All the Tax Benefits You Need for Your Small Business

Harness Wealth

APRIL 17, 2025

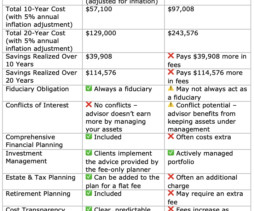

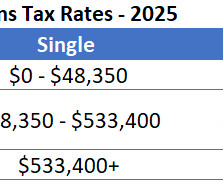

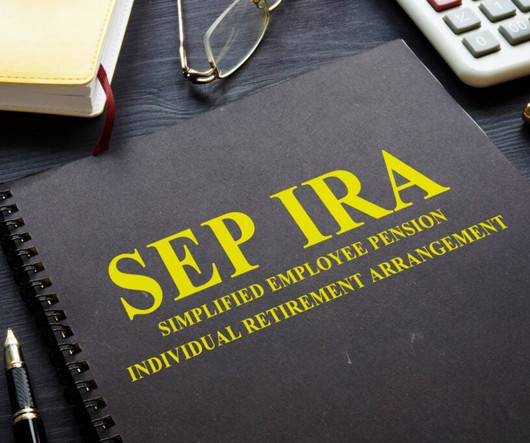

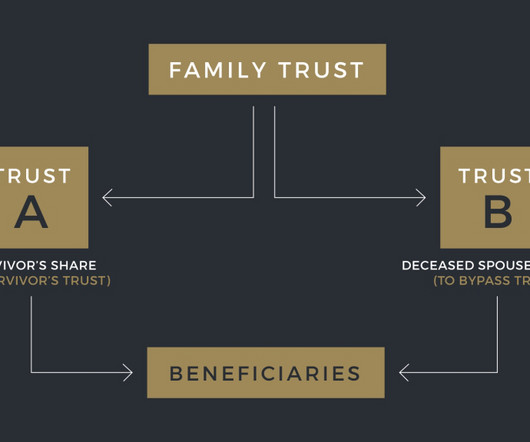

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Let's personalize your content