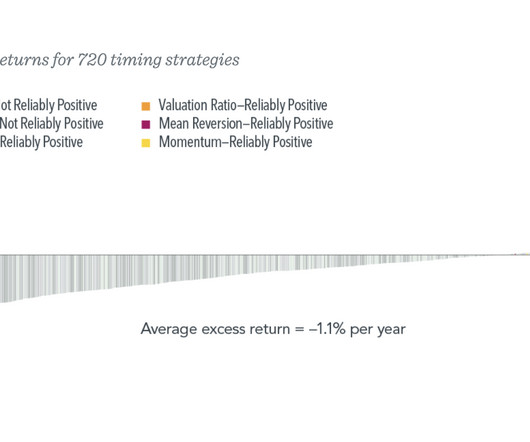

The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

Low Stakes : The most successful market timers are often those people who do not have actual assets at risk. When you get it wrong, it crushes your retirement plans. My own track record at making big calls is pretty damned good, but none of our clients wants me slinging around their retirement monies based on my gut instinct.

Let's personalize your content