Stock Market Highs and Your Retirement

The Chicago Financial Planner

NOVEMBER 8, 2021

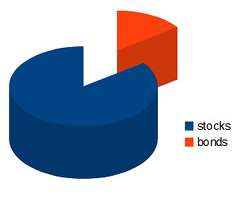

This might have been their own doing or the result of poor financial advice. For example, your plan might call for a 60% allocation to stocks but with the gains that stocks have experienced you might now be at 70% or more. Manage your portfolio with and eye towards downside risk. Click To Tweet.

Let's personalize your content