How Sequence-Of-Inflation Risk Impacts Retirees Beyond Just Sequences Of Returns

Nerd's Eye View

SEPTEMBER 20, 2023

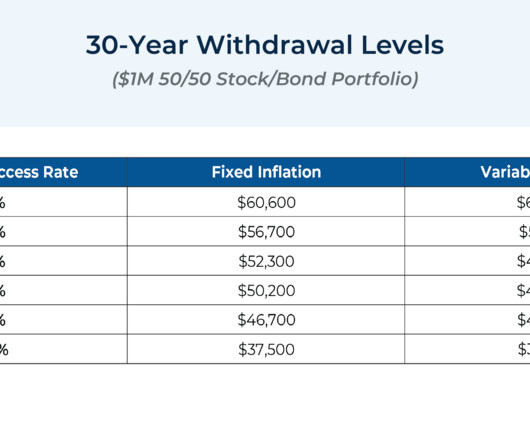

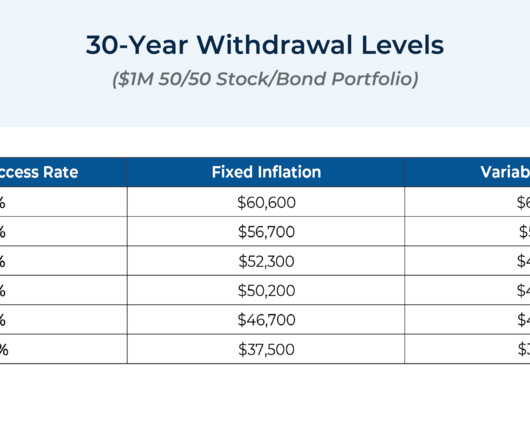

But despite recognizing the impact of investment variability and sequence of return risk on a financial plan, advisors have generally ignored the same historical trends for inflation in their clients' financial plans.

Let's personalize your content