Debt Management in Estate Planning

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

NOVEMBER 10, 2023

What if a client burdened with substantial debts or liabilities from their business unexpectedly passes away?

WiserAdvisor

JUNE 4, 2025

The financial planning industry is constantly undergoing change. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year. They would also want to plan how and when to withdraw funds since different accounts come with different tax implications.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Advisor Perspectives

SEPTEMBER 13, 2023

Incorporating debt planning into your services helps your clients achieve a more comprehensive and sustainable financial future.

Nerd's Eye View

AUGUST 15, 2022

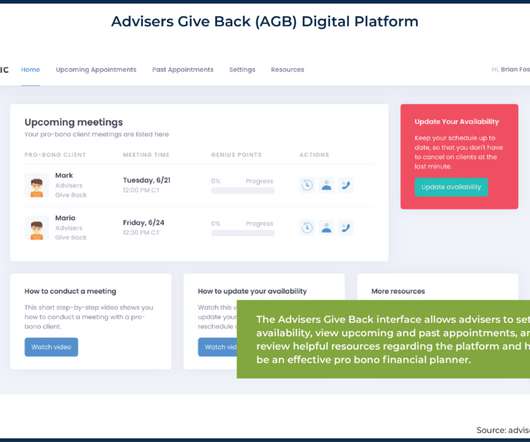

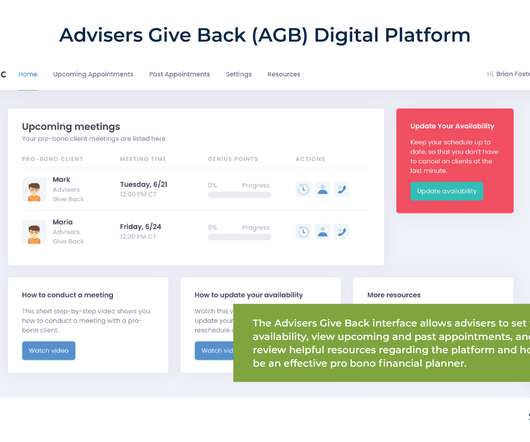

By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. Pro bono financial planning refers to free, no-strings-attached financial advice and planning for underserved people. Read More.

Nerd's Eye View

AUGUST 15, 2022

By helping clients develop financial goals, creating a financial plan, and supporting the implementation and monitoring of the plan, advisors help clients live their best lives. Pro bono financial planning refers to free, no-strings-attached financial advice and planning for underserved people. Read More.

Yardley Wealth Management

DECEMBER 17, 2024

Garry Esquire, CFP®, MBA Founder & CEO of Yardley Wealth Management Setting meaningful financial goals in 2025 requires more than just wishful thinking – it demands a strategic, well-planned approach. Interest rates remain a significant factor in financial planning, affecting everything from mortgage rates to investment returns.

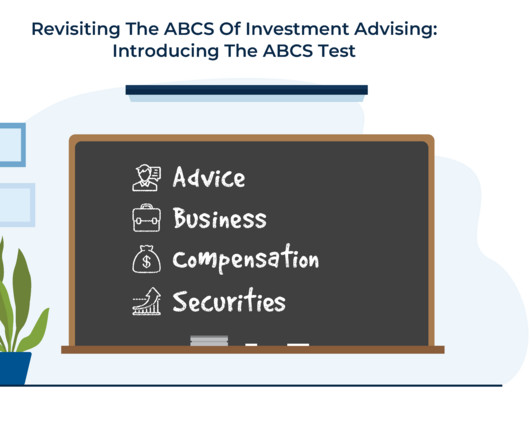

Nerd's Eye View

DECEMBER 6, 2023

Notably, while many financial coaches satisfy the majority of these requirements – they are in the business of offering advice to clients and are compensated as such – they often steer clear of making specific securities recommendations, focusing instead on areas like budgeting, debt management, savings, and retirement planning.

Clever Girl Finance

DECEMBER 1, 2022

No one cares about your financial well-being more than you, so it's important to have a financial plan for yourself. Knowing how to make a financial plan will allow you to save money, afford the things you really want, and achieve long-term goals like saving for college and retirement. What is a financial plan?

Carson Wealth

AUGUST 25, 2022

Among these are your longevity, lifestyle, comfort with market performance, sequence of return risk, current health, housing plan, proportion of fixed to variable expenses, proximity to children and so much more. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“

Carson Wealth

JANUARY 4, 2024

Your financial focus and planning in each decade should follow suit. Which decade should you really start to plan for retirement? Which decade should you really start to plan for retirement? Which decade should you focus on managing debt? Planning in Your 20s Is youth wasted on the young? Invest in yourself.

WiserAdvisor

NOVEMBER 4, 2022

Your expenses get divided, your debts are lessened, and your assets are increased. In addition to this, you can save more and plan for more significant purchases with greater ease. For these reasons and several others, it is essential to follow specific financial planning tips for dual-income families.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Nationwide Financial

MARCH 13, 2023

According to New York Fed’s quarterly Household Debt and Credit Survey (HHDC), the total consumer debt reached $16.5 1 Debt can feel like an overwhelming obstacle for many people, and it can be difficult to manage alone.

MainStreet Financial Planning

SEPTEMBER 12, 2024

In this article, we’ll explore three key areas: savings, debt management, and investment strategies, and provide actionable advice to help you stay ahead of the curve. Debt Management While lower interest rates are good news for borrowers, high-interest debt will still weigh heavily on your finances.

Fortune Financial

SEPTEMBER 5, 2023

Navigating Record-High Credit Card Debt With a Solid Financial Plan Credit card debt has reached a record high of $1 trillion despite high borrowing costs that may continue rising, according to recent data from the Federal Reserve. Work with a Fortune Financial advisor to learn how to manage your current debt.

Fortune Financial

SEPTEMBER 5, 2023

Navigating Record-High Credit Card Debt With a Solid Financial Plan Credit card debt has reached a record high of $1 trillion despite high borrowing costs that may continue rising, according to recent data from the Federal Reserve. Work with a Fortune Financial advisor to learn how to manage your current debt.

Clever Girl Finance

JANUARY 22, 2024

A trained counselor can guide you through steps to help you manage your money , such as evaluating what you need to improve. Money management includes things like setting up a budget or a better budget, monitoring your credit, and planning ahead with sinking funds for big expenses. find money stressful.

Don Connelly & Associates

NOVEMBER 4, 2024

Your role as a financial advisor is to listen carefully, ask probing questions, and translate these expressions into actionable plans created around their biggest concerns, preferences, and priorities.

WiserAdvisor

JULY 3, 2023

A financial advisor can help you understand the intricacies of financial planning for physicians. Below are 6 common financial planning mistakes physicians make: Even though financially well-off, physicians tend to make several financial mistakes. Many physicians do not have a budget to help them plan their finances for every month.

Trade Brains

SEPTEMBER 6, 2024

As a leading force in India’s business sector, RIL highlighted its plans for growth across retail, digital services, and energy. This article examines Reliance Industries Limited’s (RIL) growth strategies from its recent AGM, covering plans for retail, digital services, and energy. It plans 1.5

Clever Girl Finance

JANUARY 26, 2024

If you are in debt, you are not alone. In addition to all of the resources available to help you develop your own plan to get out of debt, there are public agencies that can offer assistance, too. Consumer credit counseling services offer financial education and assistance with debt management as it relates to using credit.

WiserAdvisor

DECEMBER 18, 2023

Retirement planning is not just about reaching a target savings number. Remember, effective retirement planning involves a balance of realistic expectations and prudent financial strategies, ensuring you can enjoy your retirement years with peace of mind and financial security.

Clever Girl Finance

APRIL 29, 2024

What to do if you have credit card debt: I like to describe debt as a stumbling block on the path to building wealth. And to get past it, you need to have a plan to roll (or blast) that block out of your way! It can be very difficult to save money when you are paying back debt at high interest.

Clever Girl Finance

SEPTEMBER 19, 2023

However, even the smallest debt owed to your credit card issuers can limit your ability in terms of how much you save and, in turn, how much you are able to invest. If you are able to create a debt repayment plan and knock down your credit card balance fast, you can then apply the money toward your goals.

WiserAdvisor

JANUARY 16, 2024

This data can serve as a baseline for tailoring your retirement plan, taking into account factors such as inflation, your current age, and your desired retirement age. This article also explores the average monthly spending habits of individuals aged 65 and older and offers practical insights to help structure your retirement plan.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Long-term goals typically encompass retirement planning, wealth preservation and estate planning. Certified Public Accountant (CPA) CPAs specialize in tax planning and accounting.

Trade Brains

DECEMBER 7, 2023

The course covers an introduction to personal finance, credit cards, life insurance, health insurance, investment instruments, loans, income tax and planning, budgeting and building a strong portfolio. Also, you will learn how to plan your taxes, credit score importance and how to budget your income to create a portfolio.

Clever Girl Finance

AUGUST 30, 2023

If you’re considering a debt settlement company, be wary of any company that guarantees they can make your debt go away and charges you before they settle your debt. Consult a credit counseling company Credit counselors advise you on your money and debt , helping you figure out a healthy debt management plan.

International College of Financial Planning

MAY 30, 2023

Some of the key components of financial literacy include: Budgeting and saving Creating a budget is the foundation of sound financial planning. Saving is an integral part of budgeting, as it allows individuals to build emergency funds, plan for future expenses, and achieve long-term financial objectives.

Fortune Financial

JANUARY 11, 2024

From 401(k) plans and health savings accounts (HSA) to general financial information, our experts explain how different financial tools help your business and employees secure a stable financial future. Detailed strategies like the ones below are necessary for HR managers to effectively select, manage and communicate health insurance plans.

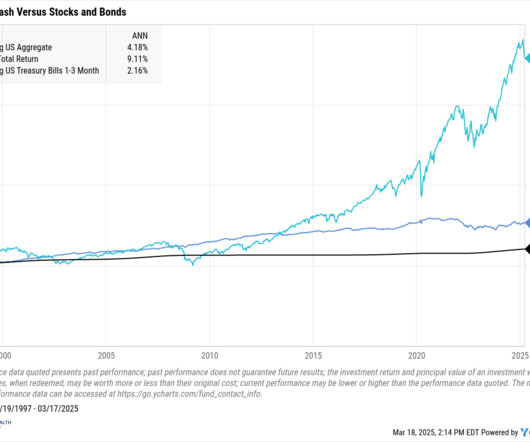

Darrow Wealth Management

MARCH 17, 2025

5 ways to use extra savings Invest excess cash using a brokerage account Increase contributions to a 401(k), 403(b), or IRA Consider using the funds to pay the tax on a Roth IRA conversion Refinance your mortgage Pay off student loans or bad debt Read more about ways to use extra savings.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Long-term goals typically encompass retirement planning, wealth preservation and estate planning. Certified Public Accountant (CPA) CPAs specialize in tax planning and accounting.

WiserAdvisor

JULY 25, 2023

A financial advisor possesses a deep understanding of complex financial concepts and can help you navigate the intricacies of investing, retirement planning, debt management, estate planning, succession planning, tax optimization, and more. For instance, you may discuss estate planning.

Clever Girl Finance

OCTOBER 16, 2023

Earning involves simple money management, such as budgeting and debt management. So beyond the budgeting and debt repayment basics , Erin dives into the mindset and a practical approach. For instance, if you’re planning a life with a partner and controlling your money habits in social situations.

Trade Brains

SEPTEMBER 21, 2024

The company has a rich history and ambitious plans but now must navigate financial losses and operational disputes. Recent efforts to reduce debt and resolve disputes have shown promise, yet the future remains uncertain. In this article, we unravel the company’s segments, future plans, and financial analysis.

Harness Wealth

MAY 25, 2023

The right advisor can help manage your wealth, plan for retirement, navigate tax implications, and more. Average Financial Advisor Fees in 2023 Understanding the costs involved in financial planning is critical to making the most of your wealth and financial potential. Fixed Fee A flat fee charged for a specific service.

International College of Financial Planning

AUGUST 2, 2021

The simplest definition of the role of a financial advisor would of that of a person who helps individuals, families, and organizations make decisions related to their investments, taxes, insurance planning, retirement planning, estate planning, and money management. Wealth Management Firms. Debt Management Firms.

WiserAdvisor

AUGUST 3, 2023

Planning for retirement and growing your wealth are critical to achieving your financial aspirations. A reputable financial advisor should provide a comprehensive range of services, including budgeting, debt management, insurance optimization, tax planning, retirement planning, estate planning, and investment management.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Financial Planning: This involves creating a comprehensive financial plan, considering all aspects of your financial situation.

Brown Advisory

MAY 4, 2020

When we are able to offer sound strategic advice on topics beyond investing—balance sheet management, donor engagement strategy, mission-related investing, leadership development, succession planning and many other issues—it can be as impactful for our clients as the work we do managing their investment assets.

Brown Advisory

SEPTEMBER 4, 2019

When we are able to offer sound strategic advice on topics beyond investing—balance sheet management, donor engagement strategy, mission-related investing, leadership development, succession planning and many other issues—it can be as impactful for our clients as the work we do managing their investment assets. BACKGROUND.

WiserAdvisor

APRIL 16, 2025

Financial planning and advice from a professional go hand in hand. Financial planning can be cumbersome and take a lot of your time. Retirement planning can be a long-term journey, and a lot can change along the way. If you have ever felt stuck while trying to make sound financial decisions, hiring an advisor can be helpful.

WiserAdvisor

JUNE 2, 2023

These professionals also hold expertise in various fields, such as retirement planning, tax management, estate planning, investment management, insurance, debt management, wealth management, and more. They help prepare a retirement plan based on a client’s financial needs and goals.

Clever Girl Finance

APRIL 29, 2024

Plan your financial goals There are different kinds of financial goals. Stay diligent with debt management, paying it down, and avoiding future debts. Nothing will block the path toward your goals like persistent bad habits such as credit card debt or overspending. And, of course, drop those bad habits.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content