Avoiding Common Mistakes and Dangerous Financial Advice

The Big Picture

JUNE 28, 2025

Barry challenges common financial myths, explores why we’re drawn to faulty financial forecasts, and highlights red flags in popular financial advice. Good stuff!

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The Big Picture

JUNE 28, 2025

Barry challenges common financial myths, explores why we’re drawn to faulty financial forecasts, and highlights red flags in popular financial advice. Good stuff!

Wealth Management

AUGUST 5, 2025

Andrew Corn August 5, 2025 2 Min Read Maximusnd/iStock/Getty Images Plus For decades, advisors have marketed themselves as portfolio managers, tailoring asset allocation to each client’s unique goals, risk tolerance and life stage.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JUNE 9, 2025

2025 has had a tumultuous start for most advisory firms, as tariffs-driven market volatility has increased client anxiety and the amount of required hand-holding, forcing advisory firms to manage their own expenses a bit more closely in the face of greater revenue uncertainty.

Nerd's Eye View

FEBRUARY 10, 2025

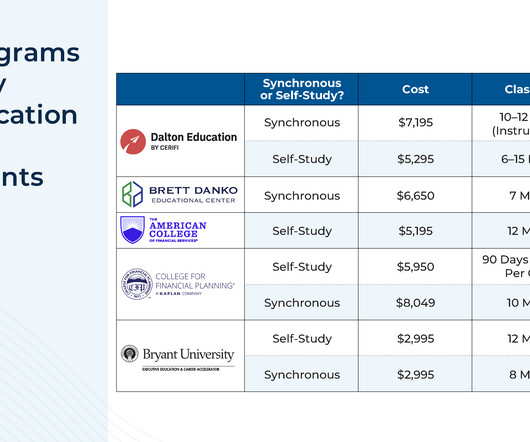

To earn the CFP marks, candidates must fulfill four key requirements: Education (holding a bachelor's degree and completing the required coursework through a CFP Board registered program), Exam (passing the 170-question CFP exam), Experience (gaining hands-on experience providing financial advice to the public), and Ethics (acting as a fiduciary).

Nerd's Eye View

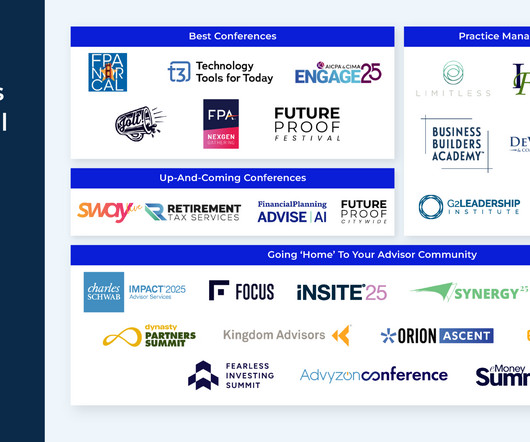

JANUARY 20, 2025

offer a high signal-to-noise ratio and are tailored to the needs of those who are a part of (or hope to join) the financial advicer community (i.e., those who are in the business of selling their financial advice as opposed to financial products).

Wealth Management

JUNE 27, 2025

June 27, 2025 Private markets are no longer just for the ultra-wealthy. Q&A: What Was Behind Schechter’s Decision to Sell to Arax? Q&A: What Was Behind Schechter’s Decision to Sell to Arax?

Wealth Management

AUGUST 5, 2025

Alex Ortolani , Senior Reporter , WealthManagement.com August 5, 2025 2 Min Read hocus-focus/iStock/Getty Images Plus Arax Investment Partners, a wealth management platform backed by private equity firm RedBird Capital Partners, has acquired another $1 billion registered investment advisor in a deal for Chesterfield, Mo.

Wealth Management

AUGUST 5, 2025

Brian Marchiel August 5, 2025 4 Min Read Donny DBM/iStock/Getty Images Plus The unified managed account has undergone a quiet but powerful evolution over the past two decades as managed accounts continue their journey to client centricity.

Wealth Management

AUGUST 8, 2025

The WealthStack Podcast: Jordan Raniszeski on Carnegie Private Wealth’s Tech Stack Playbook The WealthStack Podcast: Jordan Raniszeski on Carnegie Private Wealth’s Tech Stack Playbook Jordan Raniszeski discusses how and why he built Carnegies tech stack, and which tools that actually deliver client impact.

Nerd's Eye View

JULY 18, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent survey by Vanguard found while only 38% of investors reported considering time savings when signing up to receive financial advice , 76% of clients report saving time from working with an advisor (with a median (..)

Wealth Management

JULY 31, 2025

Ryan Munson , Research Manager , CFA Institute July 31, 2025 4 Min Read Artificial Intelligence is reshaping the financial sector, bringing unprecedented efficiency, personalization, and innovation. Raymond James Practice Mercer Advisors Lands $1.2B Raymond James Practice Mercer Advisors Lands $1.2B

Abnormal Returns

DECEMBER 25, 2024

theretirementmanifesto.com) What's changing for retirement in 2025. wsj.com) Personal finance You need to put on your own (financial) oxygen mask first. nytimes.com) Be careful who you trust for financial advice. morningstar.com) Investing Three easy ways to simplify your portfolio. Why you can't let that throw you.

Wealth Management

AUGUST 5, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all SS&C Support Platforms SS&C Unifies Wealth Management Platforms Under Black Diamond SS&C Unifies Wealth Management Platforms Under Black (..)

Wealth Management

JULY 2, 2025

Stich , CMO, Moran Wealth Management July 2, 2025 4 Min Read Anthony Stich (right) moderating a panel on AI at Wealth Management EDGE. Joey Corsica & SpotMyPhotos Wealth management is on the edge of a profound transformation—one that won’t be defined by dashboards, APIs or UX overlays.

Nerd's Eye View

JANUARY 3, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with a recent survey indicating that a majority of advisors are viewing new client acquisition as their primary challenge in the current competitive environment for financial advice (followed by compliance and technology management) and suggests (..)

Wealth Management

JULY 31, 2025

Alex Ortolani , Senior Reporter , WealthManagement.com July 31, 2025 3 Min Read Savvy Advisors, the registered investment advisor arm of platform provider Savvy Wealth , has added an advisor group managing $270 million in client assets in a first push toward bringing on larger teams alongside the solo practitioners that have fueled its growth.

Nerd's Eye View

JANUARY 13, 2025

Which is surprising to some, given that a decade ago, the emergence of so-called "robo-advisors" was supposed to displace human financial advisors and compress advisory fees. In reality, though, the robos struggled to gain traction, and the human financial advice business just continues to grow.

Indigo Marketing Agency

JUNE 18, 2025

The Best Content for Financial Advisors to Attract Clients in 2025 Does your blog feel stale? Here’s content for financial advisors that’s actually working—and how to make it easier. The Power of Video Content for Financial Advisors Video has emerged as the undisputed champion of content for financial advisors in 2025.

Wealth Management

AUGUST 5, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all SS&C Support Platforms SS&C Unifies Wealth Management Platforms Under Black Diamond SS&C Unifies Wealth Management Platforms Under Black (..)

Nerd's Eye View

MAY 16, 2025

Also in industry news this week: A recent study finds that financial advisory clients are leaving largely positive, in-depth reviews for their advisors FINRA has responded to some concerns about its proposed rule regarding outside business activities, saying that it is designed to streamline regulations and not (as has been suggested by some commenters (..)

Wealth Management

AUGUST 12, 2025

12, 2025) 11 Investment Must Reads for This Week (Aug. 12, 2025) 11 Investment Must Reads for This Week (Aug. 12, 2025) 11 Investment Must Reads for This Week (Aug. Advisors Say, Not So Fast Microsoft Report Says AI Will Replace Advisors. Advisors Say, Not So Fast Microsoft Report Says AI Will Replace Advisors.

WiserAdvisor

JUNE 17, 2025

Let’s dive into some of the key future investment trends and concerns that are already making waves in 2025 and are likely to gain even more momentum in the months ahead. 4 future investment trends and concerns to keep an eye on in 2025 1. And in 2025, that growth is expected to continue. In fact, U.S. Metacognitive AI.

WiserAdvisor

JUNE 4, 2025

Financial advisors should take these factors into account to ensure their clients receive the right experience. This article will discuss some of the most pivotal financial planning industry trends to watch out for this year. Below are top 5 finance industry trends in 2025 to look out for: 1.

Wealth Management

AUGUST 5, 2025

Diana Britton , Executive Editor , WealthManagement.com August 5, 2025 9 Min Read Wealthcare CEO Matt Regan Wealthcare, an integrated tech platform and hybrid registered investment advisory firm in West Chester, Pa., recently closed on its sale to Sammons Financial Group, an insurance holding company building out a wealth vertical.

Indigo Marketing Agency

DECEMBER 10, 2024

Protect Your Rankings: Navigating AI Content Risks in 2025 Googles ongoing algorithm updates are changing how businesses create and share content, making it more critical than ever for financial advisors to stand out with genuine, high-quality material. But it can be really challenging in todays digital age with all the noise.

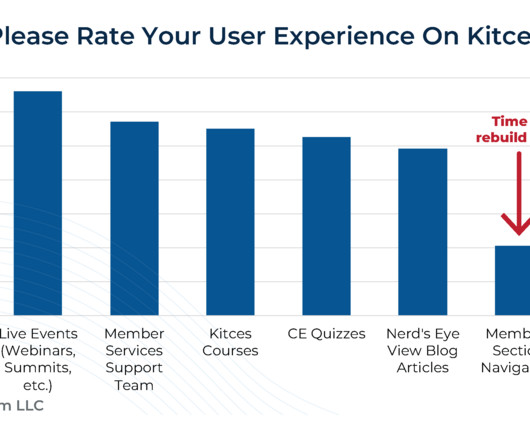

Nerd's Eye View

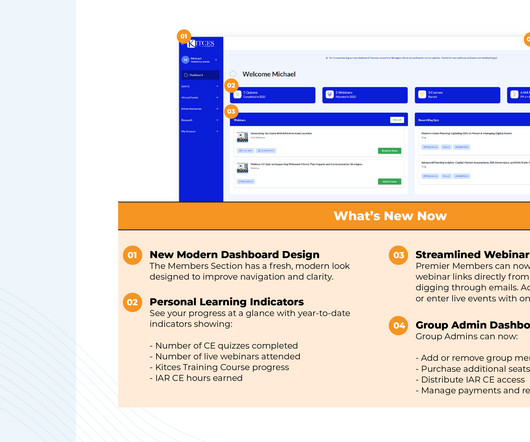

JUNE 30, 2025

Which led us at the beginning of 2025 to announce a major new initiative for the year: to completely rebuild and replace our existing Members Section , which has struggled to keep pace with the growth of our Membership and the expanded breadth of our educational offerings to Members. Read More.

The Big Picture

JULY 23, 2025

At The Money: Getting Paid in Company Stock (July 23, 2025) Equity-based compensation has become an increasingly popular form of compensation in the United States, especially in Tech and high-growth, VC-funded companies. And so the employer is also straddling that very same line It’s very unclear.

A Wealth of Common Sense

JULY 17, 2025

Posted July 17, 2025 by Ben Carlson A reader asks: I’m in my last year studying financial econ and looking to get into advising or wealth management. A Wealth of Common Sense --> A Wealth of Common Sense Home About Invest with Ben My Books Animal Spirits Podcast Speaking --> CFA or CFP?

Zoe Financial

JUNE 20, 2025

The platform itself does not offer financial advice Scenario-Based Guide: Hypothetical Investor Examples – Scenario 1: Linda, 68 — Planning for RMDs and Legacy Background : Linda holds a significant Traditional IRA and is approaching required minimum distributions (RMDs).

Advisor Perspectives

JULY 2, 2025

Financial advice is going to be in more demand than ever in 10 years. Is your firm ready for the challenge?

Indigo Marketing Agency

MAY 31, 2025

Now, in 2025, in a world where attention spans are shrinking, short-form video lets you show up with clarity, personality, and value in seconds. Whats the best financial advice youve ever received? Client Success Stories: Give a 30-second overview of how you helped someone reach a financial milestone.

Trade Brains

JULY 11, 2025

Synopsis: Indo Thai Securities announced a 1:10 stock split with a record date set for July 18, 2025. Indo Thai Securities Limited announced a 1:10 stock split on May 30, 2025, where each Rs. The record date for the stock split has been set as July 18, 2025. 10 share will be split into ten Re. crore in Q3 FY25 to Rs. percent.

Discipline Funds

JULY 14, 2025

I took a 47 year old household making $250,000 in 2025 and I backed out the numbers to create a reasonable starting point for two people, living together out of college who make a combined income of $75,000. Conclusion #2 – Americans don’t save enough. That leaves them asset rich and/or experience rich and cash poor.

Hubly

JUNE 24, 2025

Integrations solve many of those issues and free up advisors' time to answer questions and provide personalized financial advice. The wealth management experience for clients is often full of filling out repetitive forms, waiting to have questions answered, and not having an updated or accurate view of your investments.

Yardley Wealth Management

JUNE 25, 2025

Social Security as One of the Foundations of Your Retirement Income Strategy While Social Security may not be your primary source of income in retirement, it can provide a steady stream of supplemental income—adding an important layer to your overall financial strategy. USAToday.com, March 20, 2025 [link] 2. 6 Should You Convert?

Abnormal Returns

JUNE 23, 2025

theconversation.com) Due to budget cuts, the SEC is likely to examine fewer RIAs in 2025. citywire.com) How financial advisers charge for their services. kitces.com) The financial advice business was built with men in mind. (fa-mag.com) fa-mag.com) Are you a financial advisor?

XY Planning Network

JULY 7, 2025

It’s the space where fee-only advisors come together to reimagine their approach, reconnect with their vision, and get inspired by the experts, exhibitors, team, and support staff that are dedicated to making trusted financial advice accessible.

The Big Picture

JUNE 17, 2025

Like so much else involved in investing, it is simple, but hard… NOTE: I am changing the headline of the February 20, 2025 post from “ Tune out the Noise ” to “ Tune out Manage the Noise.”

SEI

JULY 28, 2025

For more information about our perspective on the future of financial advice, visit our website at wealthtechondeck.com quote Digital advice is not just about technology and technology replacing humans. Explore our comprehensive, integrated advice structure for RIAs and financial advisors.

Wealth Management

AUGUST 7, 2025

Evan Cooper August 7, 2025 5 Min Read Advice-Only Network founder Eric Simonson Given the centrality of advice in the work of financial advisors, it’s ironic how peripheral advice has been in the economics of advice providers.

Wealth Management

AUGUST 6, 2025

401(k) Real Talk Episode 162: August 6, 2025 401(k) Real Talk Episode 162: August 6, 2025 Open and honest conversation about anemic job growth, the DOL appealing the annuity safe harbor, whether PEPs are the Wild West and more.

Nerd's Eye View

SEPTEMBER 6, 2024

Notably, while the rule will create an additional compliance burden, the due diligence advisers offering comprehensive planning services (as well as their investment custodians) are likely already conducting on their clients to create an effective financial plan could be a 'defense mechanism' for these firms against criminals looking to take advantage (..)

eMoney Advisor

APRIL 13, 2023

In its Retail Banking: 2025 and Beyond report, PwC analysts explore five possible versions of the sector’s future. Closer Than Ever to Clients “We are incredibly bullish on the future of financial advice.” Retail Banking 2025 and Beyond,” August 2022. What will the future of banking look like?

Validea

MARCH 27, 2023

legislation, all new retirement savings plans will automatically enroll workers beginning in 2025, unless they opt out, and gradually increasing their savings rates as the years roll on. As a requirement of the new Secure Act 2.0 So while the Secure Act has given employees a much-needed leg-up, there is still a ways to climb.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content