Behind the Scenes: The Wealthy Wrap-Up The Year

Zoe Financial

DECEMBER 23, 2022

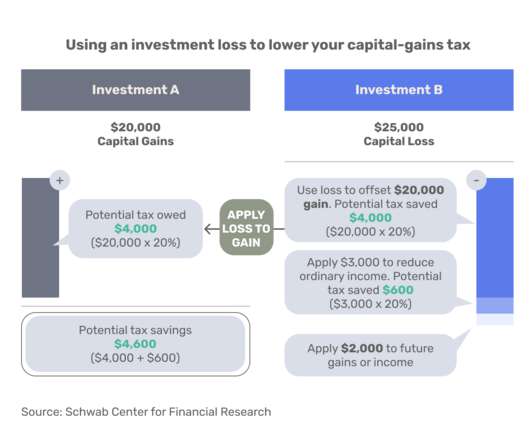

Written by: Lea Ann Knight, CFP® Zoe Network Advisor. Written by: Lea Ann Knight, CFP® Zoe Certified Advisor. The Wealthy Stay Wealthy Tax-Loss Harvesting Those with wealth want to be smart about the taxes they pay. They often start with tax-loss harvesting around this time of year. Published December 21st, 2022.

Let's personalize your content