Stock Market Highs and Your Retirement

The Chicago Financial Planner

NOVEMBER 8, 2021

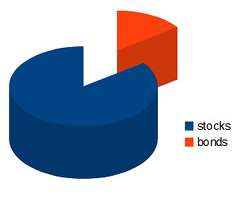

At some point we are bound to see a stock market correction of some magnitude, hopefully not on the order of the 2008-09 financial crisis. As someone saving for retirement , what should you do now? During the financial crisis there were many stories about how our 401(k) accounts had become “201(k)s.” FINANCIAL WRITING.

Let's personalize your content