Weekend Reading For Financial Planners (November 2–3)

Nerd's Eye View

NOVEMBER 1, 2024

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

APRIL 8, 2025

Welcome to the 432nd episode of the Financial Advisor Success Podcast! Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

NOVEMBER 6, 2023

(citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide. etf.com) The latest in financial advisortech including a new pay-per-lead generation platform. riaintel.com) How to prep an RIA for sale. (fa-mag.com)

FMG

MAY 19, 2025

A financial advisor Instagram bio might be short, but its impact isnt. Its one of the most visible pieces of your digital presence as a financial advisor. Financial advisors dont get second chances with first impressions. FIND OUT MORE HERE FAQs Why does a financial advisors Instagram bio matter?

Nerd's Eye View

SEPTEMBER 6, 2022

Welcome back to the 297th episode of the Financial Advisor Success Podcast ! Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households. My guest on today's podcast is Andy Panko. Read More.

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Nerd's Eye View

NOVEMBER 1, 2023

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge.

Midstream Marketing

NOVEMBER 6, 2024

Key Highlights Content marketing helps financial advisors stand out and earn trust from potential clients. When advisors share valuable content for a specific target audience, they can attract new clients and boost their online presence. It helps advisors show their thought leadership and grow their business.

Carson Wealth

JULY 3, 2024

Develop a risk management plan to implement strategies that minimize or eliminate risks, and protect your business with appropriate insurance coverage, such as liability, property and business interruption insurance. Get Help with Tax Planning Tax planning is a critical component of financial management.

Nerd's Eye View

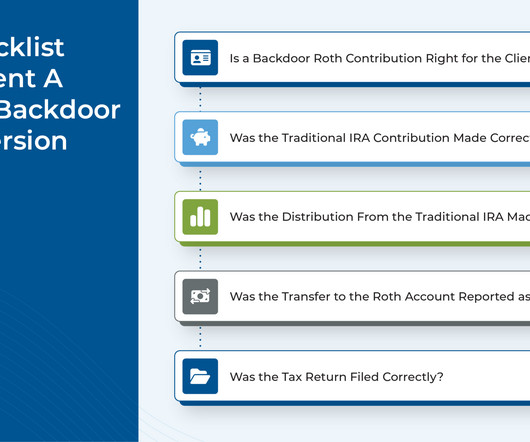

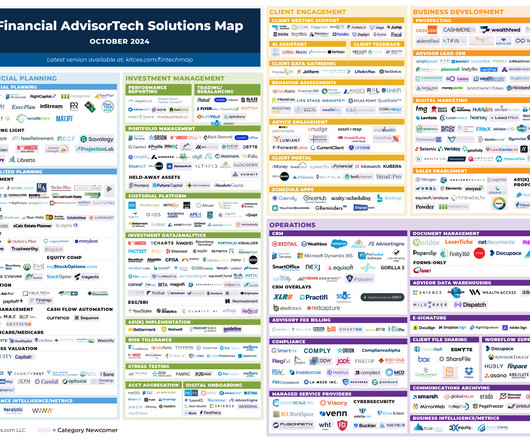

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Zoe Financial

MAY 18, 2023

5 Reasons Why You Should Hire a Financial Advisor Published May 18th, 2023 Reading Time: 3 minutes Written by: The Zoe Team Hiring a financial advisor is a big decision that can be crucial in helping you grow your wealth and achieve your goals. Here are 5 signs it might be time to hire a financial advisor.

Integrity Financial Planning

MARCH 15, 2023

Financial planning can be complicated. Have you thought about taxes or estate planning or when to withdraw and from where? Having a financial advisor can help navigate those emotions and decisions so you can feel more at ease. 4:06) Tax planning plays a key role in financial planning. (7:42)

Darrow Wealth Management

APRIL 21, 2025

This approach typically provides greater benefits to those who have significant assets and high taxable income in retirement. When a Roth conversion doesn’t make sense Since a Roth conversion will increase your ordinary income, it isn’t always advantageous as it can push you into a higher tax bracket.

WiserAdvisor

JULY 27, 2023

This advanced language processing technology has also greatly impacted the financial advisory sector, prompting a critical question: Can ChatGPT replace human financial advisors in retirement planning? Personalized guidance, empathy, and a deep contextual understanding are integral to effective retirement planning.

FMG

OCTOBER 6, 2022

From financial planning and risk analysis tools to marketing automation platforms , technology streamlines processes, increases productivity, and helps you grow your business faster. CRM for financial advisors tracks, manages, and analyzes the interactions you have with clients, prospects, referrals, and strategic partners.

Integrity Financial Planning

AUGUST 21, 2023

If you are running your own business and are interested in setting yourself up for retirement, contacting a financial advisor can be a great idea. A financial advisor can help guide you through all possible options and help you to understand how those options will affect you and your business.

Carson Wealth

JUNE 28, 2023

Your retirement income plan may be sending up bubbles, too, whether around Social Security, retirement account distributions, taxes or somewhere else – and these holes need to be patched up right away. So, to help your retirement plan be more airtight, let’s look at a few of the common leaks.

Indigo Marketing Agency

MARCH 10, 2025

Social Media Mistakes Financial Advisors Make (And How to Fix Them) Did you know that 73% of marketers think their social media marketing efforts have been either somewhat or very effective for their business? Financial advisors know social media marketing is effective, so they post. So whats the problem?

WiserAdvisor

AUGUST 3, 2023

While many individuals choose to navigate their financial journey independently, seeking the guidance of a professional financial advisor can offer unique advantages that may prove invaluable in the long run. One common aspect that most individuals consider is the cost associated with engaging a financial advisor.

Integrity Financial Planning

NOVEMBER 1, 2022

It doesn’t factor in your healthcare coverage situation, it isn’t designed to avoid the 3 strikes of tax planning , and it doesn’t account for the location and liquidity of your wealth and savings. However, the 4% Rule may be used as a conversation starter with your financial advisor on how to turn your savings into income.

WiserAdvisor

DECEMBER 15, 2023

While the prospect of accumulating sufficient retirement income may appear daunting, hiring a professional can be beneficial. The assistance of a financial advisor can play a pivotal role in helping you accumulate and safeguard your earnings. How do financial advisors help in retirement income accumulation?

International College of Financial Planning

OCTOBER 5, 2021

In this write up we look at the five most important elements of a Financial Advisor and the reasons it is important to have these traits to succeed in the industry. Are you exploring the career option as a Financial Advisor? Investments, tax planning, retirement planning is a dynamic field.

Harness Wealth

JANUARY 29, 2025

Bunching strategies Bunching strategies are tax planning techniques used to maximize deductions by combining multiple years’ worth of deductible expenses into a single tax year. Get started Harness makes it easy to find tax and financial advisors best suited to your needs. Starting at $1,500 per year.

International College of Financial Planning

AUGUST 2, 2021

There is a huge demand for Financial Advisors in India. In this write-up, we look at how one can become a financial advisor in India along with the opportunities and challenges in this career. Are you looking at a career as a Financial Advisor in India? What Does a Financial Advisor Do?

Indigo Marketing Agency

OCTOBER 6, 2020

Either way, millennials now make up the majority of the global workforce, and as they rise to the top, they’ll be looking for financial advisors to help them manage their growing wealth. . But besides these good qualities, there are three main reasons why financial advisors might want to start setting their sights on millennials.

Gen Y Planning

APRIL 3, 2023

When you think of people who use financial advisors, you may not consider yourself the right demographic. But it may surprise you that plenty of advisors cater to people who aren’t retired millionaires. There are plenty of reasons for younger people to engage with a financial advisor well before retirement age.

Integrity Financial Planning

JULY 17, 2023

How you handle taxes and when you are taxed are two of the most important factors when it comes to retirement planning. 6] Municipal bonds, in particular, can be an attractive investment because they are often exempt from most taxes. [7]

Darrow Wealth Management

NOVEMBER 17, 2022

Further, both examples ignore other sources of income, such as wages, pre-tax retirement account distributions, dividends, etc., that could increase the tax due from the surtax. Considering tax planning strategies to reduce the impact of the new MA surtax. But for others, there might be some strategies to consider.

WiserAdvisor

APRIL 16, 2025

Financial planning can be cumbersome and take a lot of your time. However, a financial advisor can help you overcome financial challenges and offer professional guidance beyond just picking stocks and bonds. Below are 6 reasons why you may need a financial advisor: 1.

Harness Wealth

APRIL 16, 2025

Strategic timing of conversions during lower-income years can minimize tax impact, though without recharacterization, investors must be more certain about their decision. This structure particularly benefits those expecting lower tax rates in retirement than during their working years.

International College of Financial Planning

JULY 10, 2023

This blog post will discuss the various aspects of being an investment advisor in India, including career prospects, roles and responsibilities, qualifying exams, necessary qualifications, job opportunities, and salary potential. They help clients manage their financial aspects and develop customized strategies based on their needs.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Table of Contents What Services Does a Financial Advisor Provide? Here, we focus on two such studies. .’

WiserAdvisor

FEBRUARY 29, 2024

Working with a financial advisor can significantly enhance your chances of retiring with more wealth. According to the National Study of Millionaires, nearly 7 out of 10 millionaires attribute their success, in part, to partnering with an investment professional or financial advisor. However, there is good news.

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

Midstream Marketing

NOVEMBER 6, 2024

Key Highlights Content marketing helps financial advisors stand out. When advisors share valuable content for a specific target audience, they can attract new clients. By tracking key metrics, advisors can adjust their strategies. Introduction In today’s world, financial advisors must be strong online.

Darrow Wealth Management

SEPTEMBER 26, 2024

This infographic has more on how a brokerage account is taxed. Tax planning opportunities in retirement If you only have assets in tax-deferred accounts, you may have fewer tax planning options in retirement. See 2024 limits to determine whether you’re eligible.

Yardley Wealth Management

FEBRUARY 4, 2025

In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations. From maximizing deductions to managing capital gains, we’ll cover everything you need to know about smart tax planning.

WiserAdvisor

JUNE 2, 2023

While there are various types of finance professionals who offer financial advice and services falling under the general financial advisor category, it should be noted that they differ significantly. Below are the different kinds of financial advisors you may choose from: 1. Need a financial advisor?

Zoe Financial

FEBRUARY 21, 2023

Depending on your situation, you may need the help of a financial advisor or an accountant. Dear Zoe Experts, I’ve been looking for tax planning guidance and am deciding whether to hire a financial advisor or an accountant. When looking for a financial advisor, ensure they’re certified.

Fortune Financial

APRIL 11, 2024

According to the Department of Labor , “Based on the experience of Council members, and testimony and conversations with recordkeepers, the value of uncashed retirement plan checks likely exceeds $100 million per year but could be considerably larger.

Fortune Financial

JUNE 2, 2023

In retirement, how you distribute that company stock will play a key role in determining your tax liability for its value. In the realm of investment and retirement planning, the concept of Net Unrealized Appreciation (NUA) holds significant importance. The remaining assets may be rolled over.

Fortune Financial

SEPTEMBER 25, 2023

Intermediate and Short-Term Goals Begin by distinguishing between your long-term, intermediate-term and short-term financial goals. Long-term goals typically encompass retirement planning, wealth preservation and estate planning. Chartered Financial Analyst (CFA) CFAs are experts in investment management and analysis.

International College of Financial Planning

NOVEMBER 10, 2021

MBA (Finance) – This is the minimum qualification that you’d need to work as an investment or financial advisor in India. Chartered Financial Analyst (CFA) – If you have set your eyes on becoming an Investment Advisor this is one of the best courses to take. Other Courses & Training Programs.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content