Friday links: a misplaced fondness

Abnormal Returns

JANUARY 26, 2024

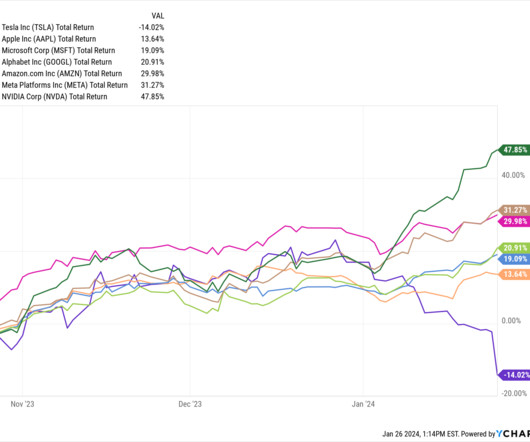

awealthofcommonsense.com) How to think about the growth in money market fund assets. news.crunchbase.com) Economy The PCE price index, excluding food and energy, increased 2.9%, down from a 5.4% abnormalreturns.com) An example where investing out of spite doesn't work out. semafor.com) Seed rounds are getting larger over time.

Let's personalize your content