Intel Severance Package: Your Complete Guide & Action Plan

Cordant Wealth Partners

DECEMBER 2, 2022

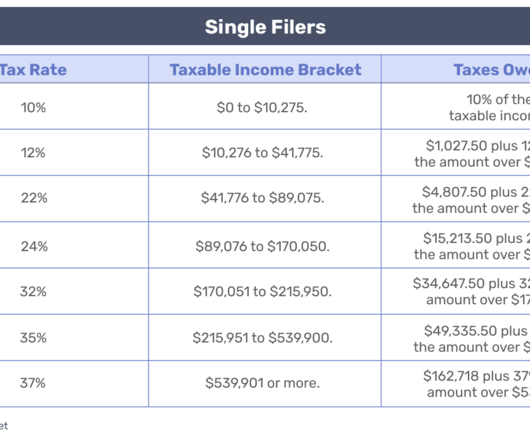

It’s important to note, severance payouts are taxed, and taxed as ordinary income in the year of payout. So, if you separate from the company near the end of the year, earning both a full year of salary plus severance payouts, you could be pushed into a higher tax bracket. Tax planning for a transition out of Intel is critical.

Let's personalize your content