Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JUNE 18, 2025

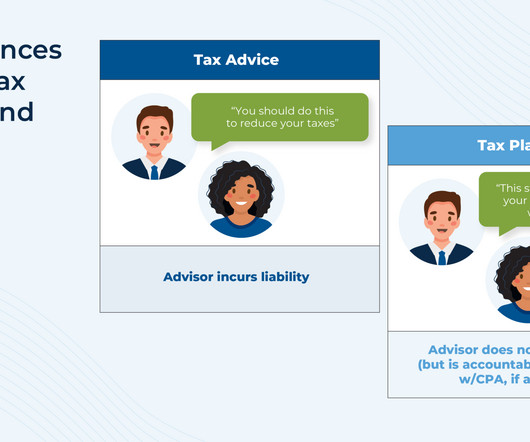

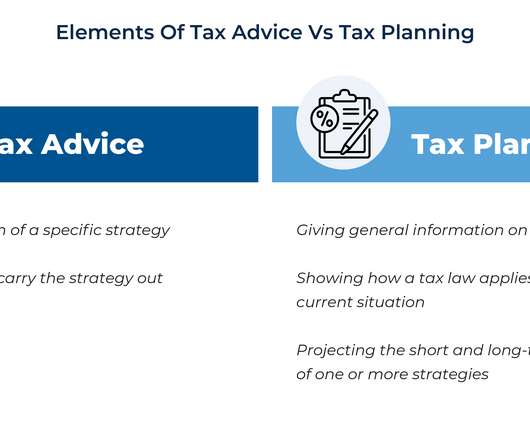

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. Despite this growing interest in tax conversations, most advisors are still quick to distinguish their services as "tax planning", not "tax advice" – a distinction largely driven by liability concerns.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility.

Nerd's Eye View

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

Nerd's Eye View

JUNE 24, 2025

In this episode, we talk in-depth about how Griffin leverages his own experience as a firm founder to support his business-owner clients navigate financial planning decisions (in particular, tax planning opportunities), how Griffin encourages his business-owner clients to invest a portion of their profits outside of the business to diversify their (..)

Nerd's Eye View

MAY 29, 2025

In this 165th episode of Kitces & Carl , Michael Kitces and client communication expert Carl Richards explore how advisors can simplify the delivery of complex advice and why doing so is such a critical (and often underdeveloped) skill. Visual aids can also help advisors clarify complexity and reinforce key messages.

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

Nerd's Eye View

JUNE 12, 2025

In our 166th episode of Kitces & Carl , Michael Kitces and client communication expert Carl Richards discuss how advisors can bridge the gap between planning and a client's lived experience to guide better decision-making. a tax bill or refund).

Nerd's Eye View

JANUARY 12, 2023

In our 103rd episode of Kitces & Carl, Michael Kitces and client communication expert Carl Richards discuss the challenges of finding an optimal balance between proactively providing value and the consistency of simply being available to respond to clients when they come to their advisor for assistance. and gaining their trust.

Nerd's Eye View

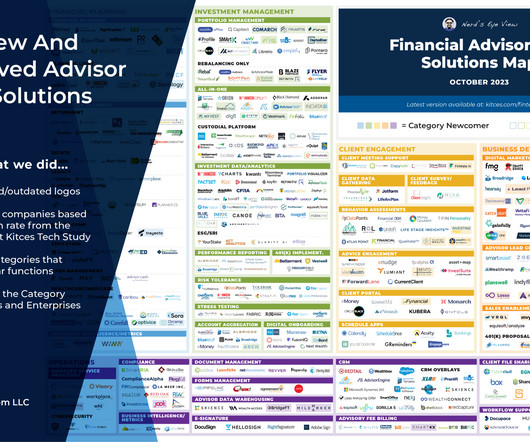

OCTOBER 2, 2023

This month's edition kicks off with the news that custodial platform Altruist is eliminating the $1 per account monthly fee for its portfolio management and reporting technology for advisors on its platform, which on the one hand suggests that the economies of scale Altruist has achieved in the wake of its move to become a fully self-clearing custodian (..)

Nerd's Eye View

MAY 31, 2024

Going beyond FPA’s existing PlannerSearch tool, the narrowed-down list is meant to help consumers identify a focused subset of the most reputable planners.

Nerd's Eye View

NOVEMBER 1, 2023

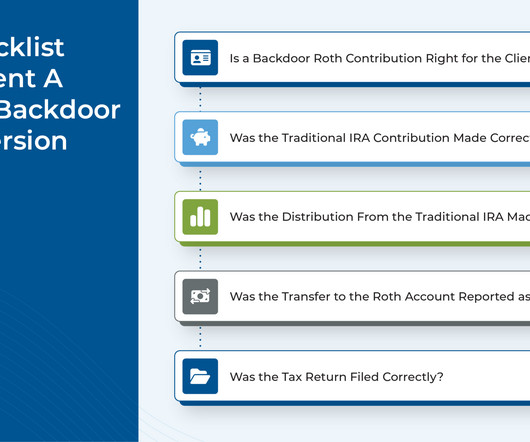

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. Advisors also can support the backdoor Roth process by communicating with clients' tax preparers about the strategy and why they are recommending it for their mutual client.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Nerd's Eye View

JULY 12, 2024

Also in industry news this week: 2 House committees this week advanced legislation that would halt implementation of the Department of Labor's new Retirement Security Rule, which, combined with ongoing lawsuits, threaten to derail the regulation either before or soon after it becomes effective in late September A Federal judge has put the future of (..)

FMG

JUNE 17, 2025

Texting for financial advisors has shifted from being a novelty to a necessary part of client communication. It communicates readiness, clarity, and accessibility. New Service Introduction “Hi [Client Name], we’re now offering tax planning services that could save you significantly next year.

Harness Wealth

MAY 8, 2025

Whether you are contemplating forming an LP or already operate one, gaining clarity on tax matters can optimize your financial outcomes and ensure compliance with state and federal regulations. Identifying and leveraging these opportunities is a vital part of effective tax planning.

Carson Wealth

MAY 30, 2023

By Mike Valenti, CPA, CFP ® , Director, Tax Planning Corporate executives often receive the brunt of the U.S. tax system. Typically, most or all of their income is W-2 income and subject to the higher ordinary tax rates as well as FICA taxes.

Ballast Advisors

NOVEMBER 21, 2022

What are appropriate checklists for year-end tax planning? Tax planners often develop checklists to guide taxpayers toward year-end strategies that might help reduce taxes. Certain tax benefits may be available if you can claim an individual as a dependent. Family tax planning. Copyright 2022.

Harness Wealth

MARCH 14, 2025

Taxpayers often find email-based requests confusing and may forget to attach all necessary documents, leading to frustrating back-and-forth communication. The hours spent managing administrative tasks , following up on missing paperwork, and ensuring compliance take away from time that could be spent on higher-value tax planning services.

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Harness Wealth

APRIL 17, 2025

Technology deductions extend beyond basic communications to encompass computer equipment, software licenses, and various technology subscriptions essential for business operations. In contrast, mixed-use services require careful allocation based on the business usage percentages.

Indigo Marketing Agency

DECEMBER 17, 2024

Personalized communication consistently delivers higher engagement and stronger client loyalty. It personalizes your communication and makes your insights more relatable, which is especially important for attracting and retaining clients in a digital-first world. Blogging can make you 13x more likely to achieve positive ROI.

Million Dollar Round Table (MDRT)

JULY 10, 2022

By Mike Beirne, MDRT Round the Table editor Try these ideas from the 2022 MDRT Annual Meeting speakers about referrals, communications and marketing. Both sessions aim to educate about the value and benefits of financial and tax planning, but no selling occurs. 1) Give the referral process a push.

Darrow Wealth Management

JULY 30, 2024

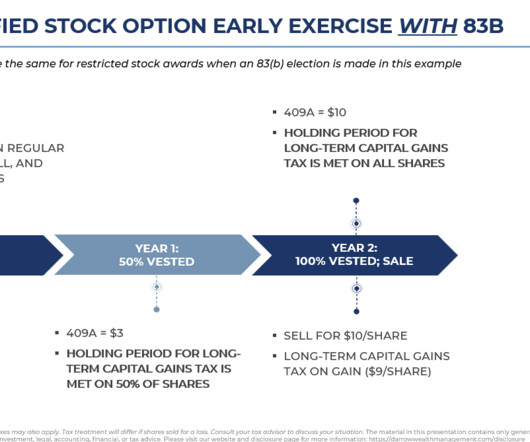

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. It can also preclude some tax planning strategies down the road.

Darrow Wealth Management

NOVEMBER 17, 2022

The ‘millionaires’ tax will also ensnare taxpayers who exceed the $1M limit after selling a home, business, stock options, or other types of one-time events. Article is a general communication only and should not be used as the basis for making any type of tax, financial, legal, or investment decision.

Integrity Financial Planning

OCTOBER 9, 2022

Although many investing and wealth-preservation principles apply to anyone – such as developing a tax plan, assessing a portfolio’s risk exposure, and more – there are key risks to be aware of when you have more money and more valuable assets to protect. Being Too Conservative.

Darrow Wealth Management

JULY 1, 2024

This tax benefit is scheduled to sunset at the end of 2026. Tax planning for 2026 Depending on your situation, income, and goals, your planning options will vary. As with anything in tax planning, it’s important not to let the tax-tail wag the dog.

Darrow Wealth Management

APRIL 23, 2025

The 83(b) election has the potential to significantly reduce the overall tax liability, especially for startup founders and employees who receive stock-based compensation. It’s usually a key part of pre-IPO tax planning and exit strategies.

Harness Wealth

OCTOBER 5, 2023

From quarterly estimated tax planning to equity compensation and crypto tax planning, diversifying your service offerings can not only set you apart from the competition, it can also help you significantly grow your revenue and retain clients.

Darrow Wealth Management

MARCH 29, 2024

Article is for informational purposes only and should not be misinterpreted as personalized advice of any kind or a recommendation for any specific financial or tax strategy. This is a general communication should not be used as the basis for making any type of tax, financial, legal, or investment decision.

Harness Wealth

OCTOBER 2, 2024

To attract new clients and foster long-term relationships, tax advisors could consider adopting digital marketing strategies. It’s also an important touchpoint to introduce your tax practice’s staff to potential clients, giving you to potential build a personal relationship from the start.

Darrow Wealth Management

MARCH 24, 2024

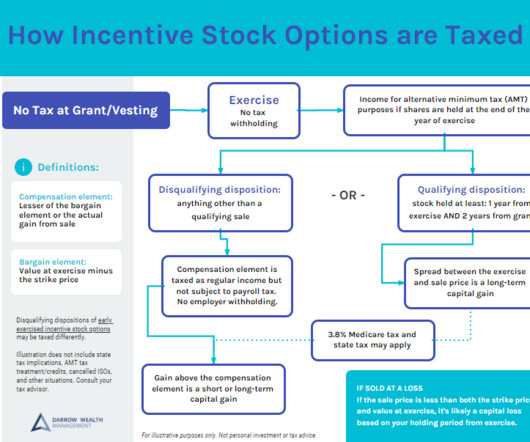

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. By the end of the year, you already know most of the tax inputs so your CPA and financial advisor can help in developing a tax projection.

FMG

OCTOBER 6, 2022

SmartOffice — SmartOffice , the customer relationship managemen t s olution from Ebix, is a financial planning CRM that helps financial advisors tackle critical tasks like analysis, communication, and client services. . CRM systems make it easier to juggle tasks, opportunities, and communications.

Carson Wealth

MARCH 21, 2025

Donations to endowment funds are tax-deductible, giving them a place in your overall financial management and tax plan. An endowment offers benefits that can extend beyond tax deductions and financial efficiency. Managing a Charitable Endowment Fund Once an endowment is established, it must be maintained.

Harness Wealth

APRIL 16, 2025

Liquidity concerns often prompted investors to reverse conversions when they discovered insufficient funds to cover the resulting tax bill. This situation became particularly acute with large conversions that generated substantial tax liabilities. Recharacterization provided flexibility to adapt to these changing circumstances.

Harness Wealth

MAY 8, 2025

Whether you are contemplating forming an LP or already operate one, gaining clarity on tax matters can optimize your financial outcomes and ensure compliance with state and federal regulations. Identifying and leveraging these opportunities is a vital part of effective tax planning.

International College of Financial Planning

OCTOBER 5, 2021

Investments, tax planning, retirement planning is a dynamic field. Not all clients are great communicators and you must put your curiosity to good use and understand their goals. Communication Skills. While some are natural communicators it is one skill you can pick up by putting in the hard work.

Darrow Wealth Management

MARCH 24, 2024

6 tax strategies for incentive stock options and AMT Triggering the alternative minimum tax isn’t the end of the world, but you don’t want to do it by accident. By the end of the year, you already know most of the tax inputs so your CPA and financial advisor can help in developing a tax projection.

Harness Wealth

MAY 14, 2025

By exploring these nuances, you can better appreciate the tax advantages and responsibilities that come with running a Co-op. Understanding Co-op Taxes Key Tax Deductions and Credits Tax planning tips for a Co-op Final Thoughts on Understanding Co-op Taxes Partner with Harness for Expert Tax Support What Is a Cooperative (Co-op)?

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. It can also preclude some tax planning strategies down the road.

Harness Wealth

NOVEMBER 27, 2023

Core components of CAS involve bookkeeping, payroll, tax planning & compliance services customized for each client. Tax Planning and Compliance With any of the above components, tax planning and compliance will be a major area of need, particularly for newer businesses.

Harness Wealth

SEPTEMBER 23, 2024

The Challenge: Tax Firms and CPAs Struggle to Expand Client Relationships Today, there is a significant opportunity for tax practices and CPAs to expand and deepen their tax-client relationships by offering more valuable, long-term services, including comprehensive tax planning.

Darrow Wealth Management

NOVEMBER 20, 2023

If your assets are mostly pre-tax, a Roth conversion can add tax diversification while preserving tax-deferred growth and potentially tax-free withdrawals. But there are other ways to go about tax planning. The post Is Retirement a Good Time for Roth Conversions?

Workable Wealth

OCTOBER 14, 2020

Overpaying on taxes. Tax Planning. A proactive tax plan can save you thousands of dollars every year. You can accomplish this task in several ways like strategic charitable giving, maxing out your retirement accounts, tax-loss harvesting, and more. Communicate Your Accomplishments.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content