Offering Tax Preparation As A Solo Advisor: How To Attain Designations And Create A Schedule By Next Tax Season

Nerd's Eye View

MAY 8, 2023

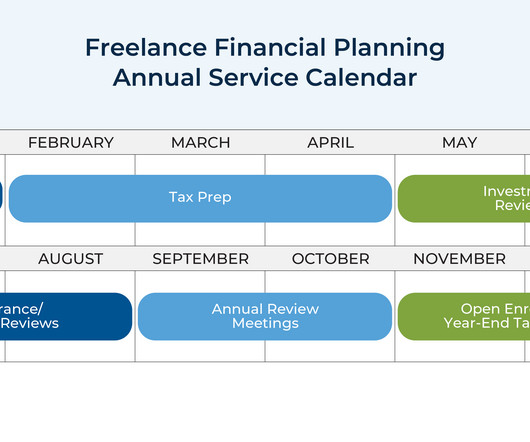

Traditionally, financial advice and tax preparation have existed as 2 related, but separate, services. Besides the fact that many financial advisors don’t hold the necessary credentials (e.g., by tailoring client data-gathering worksheets to focus on the information that is relevant to a client’s tax situation).

Let's personalize your content