializing in areas such as retirement planning, risk management, tax planning, and wealth management. By pursuing this course, you become proficient in helping individuals and companies achieve their financial goals.

Zoe Financial

JANUARY 17, 2024

The second headline was Edelman Financial engines closed down their tax prep services (separate/different from their tax planning services). But they did close tax prep. And this is just a reality, which is tax implementation is time-consuming and it’s often offered because clients want more for that 1%.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. This practical experience is vital because it connects theoretical knowledge with real-world implementation.

International College of Financial Planning

JULY 31, 2023

They are professionals who hold specialized degrees or certifications in finance, economics, or related fields. Their knowledge extends to various investment products, risk management, tax implications, and financial planning. Mitigating Tax Implications: Investment decisions can have significant tax implications.

International College of Financial Planning

MARCH 9, 2024

These professionals excel in dissecting and understanding the multifaceted aspects of an individual’s economic life, encompassing investments, savings, tax planning, and retirement strategies. This customized approach ensures that clients are not just numbers but partners in a journey toward financial stability and growth.

WiserAdvisor

JANUARY 27, 2023

Economic and market conditions are also likely to change over time, and investors may need to adjust their goals and strategies in response to these changes. Pay attention to tax planning Tax planning is another critical aspect of high-net-worth wealth management.

WiserAdvisor

MARCH 19, 2024

These investments serve not only to grow their wealth but also to protect it against market volatility and economic downturns. They are characterized by rapid economic growth and increasing integration with the global economy. Political unrest in these regions can disrupt economic activities and erode investor confidence.

Gen Y Planning

FEBRUARY 1, 2023

Our generation has lived through some of modern history’s most monumental economic and social events. Everyone has unique stressors, but the most common are saving money, managing debt, and planning for retirement. Generation Y has, for lack of a better term, “been through it.” The result? Stress, and for some, lots of it.

International College of Financial Planning

OCTOBER 26, 2023

They’re well-versed in recommending vital products like life insurance and are wizards at tax planning. As a financial advisor, it’s crucial to grasp the intricacies of financial products and understand the broader economic landscape. Typical areas of study include finance, economics, business, and accounting.

International College of Financial Planning

JULY 10, 2023

Investment advisors analyze market trends, assess the client’s economic situation, and develop personalized investment strategies tailored to their goals and risk tolerance. Investment advisors can also specialize in specific areas such as retirement planning, tax planning, or portfolio management.

Harness Wealth

MAY 14, 2025

These forms are designed to capture income, deductions, credits, and other relevant financial information in accordance with Hawaiis tax code. Unlike federal forms, Hawaii tax forms often include state-specific adjustments and considerations that reflect the unique economic and social environment of the islands.

Brown Advisory

DECEMBER 4, 2017

presidential election, we have grappled with the lack of clarity regarding the details of new tax legislation. The outcome of the tax reform debate is likely to impact how we advise clients on tax planning, estate planning and a host of other topics. Since last year’s U.S. Those conditions do not exist today.

Indigo Marketing Agency

FEBRUARY 27, 2024

In our Advisor Spotlight Series, we aim to highlight our amazing financial advisors who go above and beyond, whether through volunteer work, unique tax planning, or thought leadership (just to name a few).

International College of Financial Planning

AUGUST 2, 2021

Accounting & Tax Planning Firms. A bachelor’s degree in the field of finance, law, business, accounting, or economics is the minimum qualification you need to be a financial advisor in India. Fast-growing investment, tax planning industry. Banks & NBFCs. Brokerage Firms. Insurance Companies. Opportunities.

Diamond Consultants

AUGUST 9, 2022

The key for a breakaway team is to assess the importance of the short-term versus long-term economic considerations since options that provide more upfront capital typically offer a lower ongoing net payout. Support & Resources.

Harness Wealth

MAY 2, 2025

The Tax Cuts and Jobs Act (TCJA)the 2017 tax code overhaul designed to boost economic growthis set to expire on December 31, 2025. Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect.

Harness Wealth

MAY 15, 2025

Available Tax Credits Businesses may qualify for credits such as job tax credits, investment credits, and credits for certain types of property improvements. These credits are designed to stimulate economic development within the state.

Carson Wealth

SEPTEMBER 14, 2023

.” Mistake 3: Not Understanding the Difference Between Estate Tax and Income Tax I find it’s extremely common for these to become conflated, but a small business owner needs to understand both in order to maximize their tax position. The goal of estate tax planning is to help the next generation.

Carson Wealth

JULY 26, 2023

So, from an economic standpoint, it’s essential to plan for the future as that’s likely where you will realize the bulk of your lifetime wealth. Start succession planning as soon as you start the business, or as I like to say: “now.” The best advice?

Indigo Marketing Agency

OCTOBER 6, 2020

In fact, I’m one of the oldest of the millennial generation and I need help from my advisor with all of the following: Retirement planning. Tax planning. College planning for my kids. Long-term care planning. Estate planning. As millennials get older, their financial complexity keeps growing. Life insurance.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content