Weekend Reading For Financial Planners (November 2–3)

Nerd's Eye View

NOVEMBER 1, 2024

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 9, 2025

In the meantime, the buzz around AI continues to increase as well, less now about whether the tools will replace financial advisors (they don't), and more about how advisory firms can better leverage the technology to be more efficient in serving clients. Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Chicago Financial Planner

FEBRUARY 2, 2024

A part of this process might include hiring a financial advisor or hiring a new financial advisor if you have decided to move on from your current advisor. Hiring the right advisor for your needs is critical. Here are six questions to ask when choosing a financial advisor: How do you get paid?

Nerd's Eye View

OCTOBER 18, 2024

Also in industry news this week: 43% of wealth management firms are frustrated with the effectiveness of their CRM software, spurred on by challenges with integrations and workflows, according to a recent survey The Social Security Administration this week announced a 2.5%

Nerd's Eye View

DECEMBER 16, 2022

Also in industry news this week: While the FPA is going full steam ahead on its federal and state lobbying efforts to regulate the title “financial planner”, CFP Board is more focused on increasing recognition of the CFP marks. How individuals can best harness their willpower to achieve their biggest goals. Read More.

Nerd's Eye View

JULY 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Charles Schwab's latest RIA benchmarking study shows that firms saw significant AUM growth in 2023, thanks in part to strong equity market performance, but also thanks to organic growth initiatives that brought in additional (..)

Nerd's Eye View

OCTOBER 11, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a CFP Board ad campaign promoting a career in financial planning to high school and college students sparked an uproar in the planning community, as some advisors questioned whether the messages being sent in the ads – (..)

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

DECEMBER 23, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, ”, a series of measures that will have significant impacts on the world of retirement planning.

Nerd's Eye View

AUGUST 19, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the FPA is planning to leave the Financial Planning Coalition (which also includes the CFP Board and NAPFA) at the end of the year.

Nerd's Eye View

APRIL 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the Department of Labor released the final version of its Retirement Security Rule (a.k.a.

Nerd's Eye View

OCTOBER 13, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with a new study from Herbers & Company that provides insight into the financial planning services that consumers demand the most, and which services financial advisory firms offer the most often.

Nerd's Eye View

APRIL 12, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study has found that many small- and mid-sized advisory firms that use "supported independence" platforms for their technology and back-office needs, have the potential to see greater growth in the years ahead given (..)

Nerd's Eye View

FEBRUARY 23, 2023

The increasing popularity of financial planning has led to a growing awareness of how important managing finances and planning for the future can be. For most financial advisors today, a website is a critical tool that allows them to market their services and communicate their fees to potential clients.

Nerd's Eye View

JUNE 9, 2023

And given the opaque nature of many private investments, financial advisors could play an important role in helping their clients assess whether these opportunities make sense for their portfolio and broader financial plan.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

APRIL 7, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the T3/Inside Information Software Survey is available, providing insights into which technology tools advisors use and their level of satisfaction with them, which highlighted the continued rise of specialized financial planning (..)

Indigo Marketing Agency

JANUARY 16, 2025

10 Growth Marketing Strategies for Financial Planners in 2025 The new year wipes the slate clean and gives financial planners a fresh opportunity to focus on marketing strategies that attract and retain more clients in less time and with less energy. Case in point, Kevin Brown. And new leads and clients keep coming.

Nerd's Eye View

MAY 3, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent study indicates that nearly a third of advisors in the independent broker-dealer channel have considered transitioning to the RIA channel during the past year as they seek higher payouts and not just "independence" but (..)

Nerd's Eye View

FEBRUARY 2, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a Morningstar survey has found that financial advisory clients are more likely to stick with their advisor for emotional reasons rather than investment returns alone.

Nerd's Eye View

MAY 31, 2024

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the Financial Planning Association and Money.com are planning to publish a “Best Financial Advisors” list based on advisors’ education, credentials, and experience, as well as harder-to-quantify (..)

Nerd's Eye View

APRIL 4, 2024

Advisor Metrics, Cerulli Associates predicts that 37.5% (or nearly 110,000) of financial advisors will retire over the next 10 years. Beyond that, however, obligating financial planners to hire and train new advisors could create some unintended (and detrimental) consequences. Read More.

Yardley Wealth Management

JANUARY 21, 2025

The post Is Talking to a Financial Planner Worth It? Exploring the Benefits of Financial Planning appeared first on Yardley Wealth Management, LLC. Is Talking to a Financial Planner Worth It? ” This question crosses the minds of many people as they navigate their financial journey.

Nerd's Eye View

JUNE 7, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that recent surveys indicate that consumers continue to trust human financial advisors more than Artificial Intelligence (AI)-powered tools.

Nerd's Eye View

AUGUST 19, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the FPA is planning to leave the Financial Planning Coalition (which also includes the CFP Board and NAPFA) at the end of the year.

Darrow Wealth Management

FEBRUARY 13, 2025

When starting to search for a financial advisor, investors may not realize the different types of advisors out thereand theyre not all trying to sell you something. If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products.

MainStreet Financial Planning

MARCH 7, 2025

When choosing a financial advisor, how they charge for their services can significantly impact your long-term wealth. The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management).

Nerd's Eye View

OCTOBER 23, 2023

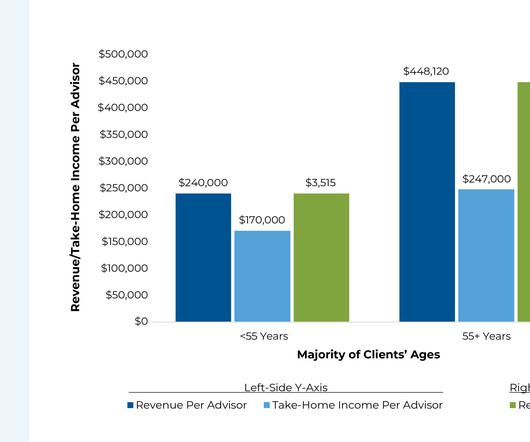

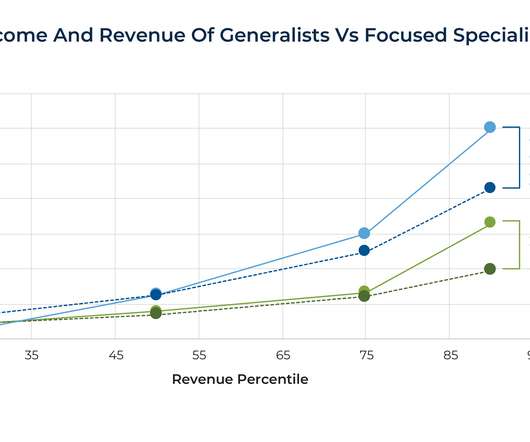

Many financial advisors take pride in the comprehensive nature of the advice they provide to clients and use the variety of services offered as a point of differentiation between themselves and other types of advisors.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Midstream Marketing

NOVEMBER 7, 2024

Key Highlights Learn how to improve your financial planner’s online visibility by using SEO and SEM wisely. Introduction In financial planning, it is key to know about search engine optimization (SEO) and search engine marketing (SEM). Digital marketing strategies are crucial for the success of financial planners.

Nerd's Eye View

JULY 18, 2023

Welcome back to the 342nd episode of the Financial Advisor Success Podcast ! Nancy is the Founder and CEO of Smarter Divorce Solutions, a consulting firm based in Phoenix, Arizona that provides financial expertise to individuals and couples (and sometimes, mediators and attorneys) going through the divorce process. Read More.

Tobias Financial

DECEMBER 15, 2024

When it comes to financial planning, working with an advisor who understands both tax law and financial strategy can offer significant benefits. Financial planning is not just about setting one goal – its a continual process of making decisions that shape your financial future.

Million Dollar Round Table (MDRT)

JANUARY 14, 2025

By Jamie McIntyre, CFP It was pretty clear from the regulator that they didn’t want product to be the focus of what a financial planner or financial advisor led with. So with that, the message was clear: Don’t lead with a financial product as the tool that is going to help someone.

Indigo Marketing Agency

FEBRUARY 8, 2025

Marketing for Financial Planners: Strategies to Build Trust and Grow Your Client Base Strategic Client Growth: Win Trust in a Trust Economy More than many other fields, trust is truly the currency that drives growth for financial planners. You have to focus on building trust!

Nerd's Eye View

DECEMBER 20, 2022

Welcome back to the 312th episode of the Financial Advisor Success Podcast ! Emily is the Senior Financial Planner for Archer Investment Management, a virtual Independent RIA based in Austin, Texas, that oversees $170 million of assets under management for nearly 170 families. My guest on today's podcast is Emily Rassam.

Nerd's Eye View

SEPTEMBER 8, 2022

For many financial advisors, the most valuable part of what they offer comes down to the financial advice that they give, whether it be the expert guidance they give to a certain niche or a unique point of view that presents unique insights to an individual client. developing a valuable offering for consumers.

The Chicago Financial Planner

FEBRUARY 8, 2023

Its important for retirees to understand how taxes will impact their retirement finances and to include this in their retirement financial planning. You should consult with the Social Security Administration, or a tax or financial advisor who is well-versed on Social Security regarding your specific situation.

Nerd's Eye View

OCTOBER 1, 2024

Welcome to the 405th episode of the Financial Advisor Success Podcast ! Gaetano is a partner and senior financial advisor at Fountainhead Advisors, an RIA based in Warren, New Jersey, that oversees approximately $900 million in assets under management for 1,000 client households. Welcome everyone! Read More.

Clever Girl Finance

DECEMBER 23, 2024

Freelancing is liberating, but without a solid financial plan, it can also be unpredictable. As a freelancer, you juggle not only your craft but also your finances, taxes, and retirement planning. That’s where financial planning for freelancers comes in. Plan for taxes ahead of time 4.

Midstream Marketing

NOVEMBER 8, 2024

Key Highlights Find good ways to get new clients as a financial advisor. Explore several ways to get financial advisor leads. Get advice from experts about good tools and methods for lead generation in financial services. It will help you connect with potential clients looking for financial help.

Midstream Marketing

NOVEMBER 12, 2024

[link] [link] [link] New Financial Advisor Prospecting When You Attend Networking Functions Keep Your Business Cards In Your Car When attending networking functions, it’s crucial to always have your business cards handy. Key Highlights Find new ways to get better at being a financial advisor.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built.

Nerd's Eye View

JANUARY 9, 2024

Welcome back to the 367th episode of the Financial Advisor Success Podcast ! Kimberly is the Lead Financial Planner and Managing Partner of Enders Wealth Management, a hybrid advisory firm based in Sterling Heights, Michigan, that oversees $50M in assets under management for 85 client households. Read More.

Nerd's Eye View

OCTOBER 3, 2023

Welcome back to the 353rd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Brett Danko. Read More.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content