Weekend Reading For Financial Planners (March 25-26)

Nerd's Eye View

MARCH 24, 2023

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

SEPTEMBER 25, 2023

In the mid-20th century, the first phone call for a person who needed guidance on saving or planning for retirement was likely to be to a stockbroker or a mutual fund or insurance salesperson.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JULY 18, 2022

Amid estimates that nearly 40% of all financial advisors are likely to retire in the next 10 years, the need for a new generation of advisor talent is clear.

Nerd's Eye View

JUNE 30, 2025

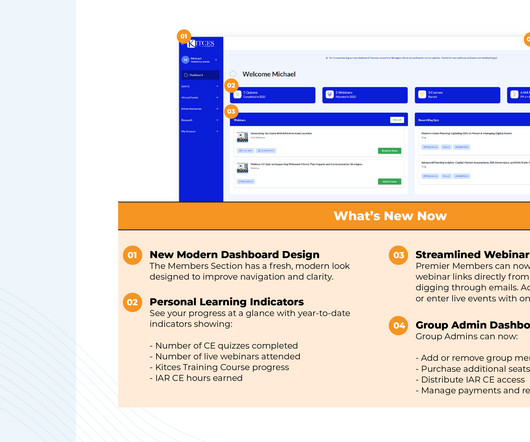

Which led us at the beginning of 2025 to announce a major new initiative for the year: to completely rebuild and replace our existing Members Section , which has struggled to keep pace with the growth of our Membership and the expanded breadth of our educational offerings to Members.

International College of Financial Planning

JULY 2, 2025

And for those looking to become such professionals, the question naturally arises: Is pursuing the Certified Financial Planner (CFP) certification worth it in India? What is the CFP Certification? The Certified Financial Planner (CFP) certification is widely regarded as the gold standard in personal financial planning.

Good Financial Cents

JANUARY 26, 2023

Early retirement has become a popular financial goal. Even if you never retire early, just knowing that you can is liberating! Can You Really Retire at 50? Can You Really Retire at 50? Table of Contents Can You Really Retire at 50? FAQs on Retiring Early at 50 It’s a big bold claim – retire at 50?

Yardley Wealth Management

DECEMBER 17, 2024

Retirement Planning: Looking Beyond the Basics For 2025, it’s essential to think beyond the standard “maximize your 401(k)” advice. While that remains important, consider diversifying your retirement strategy. This can significantly impact your retirement savings trajectory.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. Individuals who earn this certification are thoroughly prepared to offer expert financial advice.

Indigo Marketing Agency

JUNE 12, 2025

Most financial advisors enjoy working with hardworking, educated, long-term planners who have money to invest today for a respectable return tomorrow. An example of a solid specialty niche for a financial advisor would be “investing strategies for retirement income.” This will draw in the people who need your services most.

Carson Wealth

JULY 12, 2022

So much of our world is filled with abbreviations surrounding insurance and investment products, processes, education and accomplishments. . She reviewed two types of annuity contracts often used for retirement and helped determine which one is the best fit for her client.” . Professional Certifications for Financial Advisors.

International College of Financial Planning

FEBRUARY 23, 2024

At the heart of this profession lies the financial planner certification, a credential that not only signifies expertise but also opens doors to significant career opportunities. This certification is recognized globally and is considered a benchmark for competence and professionalism in financial planning.

International College of Financial Planning

JULY 9, 2025

The Fee only space or being a MFD with CFP certification will enable you to provide service of the highest quality. Mis-selling would be at its peak during such times, only a certified professional can act on client first approach to help choose investors what is right for them.

International College of Financial Planning

OCTOBER 26, 2023

Crafting a Comprehensive Financial Plan: This includes a detailed net worth statement, defining SMART Goals including retirement, children education etc., Empowerment Through Education A quintessential trait of genuine CFP® professionals is their commitment to enlightening the clients.

International College of Financial Planning

OCTOBER 26, 2023

Their wisdom extends to suggesting tax-efficient avenues for pivotal life moments, be it education or the golden years of retirement. Achieving them typically involves: Completing a dedicated education program. Educating Clients: Knowledge is power. Where Do They Shine? Successfully passing the respective examination.

MazumaBusinessAccounting

MAY 31, 2022

Keep the following documents for seven or more years: Income tax returns (federal and state) W-2s and 1099s Medical bills Contracts Receipts for tax-deductible items Mileage records Canceled checks Real estate tax forms Credit cards statements that contain purchases used as tax deductions Retirement plan contributions. for insurance purposes.

Financial Symmetry

APRIL 14, 2025

529 Plan When it comes to saving for future education expenses, this is probably the most advertised or talked about account for children given the ballooning cost of college tuition the past two decades. 529 plans can be used for tuition expenses for K-12 in addition to college expenses, but the withdrawal limit is $10,000 per year there.

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Nationwide Financial

FEBRUARY 14, 2023

According to a Nationwide Retirement Institute® Diverse Markets White Paper, decades of research show that Black consumers tend to express higher levels of generalized distrust than whites. I’m excited about how the education and financial services industries have been able to come together, using research as the basis for change.

Good Financial Cents

MAY 8, 2023

So whether you need to pay off debt , build an emergency fund , save for your kids’ college education , or invest for retirement , here are some ways you can make it hap’n, cap’n. Start Investing for Retirement Now it’s time to start investing for your latter years. Invest for the future!

International College of Financial Planning

APRIL 20, 2022

You can make your mark in this field with the proper education and a little effort. This article will discuss the basics of financial planning , the education and certifications required to become a financial planner, and how to develop your financial planning skills and network.

International College of Financial Planning

SEPTEMBER 7, 2024

The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry. Unlike the regular pathway that requires passing multiple exams over a year, the fast track allows eligible candidates to take just one exam and complete the certification in 3-4 months.

International College of Financial Planning

JUNE 17, 2025

Increase Investor Literacy: Use awareness campaigns, workshops, and institutional outreach to educate investors. Remittance strategies should be phased to manage currency risk, especially for education and retirement planning. Digitize Compliance: Leverage fintech solutions to simplify KYC, AML, and remittance workflows.

Trade Brains

DECEMBER 7, 2023

Personal Finance for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on financial products for better investment opportunities. By enrolling in this course you will learn to manage your finances more effectively by mastering budgeting and portfolio creating for a healthy retirement corpus.

International College of Financial Planning

DECEMBER 4, 2023

Understanding the Need for Qualified Financial Advisors Financial advisors are experts who provide investment, retirement, and overall financial planning advice, aiding clients in better managing their finances. It opens doors to various roles in financial services, including retirement planning and estate planning.

International College of Financial Planning

JUNE 27, 2025

Laying the foundation with a basic emergency fund, securing adequate life and health insurance, beginning investments for her child’s education, and planning early for retirement are essential steps toward building long-term financial security.

International College of Financial Planning

JUNE 10, 2022

CFP, also known as Certified Financial Planner , is a certification given by the Financial Planning Standards Board (FPSB) to professionals who wish to take up financial planning. This certification is recognized internationally and considered the best for financial planning training, education, and ethical practice. .

International College of Financial Planning

JANUARY 15, 2024

Embracing Financial Planning Courses Online versus On-Campus Learning The advent of online financial planning courses marks a pivotal shift in educational methodologies. On-Campus Learning: A Rich Educational Tapestry Contrasting to the online experience, on-campus learning offers a more immersive educational journey.

International College of Financial Planning

SEPTEMBER 23, 2024

This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. b) Increased Earning Potential Obtaining a CFP® certification significantly enhances your earning potential.

International College of Financial Planning

MARCH 9, 2024

This blog is designed to illuminate the path to becoming a CFP® professional, focusing on the critical steps involved in the admission process, exploring the myriad of career prospects, delving into the eligibility criteria, and the future of the CFP® certification.

Clever Girl Finance

MARCH 14, 2023

Common accounts that earn this sort of income include retirement accounts, like a 401(k) or IRA , savings accounts , or a general brokerage account that lets you sell and buy investment products like stocks, funds, etc. Retirement accounts, health savings accounts , and educational savings accounts are often tax-advantaged.

Clever Girl Finance

NOVEMBER 8, 2022

When you decide to start investing, the most important part of the process is educating yourself. Generally, you will use these investments to fund your retirement. In general, these accounts are aimed at saving for your retirement in a tax-advantaged way. Consider certificates of deposits.

Good Financial Cents

AUGUST 11, 2022

Track your retirement. Did you know you might be able to actually retire with $1 million? While it’s better if you have some time to invest the money instead of using it for retirement, retiring with this much is a reality for many people. You may be wondering if you can actually retire with $2 million dollars!

Good Financial Cents

DECEMBER 26, 2022

A Roth IRA is a type of individual retirement account (IRA) that allows you to contribute after-tax money and withdraw it tax-free in retirement. Contributions to a traditional IRA may be tax-deductible, but withdrawals in retirement are taxed as ordinary income. What is a Roth IRA? What are The Benefits of a Roth IRA?

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

Trade Brains

NOVEMBER 30, 2023

Mutual Fund Investing for Beginners by FinGrad FinGrad Academy is an educational platform that offers various courses on investing and trading. Personal Finance – Mutual funds by Zerodha Varsity Zerodha Varsity is an educational platform related to stock trading investing to educate the market participants.

International College of Financial Planning

AUGUST 2, 2021

The simplest definition of the role of a financial advisor would of that of a person who helps individuals, families, and organizations make decisions related to their investments, taxes, insurance planning, retirement planning, estate planning, and money management. Educational Qualification Requirements. Banks & NBFCs.

Clever Girl Finance

NOVEMBER 21, 2023

Boost your retirement savings Now that you have excess money in the bank, it may be a smart time to increase your retirement savings. One in four Americans don’t have any retirement savings whatsoever, explains Yahoo Money. How many IRAs can you have in your retirement strategy? Click to grab your copy!

International College of Financial Planning

JULY 10, 2023

Some common career paths for investment advisors include working as wealth manager, family office, portfolio manager (PMS), Retirement Planner, Estate Planner. Investment advisors can also specialize in specific areas such as retirement planning, tax planning, or portfolio management. Excellent communication and interpersonal skills.

Indigo Marketing Agency

JANUARY 11, 2021

We are thrilled to have a new article published in the December 2020 issue of the Investments & Wealth Monitor , a bimonthly educational magazine for financial professionals published by Investments & Wealth Institute. Need Help Growing Your Business?

Clever Girl Finance

NOVEMBER 4, 2023

This group of categories includes: Retirement account contributions e.g. 401k/403b/IRA Non-retirement investing (e.g. Before you pay any bills or do any shopping, a portion of your earnings should be diverted into your retirement account, if possible, for your future self and your emergency savings accounts for a rainy day.

Clever Girl Finance

NOVEMBER 25, 2023

When you decide to start investing, the most important part of the process is educating yourself. Generally, you will use these investments to fund your retirement. For most people, one big goal is funding their retirement. Some experts advise saving 10% of your income for retirement. Or send your kids to college.

Clever Girl Finance

MARCH 30, 2023

A money market fund is a sort of mutual fund that invests in short-term and low-risk securities like government bonds , certificates of deposit, and commercial paper. It's a good strategy for things like saving for a child's education or starting a business. Some employers may match a portion of their contributions.

Fortune Financial

SEPTEMBER 25, 2023

Whether planning for retirement, saving for your children’s education or simply looking to grow your investments, finding the right wealth management services in Kansas City can make all the difference. Long-term goals typically encompass retirement planning, wealth preservation and estate planning.

International College of Financial Planning

JULY 30, 2022

Credentials matter in any profession and when it comes to personal finance, there’s no certification more highly coveted than Certified Financial Planner. Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content