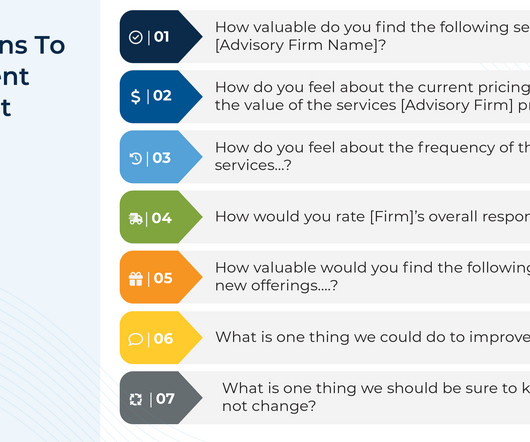

Gathering Feedback That Counts: Crafting Client Surveys To Offer Services That Matter Most

Nerd's Eye View

MARCH 10, 2025

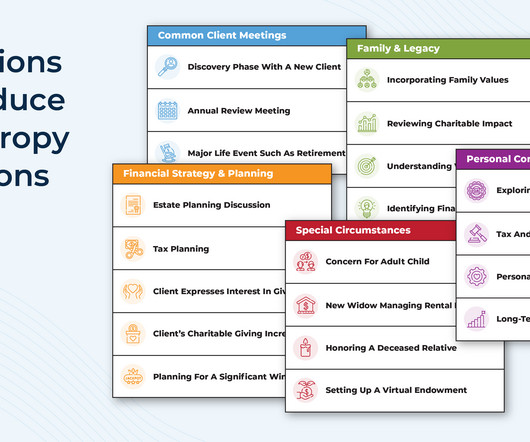

In a firm's early years, there tends to be more room for experimentation, with advisors adding new services to provide value and attract clients. The best roadmap for focusing an advisory firm will reflect how to do more of what clients value and scale back on what they don't use or appreciate.

Let's personalize your content