Cerulli: Gen X Presents the Next Great Opportunity for Financial Advisors

Wealth Management

JULY 2, 2025

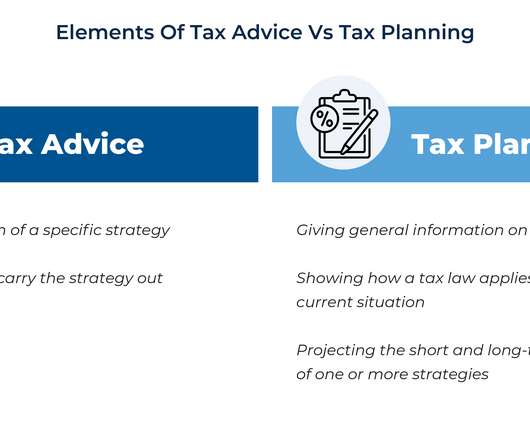

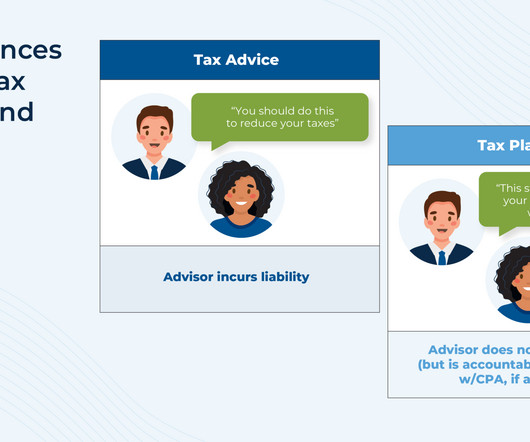

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. Number 8860726. trillion annually over the next decade as part of the great wealth transfer, a new report finds. trillion annually.

Let's personalize your content