Monday links: a loss of trust

Abnormal Returns

MARCH 13, 2023

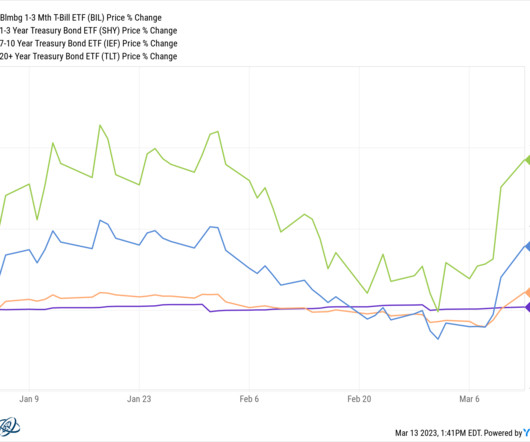

(bonddad.blogspot.com) We still don't know everything about the downfall of Silicon Valley Bank. ritholtz.com) The reversal in interest rates could relieve some pressure on bank portfolios. mailchi.mp) Why more assets are going to flow to systemically important banks. marginalrevolution.com) Why Signature Bank went under.

Let's personalize your content