Intel Severance Package: Your Complete Guide & Action Plan

Cordant Wealth Partners

DECEMBER 2, 2022

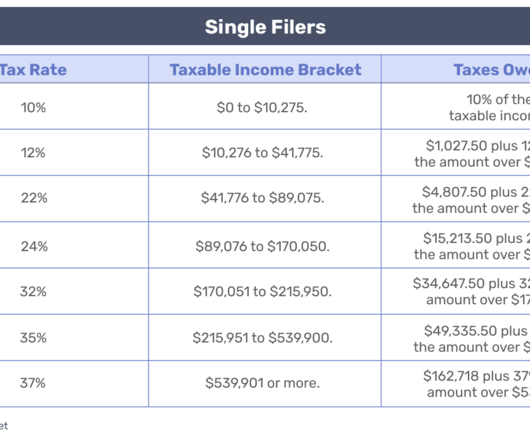

Most recently, Intel announced layoffs impacting 11% of the workforce in the fall of 2022 with a plan to cut $3 billion in costs over the next year. So, if you separate from the company near the end of the year, earning both a full year of salary plus severance payouts, you could be pushed into a higher tax bracket.

Let's personalize your content