Animal Spirits Talk Your Book: Investing in Commodities

The Irrelevant Investor

DECEMBER 3, 2018

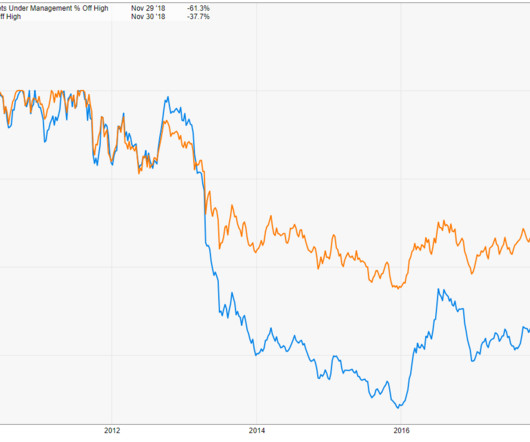

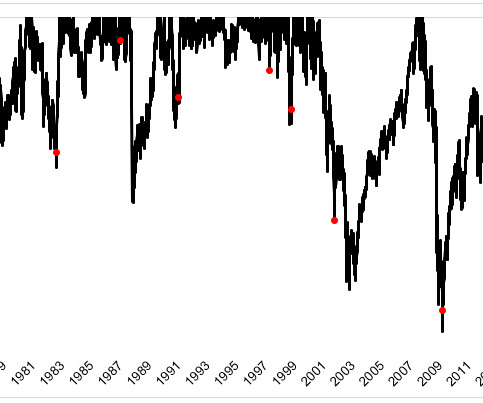

Today's Animal Spirits Talk Your Book is presented by Graniteshares Topics discussed Boom and bust nature of commodities What is the role of commodities in a portfolio -- manage risk or price appreciation? Why would commodities add a risk management component to a typical portfolio?

Let's personalize your content