The 18 Best Financial Advisor Conferences To Attend In 2025

Nerd's Eye View

OCTOBER 28, 2024

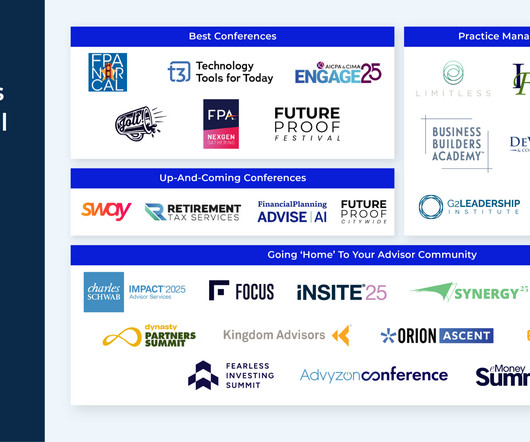

As a result, I am often asked for my own suggestions of what, really, are the industry's 'best' conferences to attend, and back in 2012, I started to craft my own annual list of 'best-in-class' top conferences for financial advisors.

Let's personalize your content