FDIC Changes Insurance Coverage of Trust Bank Accounts

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 21, 2023

Soon, accounts held by trust may be insured by the FDIC for up to $1,250,000, rather than the current $250,000 limit on many individual accounts.

Abnormal Returns

MARCH 12, 2025

financialducksinarow.com) Americans are not shy about withdrawing early from their 401(k) accounts. mr-stingy.com) Should you get your insurance coverage re-quoted? (theretirementmanifesto.com) 401(k) Five things to understand about your retirement savings plan. wsj.com) Investing Why you need to be diversified by time horizon.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MARCH 15, 2023

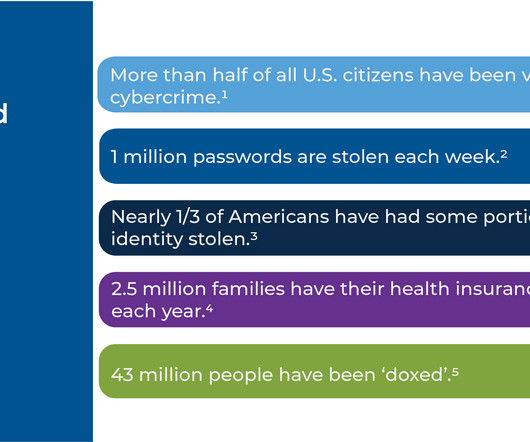

For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. Risk management is a key part of many financial advisors’ value propositions. At the same time, clients face another class of risks that advisors often do not consider: cyber.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Be sure two open separate bank accounts e.g. your personal bank accounts should be separate from your business bank accounts. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

MainStreet Financial Planning

MARCH 15, 2023

Even though the federal government has rescued SVB and guaranteed all deposits over the FDIC insurance limit of $250,000 per account, that doesn’t mean they will be doing it again for other banks. Let’s review and recap how Federal Deposit Insurance Corporation (FDIC) insurance works and what other alternatives are available.

AdvicePay

JUNE 13, 2024

Here are some examples of one-time and ongoing services you can offer clients under the fee-for-service model: One-Time Services Ongoing Services Comprehensive Financial Plan Ongoing Financial Planning Second Opinion Engagement Advising on Held-Away Accounts Student Loan Analysis Tax Planning Portfolio Tax Efficiency Review Estate Planning Housing (..)

Walkner Condon Financial Advisors

NOVEMBER 11, 2022

CONTRIBUTIONS ACCOUNTS. Employer-Sponsored Accounts such as 401(k) and 403(b). The maximum contribution amount for these respective accounts is $20,500 , with an additional catch-up contribution limit of $6,500 for individuals aged 50 or older. IRA Accounts. Here is our list of things to consider as we come to the end .

Integrity Financial Planning

MARCH 19, 2023

As a result, and due to the fact that, like many large bank accounts, most of SVB’s funds were not covered by the FDIC (Federal Deposit Insurance Corporation), other venture capital firms and tech companies panicked, yanking their funds due to the stock loss.

MarketWatch

MARCH 22, 2023

SOFI said Wednesday that those with its checking or savings accounts will be able to access up to $2 million of Federal Deposit Insurance Corporation (FDIC) insurance, versus the standard $250,000 amount. SoFi Technologies Inc.

Clever Girl Finance

AUGUST 19, 2024

Review your maternity leave and insurance coverage 6. Update your life insurance policy 8. Explore Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) 12. Consider opening a 529 college savings plan or another type of account specifically for your child’s education.

Truemind Capital

SEPTEMBER 8, 2024

Consider investing in safe, ultra-short-term liquid funds, currently yielding ~7.5%, offering a better alternative to bank savings accounts. #2 2 Adequate Life and Health Insurance Coverage Ensure you have sufficient health insurance—at least Rs 20 lakhs for a family of four in a metro city.

MainStreet Financial Planning

JUNE 13, 2023

Update your life and disability insurance. Now more than ever you want to have appropriate life and disability insurance coverage, so if something unexpected happens your family will be OK. Start saving and investing in a brokerage account so you have funds saved up to meet these future expenses.

Carson Wealth

AUGUST 4, 2022

Of course, there are always the everyday household expenses to account for in your post-retirement budget. Oh, and it doesn’t account for things like over-the-counter medications, dental care or long-term care costs. . Another option is adding insurance coverage that can help pay for some of the more significant health events.

Clever Girl Finance

DECEMBER 1, 2022

A fully-funded emergency account. The right type of insurance coverage (Life, health, disability, home, etc.). Should you have joint accounts or separate accounts? Having joint accounts is great, but I also believe in having your own personal savings accounts. What does your savings account look like?

Good Financial Cents

DECEMBER 12, 2022

There are no fees for opening an account, transferring money, or managing your portfolio. They also make money through interest earned on cash balances in customer accounts, as well as from select securities transactions. FDIC coverage protects depositors up to $250,000 per account in the event of a bank failure.

Clever Girl Finance

MARCH 19, 2024

your short, mid-term, and long-term goals) The right types of insurance coverage (Life, health, disability, home, etc.) What does my savings account look like? Track your spending A master plan for your money should be an accurate representation of your finances, which means accounting for exactly where your money is going.

eMoney Advisor

FEBRUARY 9, 2023

Financial Planning Needs: Retirement planning Education and family planning Obtaining appropriate insurance coverage Business and tax planning Significant asset purchases Strategies for Serving Clients in This Stage: Clients at this stage are experiencing life events — both large and small — that will impact their financial planning needs.

Clever Girl Finance

FEBRUARY 2, 2023

Open a checking account A checking account is one of the basic tools you should have in your personal finance arsenal. Unfortunately, some low-income families are denied access to traditional checking accounts. If you do not have access to a traditional checking account, consider an online checking account.

Truemind Capital

APRIL 4, 2024

I have encountered a few cases where a significant amount of money was kept in a savings account that was yielding 2.5-3.5% In case the debt is more than the investments, a term insurance plan over the tenure of the debt is absolutely necessary. returns while an outstanding loan costing 8-9%.

Carson Wealth

JANUARY 4, 2024

While from a behavioral standpoint some suggest you should tackle low balance accounts first, a financial planning approach suggests you tackle high interest rate debt first. Proper insurance coverage: One of the biggest risks for many people in their 30s is they’re still acting as if they’re invincible.

MainStreet Financial Planning

JUNE 2, 2022

Without sufficient insurance coverage, a homeowner is at risk of having to pay out of pocket to rebuild their home after a disaster. Here are the 8 types of insurance coverage that you will want to review to see if you have sufficient coverage for your home. Replacement cost coverage (aka “Dwelling”).

Clever Girl Finance

APRIL 29, 2024

Not saving any of your monthly income When it comes to saving money, I’ve heard so many people complain that after they’ve paid their bills, they don’t have any money to contribute to their retirement accounts or to add to their emergency fund. Next assess your current life to determine what insurance gaps you have.

WiserAdvisor

JULY 27, 2023

Calculate potential income from investments, such as retirement accounts (401(k), IRA), and other assets. Take advantage of catch-up contributions to retirement accounts, as you’re 50 years old. Review Insurance Coverage: Ensure you have adequate health, life, and long-term care insurance coverage.

Gen Y Planning

JANUARY 5, 2022

Start by automating drafts from your checking account to an emergency fund. Set up recurring payments for your mortgage/rent, insurance, utilities, etc., Depending on the bill, you might decide to set up automatic drafts from your bank account or a credit card. Review Your Insurance Coverage .

Workable Wealth

OCTOBER 14, 2020

Improper risk management and insurance coverage. You can accomplish this task in several ways like strategic charitable giving, maxing out your retirement accounts, tax-loss harvesting, and more. You will have an investment strategy that already accounts for your risk tolerance, capacity, time horizon, and goals.

Truemind Capital

FEBRUARY 2, 2021

Insurance is needed when you have dependents and do not have sufficient assets to take care of them in case of any mishap. One should always opt for a pure term plan (pure cost for insurance coverage) when insurance is required. NPS offers you two approaches to invest in your account: Auto choice or Active choice.

Gen Y Planning

OCTOBER 13, 2023

This likely means maxing out retirement savings accounts like a 401k or Roth IRA, and opening a brokerage account to continue saving beyond the “traditional” routes. You might even look to create a “bucket strategy” where you invest in different buckets or accounts based on different time horizons. Take your time.

Clever Girl Finance

DECEMBER 23, 2024

As a freelancer, youre your own boss, accountant, and financial planner all rolled into one. Be sure two open separate bank accounts e.g. your personal bank accounts should be separate from your business bank accounts. Keep funds separate Maintain separate accounts for your personal emergency fund and business savings.

Harness Wealth

OCTOBER 24, 2024

Bank Routing and Account Numbers: Required for direct deposit of any refunds or for payments due. 1099-INT (Interest Income): Reports interest income earned from bank accounts, bonds, or other investments over $10 during the tax year. or details of foreign accounts or investments may need to be reported.

Trade Brains

JANUARY 8, 2024

High DII Holding Stocks Under Rs 200: When it comes to making investment decisions, it is essential to take into account a wide range of factors that can affect the performance and growth potential of a business. 10,896 crores accounting for 26.42%. Provision Coverage Ratio 92.14 25,449 crores accounting for 33%.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. One of the great tricks for repairing the tire was to submerge the inner tube in water to see where the bubbles came from.

Harness Wealth

DECEMBER 19, 2022

Gone are the days of only keeping your money in traditional banking, savings, and brokerage accounts — with compensation in the form of equity and digital assets such as crypto, it can be hard to keep track of all of your disparate accounts, assets, and investments. Create a complete picture of your personal net worth.

Workable Wealth

NOVEMBER 11, 2020

One of the most common questions about life insurance is how much coverage you’ll need. Your coverage level is unique to you and your situation. Existing insurance coverage. All of these should spark review to potentially increase coverage that meets your changing needs. Family size and additional income.

Trade Brains

JULY 8, 2023

This can be an indication of an increase in the number of accounts opened in the Bank Similarly, its advances have also increased from Rs. 2) The company offers a wide range of deposit products that include salary accounts, savings accounts, current accounts, recurring & fixed deposits and locker facilities.

Cordant Wealth Partners

AUGUST 16, 2024

Medical It’s typical to get a year of COBRA as part of your separation package at Intel, which pays for continued health insurance coverage and allows you to stay on your Intel plan. 18 months of coverage is being offered for COBRA plus a $20k Healthcare bonus. Tax planning for a transition out of Intel is critical.

WiserAdvisor

JANUARY 3, 2024

Five retirement investing tips to build the ideal portfolio for your golden years Tip 1: Ensure your investment portfolio includes tax-advantaged accounts Building an ideal retirement portfolio begins with optimal use of tax-advantaged accounts like Roth and Traditional options. You also use this account in addition to a 401(k).

Clever Girl Finance

DECEMBER 13, 2023

By adding to your savings accounts slowly but surely, you can confidently grow your emergency fund over time. Automating your savings means setting up automatic transfers to send money from your checking account to your fund every month, twice a month, or however often you want.

Mr. Money Mustache

JANUARY 29, 2021

The problem: I didn’t have anywhere near $400,000 sitting in my checking account, and I did not want to sell a bunch of shares and trigger capital gains taxes (which in my case would be at least $60,000), just for this short term project. The way a margin account can work, if you’re careful. I’m a good friend, but not that good.

WiserAdvisor

OCTOBER 31, 2023

No matter how meticulously you plan, your financial safety net must account for every possible worst-case scenario. You can consider Roth and Traditional accounts for this. Roth accounts are funded with after-tax dollars, so you do not pay taxes when you withdraw your funds during retirement. Life, however, might surprise you.

Good Financial Cents

DECEMBER 19, 2022

When we had this conversation, I initially joked that we would need to set up “braces savings accounts” for them instead of 529 college savings plans. For adults, insurance coverage might be less common, but some policies will still provide some coverage for cosmetic reasons.

Cordant Wealth Partners

DECEMBER 2, 2022

As part of your separation package at Intel, it’s typical to get a year of COBRA which pays for continued health insurance coverage and allows you to stay on your Intel plan. SERPLUS (Intel’s deferred compensation account). E*Trade Stock Account. Spouse’s Retirement Accounts. Taxable Brokerage account.

Fortune Financial

JULY 12, 2023

Additionally, keeping up with changes in healthcare policies, insurance plans and available resources is crucial. Retirees should review their insurance coverage annually, compare plans and explore options that provide the necessary healthcare services at a more affordable cost. Scan the QR code below to connect with us.

Fortune Financial

JULY 12, 2023

Additionally, keeping up with changes in healthcare policies, insurance plans and available resources is crucial. Retirees should review their insurance coverage annually, compare plans and explore options that provide the necessary healthcare services at a more affordable cost. Scan the QR code below to connect with us.

Clever Girl Finance

SEPTEMBER 1, 2022

While the money might not be a lot by itself, the combined amount can quickly add up and make a large dent in your bank account. Bank fees have been going up over the years, especially for interest-bearing accounts. For example, if you have a car but aren’t driving it often, you might not need full insurance coverage.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content