Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 20, 2025

There is no shortage of written content available for financial advisors to enhance their technical skills, grow in their careers, and run more successful planning practices, from books to research studies to long-form written content. Further, because choosing 'top' podcasts is inherently subjective (e.g., Read More.

Nerd's Eye View

APRIL 18, 2025

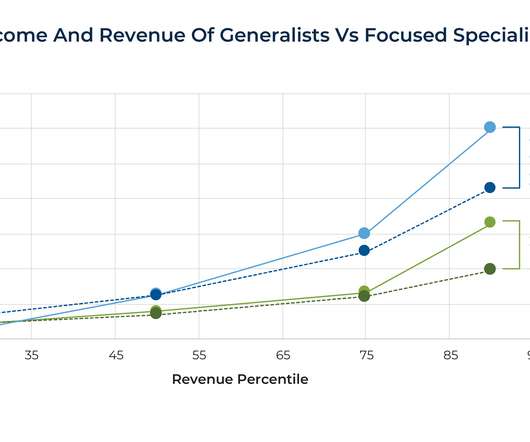

Which, according to Kitces Research on Advisor Productivity, can lead to higher productivity for advisor teams (but can require an investment in staffing and higher-end planning services to meet their complex planning needs).

Nerd's Eye View

JUNE 21, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5 million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey.

Nerd's Eye View

DECEMBER 1, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the U.S. Supreme Court heard arguments this week in the case of SEC v.

Wealth Management

JUNE 27, 2025

Finally, I was excited to interview Royi Markowitz and Jonathan Dane, the CEO and chief financial planner, respectively of the AI-powered and AI-driven financial planning startup Quinn , which came out of stealth this week and announced an $11 million seed round of funding, led by the Israeli venture capital firm Viola Fintech. “We

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Only fiduciary advisors are legally bound to act in your best interest at all times. Here are five ways you can find a full-time fiduciary financial advisor. What is a fiduciary advisor?

Nerd's Eye View

JUNE 7, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that recent surveys indicate that consumers continue to trust human financial advisors more than Artificial Intelligence (AI)-powered tools.

MainStreet Financial Planning

MARCH 7, 2025

When choosing a financial advisor, how they charge for their services can significantly impact your long-term wealth. The two most common pricing models are fee-only financial planners (flat-fee or fixed-fee advisors) and AUM-based financial advisors (who charge a percentage of assets under management).

Yardley Wealth Management

JANUARY 21, 2025

The post Is Talking to a Financial Planner Worth It? Exploring the Benefits of Financial Planning appeared first on Yardley Wealth Management, LLC. Is Talking to a Financial Planner Worth It? ” This question crosses the minds of many people as they navigate their financial journey.

Nerd's Eye View

SEPTEMBER 19, 2022

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively.

Indigo Marketing Agency

MARCH 5, 2025

Seminar Marketing for Financial Advisors Guide to Seminar Marketing for Financial Advisors: Generate Endless High-Quality Leads Theres a reason some of the most successful and fast-growing financial advisor businesses spend a great deal of their marketing efforts promoting and hosting seminars.

Midstream Marketing

DECEMBER 10, 2024

By adopting these campaigns, advisors can achieve better results, connect with their target audience, and grow their business successfully. Introduction In todays challenging market, financial advisors need strong financial advisor marketing strategies. This is why video marketing works well for financial advisors.

eMoney Advisor

APRIL 4, 2023

While your clients may spend time and money to get their estate properly organized, there are additional steps financial professionals can take to help them prepare their children to receive their inheritance. This same report noted that more than 70 percent of heirs are likely to change financial advisors after inheriting.

WiserAdvisor

SEPTEMBER 1, 2022

If you are thinking about why you should continue meeting with your financial advisor, you have already taken a big step toward securing your financial future – you have engaged the services of a professional. Now, how often you need to meet with your advisor depends on the degree of help needed by you.

FMG

JULY 9, 2025

The other day, a financial advisor asked Samantha Russell: “How in the world do we get AI to recommend our business?” She answered right away and said financial advisors need to focus on three things: get reviews, build their reputation, and format their content using natural language and Q&As.

International College of Financial Planning

OCTOBER 26, 2023

The Imperative of Estate Planning: Not Just for the Affluent Often, there’s a prevailing misconception that estate planning is a luxury reserved for the wealthy elite. Real estate planning is a crucial undertaking that every adult and family should prioritize.

International College of Financial Planning

APRIL 20, 2022

If you are a student looking to make a career in finance, becoming a financial planner is a great place to start. Financial planning is a rewarding, stable career that can give you the opportunity to help people make the most of their money. They advise on investments, taxes, retirement, and estate planning.

Your Richest Life

JULY 17, 2024

Financial advice from the internet, podcasts, books or even your family members has to be taken with a grain of salt, because those sources don’t know your full financial picture. Money lesson #7: Find the financial planner who is right for you. For more information on the services offered, contact Katie today.

Sara Grillo

JULY 8, 2022

Here are real accounts of what a day in the life of a financial advisor entails, from real professional financial advisors. Why did I find it necessary to write about the day in the life of a financial advisor? I am a CFA® charterholder and financial advisor marketing consultant.

International College of Financial Planning

JANUARY 18, 2023

.” Today’s businesses require financial advice to fulfill their financial objectives. Selecting a career as a “financial planner” will aid in opening doors to success. If you are aspiring to become a successful financial planner? Consider the CFP course. He discussed his insights.

International College of Financial Planning

MAY 6, 2022

A Certified Financial Planner (CFP) is a professional designation awarded to individuals who have completed a rigorous course of study and passed a comprehensive exam. The CFP designation is recognized worldwide and marks excellence in the financial planning industry. FP designation.

Carson Wealth

DECEMBER 13, 2022

Financial service professionals call themselves lots of things — most of the time using the title established by their firm. Regulators of financial planning firms and accrediting bodies do not lay out differences in nomenclature. RIAs commonly use two titles for their IARs: Financial Advisor and Wealth Manager.

International College of Financial Planning

DECEMBER 4, 2023

In the ever-changing finance sector, the significance of a financial advisor cannot be overstated. As financial markets grow more intricate and client needs to diversify, particularly in India, the focus on a financial advisor’s qualifications have intensified. In India, this landscape is evolving.

Indigo Marketing Agency

JUNE 14, 2025

Advisor Spotlight: Bryan Trugman In our Advisor Spotlight Series, we aim to highlight our amazing financial advisors who go above and beyond, whether through volunteer work, unique tax planning, or thought leadership (just to name a few). Real Collaboration. Real Results. Let the Experts Handle Your Marketing.

Park Place Financial

SEPTEMBER 8, 2022

ESTATES How to Choose a Personal Financial Advisor Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Whether planning for retirement or evaluating different investment options, people seek the assistance of a personal financial advisor for many reasons. Financial Advisor .

Indigo Marketing Agency

APRIL 28, 2023

Remember that headlines are searchable by keyword, so you’ll want to spend some time thinking about what your prospects might type into a search when trying to find an advisor to help them with their particular plight. Advisors often ask me whether they should list their job title and firm name in their headline.

Walkner Condon Financial Advisors

APRIL 21, 2023

What does it mean to be a Fee-Only financial advisor ? Fee-Only financial advisors and firms receive no sales-related compensation or incentives. This can include mutual funds, insurance policies, annuities, and other financial products. At Walkner Condon, all of our advisors are fiduciaries for our clients.

International College of Financial Planning

AUGUST 2, 2021

There is a huge demand for Financial Advisors in India. In this write-up, we look at how one can become a financial advisor in India along with the opportunities and challenges in this career. Are you looking at a career as a Financial Advisor in India? What Does a Financial Advisor Do?

Harness Wealth

MAY 25, 2023

Here’s a deep dive into the average fees of financial advisors, in 2023. The primary fee structures are: Fee-only : Advisors only receive payment from their clients for the services they provide, not receiving any commissions or other incentives from product providers. Between 0.5%

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

Clever Girl Finance

JULY 16, 2023

And that’s probably why you’re asking the question: do I need a financial advisor? Table of contents Is it really necessary to have a financial advisor? How to know When don’t you need a financial advisor? How much does a financial advisor cost? Leverage these tips to decide!

WiserAdvisor

JUNE 2, 2023

While there are various types of finance professionals who offer financial advice and services falling under the general financial advisor category, it should be noted that they differ significantly. Below are the different kinds of financial advisors you may choose from: 1. Need a financial advisor?

WiserAdvisor

AUGUST 3, 2023

While many individuals choose to navigate their financial journey independently, seeking the guidance of a professional financial advisor can offer unique advantages that may prove invaluable in the long run. One common aspect that most individuals consider is the cost associated with engaging a financial advisor.

WiserAdvisor

DECEMBER 1, 2023

The need for sound financial guidance is universal. Whether you are self-employed or salaried, everyone can benefit from the expertise of a financial advisor. However, some professionals, like doctors, may need the guidance of a financial advisor more than others.

International College of Financial Planning

OCTOBER 5, 2021

In this write up we look at the five most important elements of a Financial Advisor and the reasons it is important to have these traits to succeed in the industry. Are you exploring the career option as a Financial Advisor? Investments, tax planning, retirement planning is a dynamic field.

FMG

MAY 22, 2023

For our latest Financial Advisor Website Showcase, we are joined by James. M Comblo, CEO of FSC Wealth Advisors. So I chose to join the family business as an advisor in 2012 and continued on until becoming president and CEO in 2021. James has seen some amazing results from his updated FMG website.

Carson Wealth

JULY 12, 2022

In this blog, we’ll break down industry jargon, share what various credentials indicate and explain why the financial services industry is so regulated. . Registration Standards for Financial Advisors. Professional Certifications for Financial Advisors. Broad Based Financial Planning Designations.

International College of Financial Planning

JUNE 27, 2025

Laying the foundation with a basic emergency fund, securing adequate life and health insurance, beginning investments for her child’s education, and planning early for retirement are essential steps toward building long-term financial security.

Sara Grillo

DECEMBER 12, 2022

Watch as all h&#@ breaks loose discussing the question of broker vs. financial advisor, commissions, fees, value, and more! I am a CFA® charterholder and financial advisor marketing consultant. I am an irreverent and fun marketing consultant for financial advisors. This debate went psycho at times.

Ballast Advisors

MAY 8, 2023

They started working with the team of financial advisors at Ballast Advisors over a decade ago. Jean and her husband worked hard to realize their financial goals, being a snowbird in Florida, golfing, traveling, and loving on eight great-grandchildren. We followed the advice of our financial planner.

Clever Girl Finance

JANUARY 22, 2024

Consult with professionals for your windfall finance planning During the waiting period, consult with a certified financial planner , a financial advisor, and/or a CPA to determine what to do concerning taxes. After receiving a significant amount of cash, your net worth and financial circumstances change.

Zoe Financial

FEBRUARY 21, 2023

Depending on your situation, you may need the help of a financial advisor or an accountant. Dear Zoe Experts, I’ve been looking for tax planning guidance and am deciding whether to hire a financial advisor or an accountant. When looking for a financial advisor, ensure they’re certified.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content