How a Fee-Only, Flat-Fee Financial Planner Can Save You $114K+

MainStreet Financial Planning

MARCH 7, 2025

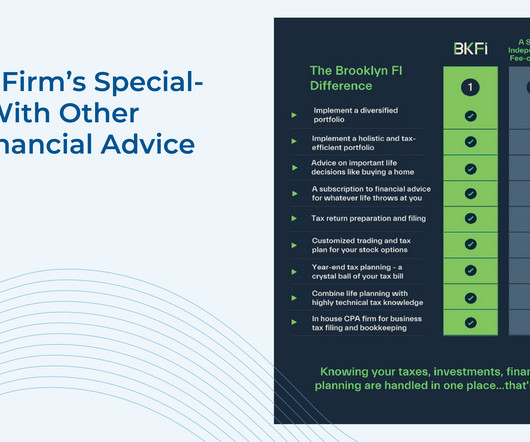

The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management). While AUM advisors may seem appealing, they often come with high lifetime fees and potential conflicts of interest.

Let's personalize your content