Weekend Reading For Financial Planners (May 3–4)

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Nerd's Eye View

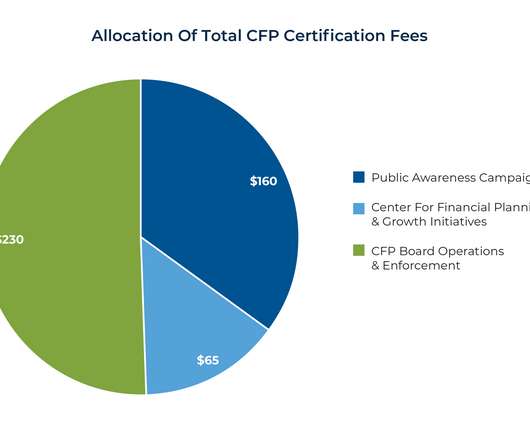

MARCH 24, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week’s edition kicks off with the news that the CFP Board of Standards launched its 1st ad campaign, dubbed "It’s Gotta Be A CFP", following its transition to a 501(c)(6) organization. Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

OCTOBER 11, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a CFP Board ad campaign promoting a career in financial planning to high school and college students sparked an uproar in the planning community, as some advisors questioned whether the messages being sent in the ads – (..)

Nerd's Eye View

SEPTEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study by Cerulli has shown a sharp increase in the number of affluent investors willing to pay for advice, which on the one hand reflects the increasing financial complexity in peoples' lives (while they've also gotten (..)

Nerd's Eye View

SEPTEMBER 25, 2023

In the mid-20th century, the first phone call for a person who needed guidance on saving or planning for retirement was likely to be to a stockbroker or a mutual fund or insurance salesperson. As a result, in 1973, a group of 35 planners became the inaugural recipients of the CFP marks.

Nerd's Eye View

JULY 18, 2022

Amid estimates that nearly 40% of all financial advisors are likely to retire in the next 10 years, the need for a new generation of advisor talent is clear.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. Read More.

Darrow Wealth Management

NOVEMBER 4, 2024

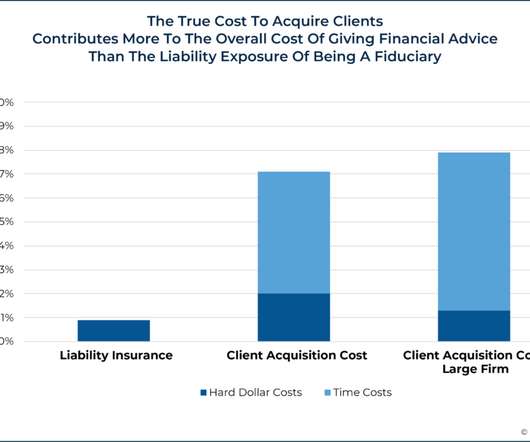

Stockbrokers, registered representatives, dual registered advisors, insurance agents, and other types of advisor-sales roles don’t always have to act in your best interest depending on the situation. For non-fiduciary financial advisors, recommendations may only need to be suitable , not necessarily in the client’s best interest.

Nerd's Eye View

JULY 26, 2022

We also talk about how the tragedy of 9/11 (coupled with Amy’s personal loss of friends and colleagues) and seeing how underfunded life or disability insurance can seriously impact people's lives inspired Amy to return to college and get her undergraduate degree just so she could gain her CFP marks and become a financial planner, how even though (..)

Darrow Wealth Management

FEBRUARY 13, 2025

Fee-only firms are unique as they do not receive commissions from selling financial products, such as insurance policies or investment products. Fee-only financial advisors are often registered investment advisors too, meaning they have a legal duty to act in the clients best interest. Do you have a unique situation?

International College of Financial Planning

DECEMBER 9, 2024

The financial planning industry has witnessed remarkable growth, making the Certified Financial Planner (CFP) certification increasingly valuable for professionals seeking to advance their careers. Why Choose CFP Certification?

International College of Financial Planning

FEBRUARY 23, 2024

In the professional domain of finance, the role of a financial planner has become increasingly pivotal. As individuals and businesses alike strive for financial stability and growth, the demand for skilled financial planners has surged.

eMoney Advisor

JANUARY 12, 2023

If you’ve resolved to add more meaning to your work in 2023 using your skills as a financial planner, you’ve come to the right place. We’ve gathered seven unique volunteer opportunities for financial professionals, including pro bono financial planning. Foundation for Financial Planning.

Sara Grillo

OCTOBER 21, 2022

For those looking to crack in and get a job at an RIA firm and become a financial advisor – good news! There are better options than entering a predatory insurance or wirehouse training program and crossing your fingers (which is an AWFUL idea, by the way). I am an irreverent and fun marketing consultant for financial advisors.

Million Dollar Round Table (MDRT)

JUNE 18, 2023

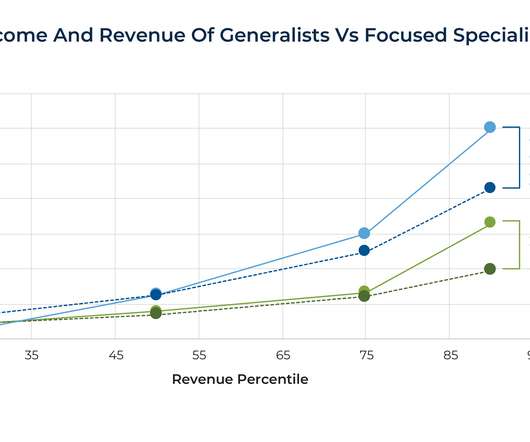

Robert, a financial advisor in North Carolina, came to me after he had tried most of these. He’s an investment advisor representative and CFP with life and health insurance licenses. He told people he was a financial planner and that he worked with all kinds of clients.

International College of Financial Planning

APRIL 20, 2022

If you are a student looking to make a career in finance, becoming a financial planner is a great place to start. Financial planning is a rewarding, stable career that can give you the opportunity to help people make the most of their money. Financial planning is an ongoing process, and it is essential to stay on top of it.

International College of Financial Planning

MAY 6, 2022

A Certified Financial Planner (CFP) is a professional designation awarded to individuals who have completed a rigorous course of study and passed a comprehensive exam. The CFP designation is recognized worldwide and marks excellence in the financial planning industry. CFP enables you to save big by learning better.

International College of Financial Planning

JULY 30, 2022

Certified Financial Planner (CFP) is globally the most respected financial designation for personal assets management. Here will discuss why CFP professionals are the first choice for millions of people worldwide regarding managing their finances. For e.g. saving for a home, retirement, or Higher education.

Nerd's Eye View

SEPTEMBER 26, 2022

The financial advisory industry is not immune to the same problems faced in Akerlof’s used-car market. Accordingly, advisor licensing could mean establishing a requirement involving a professional designation like the CFP certification for those who provide financial advice.

International College of Financial Planning

APRIL 25, 2024

Achieving the status of Certified Financial Planner® (CFP®) represents a significant professional milestone in financial services. What Is a Certified Financial Planner®? A Certified Financial Planner® is a distinguished professional who has met the stringent standards set by the FPSB Board.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Your Richest Life

JULY 17, 2024

Financial advice from the internet, podcasts, books or even your family members has to be taken with a grain of salt, because those sources don’t know your full financial picture. Money lesson #7: Find the financial planner who is right for you. For more information on the services offered, contact Katie today.

International College of Financial Planning

JULY 20, 2022

To become a certified financial planner (CFP), you must learn about risk analysis in-depth. Here are some of the key things you learn in risk analysis under CFP certification. The CFP examination program includes eight topics covering all aspects, from the program’s fundamentals to applying skills in the real world.

International College of Financial Planning

OCTOBER 26, 2023

Why Do You Need a Financial Planner? In the vast realm of finance, numerous pathways lead to the esteemed financial advisor title. Let’s unveil the roles of these dedicated experts, who tirelessly weave strategies to illuminate the path towards their clients’ financial aspirations. Who is a Financial Advisor?

International College of Financial Planning

SEPTEMBER 3, 2021

When it comes to choosing a financial planner, it’s important to choose the right fit for you. Do the research of the available advisors – the first step is to find a financial planner who will help you plan your finances. After all, if a client feels that a financial planner understands him, then he remains loyal to him.

International College of Financial Planning

SEPTEMBER 7, 2024

Whether you are already a professional in the financial sector or just beginning your journey, earning the Certified Financial Planner (CFP®) designation can be a game-changer. What Is the CFP® Fast Track Course? Why Choose the CFP® Fast Track?

International College of Financial Planning

JULY 10, 2023

CFP, or the Certified Financial Planner exam, is a significant milestone in becoming a certified financial planner. In this blog post, we will explore valuable tips to help you navigate the CFP exam and maximize your chances of success. The exam no longer includes essays or written response questions.

Carson Wealth

JULY 12, 2022

So much of our world is filled with abbreviations surrounding insurance and investment products, processes, education and accomplishments. . Translating from the secret language of financial planning, the sentence would read “Tammy specializes in insurance. Three broad financial planning designations include: .

Ron A. Rhodes

DECEMBER 12, 2023

Can the use of a title – such as “financial planner” (or CFP) or “financial consultant” or “wealth manager” or “investment consultant” or similar – by the registered represent of…

Sara Grillo

MAY 23, 2022

This interview with Cody Garrett, CFP, of Measure Twice Financial was mind-blowing. It’s so clear to me what the future of financial advice is – what it should be – and what it will be. What’s up with these “advice-only financial planners?” What is an advice-only financial planner?

Your Richest Life

MAY 20, 2025

In recent years, getting professional help for your mental well being has become more accessible than ever, and more widely covered by health insurance companies. Check out LetsMakeaPlan.org for a list of certified financial planners that suit your needs. For more information on the services offered, contact Katie today.

Your Richest Life

MAY 16, 2023

You’ll encounter plenty of financial DIYers working toward early retirement, unsolicited advice from well meaning family and friends, suggestions from coworkers and even professionals offering their products or services for financial planning and insurance policies. The truth is, you need to know your own limitations.

NAIFA Advisor Today

APRIL 25, 2024

Richard Dobson is a Certified Financial Planner (CFP) who strives to simplify communication between clients and financial advisors. As a keynote speaker, he has provided insurance and investment advice for over 40 years. Richard is the author of Make Simplicity Your Superpower! and The Trusted Professional.

International College of Financial Planning

MARCH 24, 2024

Understanding the nuanced differences between an investment advisor and a financial planner is vital for individuals in India aspiring to carve a niche in the financial sector. They are the architects of financial well-being, crafting comprehensive plans that address various facets of personal finance.

International College of Financial Planning

JULY 9, 2022

To plan for retired life important thing is financial plan. Certified Financial Planner can guide us in the early stage of life best for retirement financial planning. A Certified Financial Planner will help you determine your retirement goals based on your current income, expenses and future needs.

MainStreet Financial Planning

APRIL 4, 2023

“MainStreet Chalk Talk” The MainStreet Financial Planning Discussion Club When: Tuesday 4-18-23 at 7:30pm Eastern; 4:30pm Pacific ~30-45 minutes Recorded and able to retrieve for one week How : Zoom Meeting, Free to ongoing clients; $10 for guests Register here! Reverse Mortgages!

Your Richest Life

MAY 31, 2023

Check Over Retirement Savings Plans and Health Insurance Open enrollment doesn’t begin until the fall, but the summer is a great time to check over your benefits and make sure they’re working for you. Review your health insurance spending and retirement savings for the year, and make note of any major life changes this year.

NAIFA Advisor Today

AUGUST 27, 2023

Laurie Adams is a Certified Financial Planner (CFP), helping people create financial plans to achieve financial security through investment management, retirement, trust, and planning services.

Walkner Condon Financial Advisors

APRIL 21, 2023

In contrast, a commission-based financial advisor receives commissions or other forms of compensation from financial product providers for recommending and selling their products. This can include mutual funds, insurance policies, annuities, and other financial products. What is a Certified Financial Planner (CFP) ?

International College of Financial Planning

AUGUST 3, 2024

The financial planning and insurance industry offers a dynamic career path with immense growth potential. In this blog, we will explore the benefits of pursuing short-term courses in the insurance planning industry and how they can help you unlock your dream job with guaranteed placements.

Carson Wealth

AUGUST 25, 2022

Examples of fixed expenses include rent or mortgage payments, insurance premiums, groceries, heating and electric bills. Investment assets include retirement plans, investment or savings accounts, annuity or insurance cash values, or any other asset you may use towards a financial goal. Talk to a Financial Advisor Today.

International College of Financial Planning

JULY 10, 2023

Different Types of Investment Advisors Financial Planner: A financial planner assists individuals achieve their financial goals. They help clients manage their financial aspects and develop customized strategies based on their needs. Excellent communication and interpersonal skills.

Walkner Condon Financial Advisors

APRIL 17, 2023

In contrast, a commission-based financial advisor receives commissions or other forms of compensation from financial product providers for recommending and selling their products. This can include mutual funds, insurance policies, annuities, and other financial products. What is a Certified Financial Planner (CFP)?

Carson Wealth

DECEMBER 1, 2022

CFP ® , Director of Consumer Investment Research. LLM, CFP ® , ChFC ® , CLU ® , RICP ® ,? In other words, your 20s present a financial challenge. . Purchase adequate insurance policies on your car, renters or homeowners insurance and consider life insurance if family members depend on you.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content