Has ERISA Litigation Been Helpful or Harmful?

Wealth Management

JULY 28, 2025

According to Engstrom, even the threat of litigation has helped, resulting in more plans searching for lower-cost share classes and conducting periodic RFIs and RFPs.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 28, 2025

According to Engstrom, even the threat of litigation has helped, resulting in more plans searching for lower-cost share classes and conducting periodic RFIs and RFPs.

Wealth Management

JULY 31, 2025

Derek Fitteron July 31, 2025 3 Min Read For wealthy families with complex financial lives, protection often starts with trusts, estate plans, and tax-optimized investment strategies. That includes ensuring healthcare coverage fits the client’s lifestyle, health needs, risk tolerance, and long-term goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JULY 25, 2025

The firm specializes in serving employees of the Florida Retirement System, including educators, healthcare workers and municipal employees. Oestreicher is joined by advisors Nicholas Brown and Travis Rich, and executive assistant Daniel Erazo. Oestreicher said he selected Osaic for its culture, technology and scale.

Wealth Management

JUNE 20, 2025

The services they offer are great differentiators and help make advisors a go-to resource for navigating the intricacies of retirement income planning (which is very complex), healthcare-cost planning (a too often overlooked major expense), and as an end-of-life services guide (in the case of bQuest).

Yardley Wealth Management

NOVEMBER 12, 2024

By planning for the unexpected, you can be confident that your family is prepared to weather any storms. Create a Will and Estate Plan Estate planning allows you to outline precisely how your assets should be distributed and how your children should be provided for if you’re no longer there.

WiserAdvisor

JUNE 13, 2025

Mistake #2: Not having an estate plan in place Estate planning is essential for protecting what you’ve worked hard to build. A good estate plan ensures your assets go where you want them to. A 2023 survey by Law Depot found that 73% of Americans didn’t have an estate plan.

Yardley Wealth Management

JANUARY 21, 2025

Retirement Planning Retirement planning is one area where talking to a financial planner proves particularly worthwhile. Tax Optimization When it comes to tax strategy, talking to a financial planner can be worth it for the potential savings alone.

The Big Picture

JULY 16, 2025

Um, hobbies, legacy, philanthropy or charitable goals to say nothing of future healthcare needs. How should people organize their thoughts and planning for, for future spending? You mentioned donor-advised funds, uh, philanthropy when it comes to both financial and estate planning. Talk a little bit about the idea behind.

Harness Wealth

NOVEMBER 12, 2024

Contribute to a FSA or Health Savings Account If you have a qualifying high-deductible health plan (HDHP), you might consider contributing to a Flexible Spending Account (FSA) or Health Savings Account (HSA). Review Your Estate Planning The end of the year can also be a practical time to take stock of your long-term estate planning.

Harness Wealth

APRIL 17, 2025

These variables can significantly impact the final deduction amount, necessitating strategic planning to optimize this benefit. For specified service businesses in fields such as healthcare, law, accounting, and financial services, income thresholds introduce phase-outs that may reduce or eliminate the deduction altogether.

Yardley Wealth Management

FEBRUARY 4, 2025

Tax Strategies for High-Income Earners in 2025.

WiserAdvisor

JUNE 4, 2025

At any given moment, people are working towards multiple goals like saving for retirement, managing taxes, buying a home, protecting their family through insurance, or planning for healthcare needs. People want all these goals to work together.

Midstream Marketing

NOVEMBER 6, 2024

Or are you focusing on older people who are concerned about estate planning for retirement or retirement income planning? Retirement Planning: Give tips on how to save for retirement. Explain how to manage your retirement funds and pay for healthcare. Tax Planning: Help clients learn smart tax strategies.

Cornerstone Financial Advisory

MARCH 14, 2025

As a Christian, your estate plan should represent your dedication to financial stewardship according to Scripture. W hat important factors should Christians consider when estate planning? W hat important factors should Christians consider when estate planning?

Carson Wealth

MARCH 6, 2025

Whats less common, but just as important, is outlining a specific plan for this transfer and updating it as circumstances change. If its been some time since you established your estate plan, you may want to think about giving it a review. How will this affect your overall plan? million.

Yardley Wealth Management

JUNE 25, 2025

Estate Strategy Benefits —Roth conversions can offer significant estate planning advantages, including no RMDs for the original account holder and tax-free inheritance for beneficiaries. There are also healthcare exceptions. There are a few exceptions.

The Big Picture

APRIL 8, 2025

And then the next step up seems to be full on wealth management, where you’re dealing with philanthropy, generational wealth transfer, a lot of bells and whistles including estate planning tax. But where AI is likely to have some of its most profound impacts is in healthcare. You guys offer the full suite of services.

WiserAdvisor

JUNE 11, 2025

Your plan should go beyond your 401(k) and take into account all aspects of your financial life, including your Social Security timing, pensions, healthcare costs, tax strategies, and estate planning. This is an ideal time to consult with a financial advisor to develop a comprehensive financial strategy.

MainStreet Financial Planning

NOVEMBER 14, 2024

Join Anna Sergunina, CFP® and Vida Jaulis, CFP®, and guest estate planning expert Barry W. Finkelstein, as they provide insights into establishing a meaningful estate plan to ensure a smooth transfer of assets through trusts, wills, and essential directives. About Barry W.

WiserAdvisor

JULY 4, 2025

Estate tax credits and gift tax exclusion Let’s talk estate planning for a moment. In 2025: The basic exclusion amount for federal estate tax is $13.99 Now is a good time to work with a financial advisor or estate attorney and revisit your estate planning strategies. e. taxes in 2025.

Yardley Wealth Management

DECEMBER 10, 2024

Plan for Longevity Women typically live longer than men, which means they need to plan for a longer retirement period and potentially higher healthcare costs. Factor longevity into your retirement planning by estimating your life expectancy and budgeting for additional years in retirement.

Indigo Marketing Agency

AUGUST 11, 2025

Whether you specialize in retirement planning for healthcare professionals, tax strategies for small business owners, or estate planning for high-net-worth individuals, there are people actively searching for your expertise. The key to success isn’t whether Google ads work in your niche.

Carson Wealth

MARCH 27, 2025

A medical POA can help ensure that healthcare decisions are based on your choices and preferences, even if you cant communicate them yourself. The person authorized to act as your financial POA can: Access your financial accounts to pay for healthcare, housing needs, and other bills. Ready to get started on your estate plan?

Cornerstone Financial Advisory

FEBRUARY 26, 2025

This includes how we plan and manage our estate. Effective estate planning is an act of financial stewardship. With our estate, we have the immense power to bless others, including our families, children, and charitable organizations we care about. In fact, your estate plan can reflect your deepest held values.

Carson Wealth

MAY 8, 2025

From there, estimate your future monthly expenses, including housing, healthcare, travel, and entertainment. The more accurately you understand your needs, the better you can plan. Plan for the Unexpected Life is unpredictable. Make sure you have at least a basic estate plan in place.

Yardley Wealth Management

JANUARY 28, 2025

The post Expert Insights: Estate Planning Communication and Modern HR Leadership Challenges in 2025 appeared first on Yardley Wealth Management, LLC. Clear Communication: Have detailed conversations with your chosen healthcare proxy about your specific wishes. Ensure documents are easily accessible when needed.

WiserAdvisor

JULY 1, 2025

Estate planning is not just for the wealthy; it is essential for anyone who wants to ensure their assets are managed and distributed according to their wishes. Whether you own an elaborate portfolio or a single family home, having a comprehensive plan in place can protect your legacy and provide peace of mind for your loved ones.

Tobias Financial

JUNE 12, 2025

Healthcare Proxy (or Medical Power of Attorney): This authorizes someone to make medical decisions if the young adult is unable to do so themselves, such as during an accident or illness. While we do not provide legal advice, we can help you understand how these documents may fit into a broader financial or estate plan.

WiserAdvisor

AUGUST 12, 2025

The child would have needs, like education, healthcare, and day-to-day expenses. What about estate planning? One thing many people overlook during this phase is estate planning. Unfortunately, financial fraud between partners is not unheard of.

Wealth Management

JULY 30, 2025

DNR orders are typically discussed with healthcare providers and documented in medical records to guide healthcare professionals during emergencies. This enhanced accuracy ensures that medical decisions are made promptly and correctly, reducing the risk of errors and misunderstandings.

Nerd's Eye View

JANUARY 8, 2024

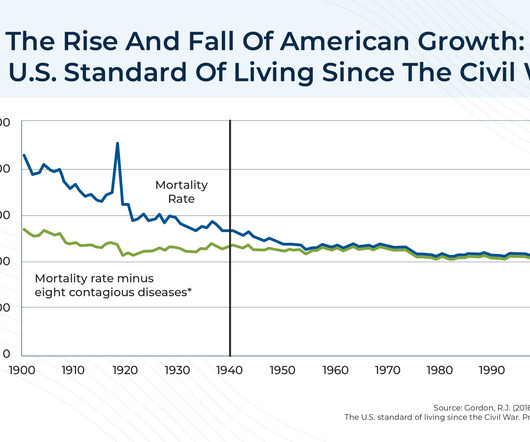

represents our current state of healthcare, in which genetic makeup and the environment play a major role in illness and disease, and where the focus of doctors lies primarily on the administration of treatments to cure and mitigate human ailments; and Medicine 3.0 In the context of the financial planning industry, whereas Financial Advice 1.0

eMoney Advisor

FEBRUARY 22, 2023

And if they’re unprepared—or worse, if the family estate planning strategies are less than buttoned up—how will that affect your practice down the line? To start the conversation with clients preparing to transfer wealth, you can simply say: “Tell me about who in the family was involved in the development of your estate plan.”

Pacifica Wealth

FEBRUARY 17, 2022

The decisions you choose to make and those you ignore or overlook for your estate plan will have long-lasting and permanent ramifications. Don’t let the significance of estate planning prevent you from getting started. When it comes to your estate plan, just jump in and get started. Of course not!

Yardley Wealth Management

NOVEMBER 19, 2024

The post Including Pets in Your Estate Plan for Peace of Mind appeared first on Yardley Wealth Management, LLC. Including Pets in Your Estate Plan for Peace of Mind As a pet owner, you’ve likely considered your furry friend’s well-being in many aspects of your life. People now treat pets like family.

Carson Wealth

APRIL 4, 2024

Information you’ll want to document includes: Bank accounts Investments Retirement accounts Estate planning documents (wills, trusts, etc.) I suggest putting together a folio file that you can store somewhere that is both safe and easy to access.

Integrity Financial Planning

JUNE 27, 2023

Maintaining Physical and Mental Health This might not be an apparent point at first, but maintaining physical and mental health in retirement can help you reduce one of the largest expenses many people incur as they age: healthcare.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help you with estate planning and preparing for your legacy goals Life is ever-changing, and estate planning becomes even more crucial during retirement. To ensure your assets are distributed per your wishes, estate planning is essential.

Advisor Perspectives

FEBRUARY 5, 2024

Clients want help with tax and estate planning, healthcare planning, and much more. Technology-based solutions make it possible to offer this.

MainStreet Financial Planning

JUNE 13, 2023

Plan for out-of-pocket costs for fertility treatments and costs to deliver your baby. Once your new dependent arrives your monthly premiums for healthcare will increase. Plan for family leave from work. Get your estate plan in order. Review your health coverage. Arrange for childcare.

NAIFA Advisor Today

FEBRUARY 15, 2023

Ike is highly skilled in analyzing long-term care insurance, Medicare supplement coverage, disability insurance, life insurance, and retirement planning. As a Financial Services Professional for Ike Trotter Agency , he provides healthcare, risk management, and "basic" estate planning solutions to families and small businesses.

Darrow Wealth Management

MARCH 31, 2023

You’ll also want to consider engaging a financial advisor, tax advisor, and estate planning attorney too. Estate planning is an important part of this, especially if you have young children, so consider setting up a trust. Get a new estate plan. This is a really important step.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. However, the main drawback to this can be the lack of foresight regarding what and how to plan.

eMoney Advisor

FEBRUARY 9, 2023

Now that they’re living from their retirement accounts, the financial challenges they face will include sustaining their current lifestyle, not outlasting their savings, and healthcare costs. Fortunately, these are all things you can do efficiently with the support of your technology solution.

MainStreet Financial Planning

OCTOBER 11, 2024

Healthcare Open enrollment is an excellent time to reassess your healthcare needs for the upcoming year. Here are a few items to review for your healthcare benefits: Consider if you need to change the type of healthcare plan you will have for the upcoming year.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content