There’s No Smart Money

The Irrelevant Investor

AUGUST 14, 2020

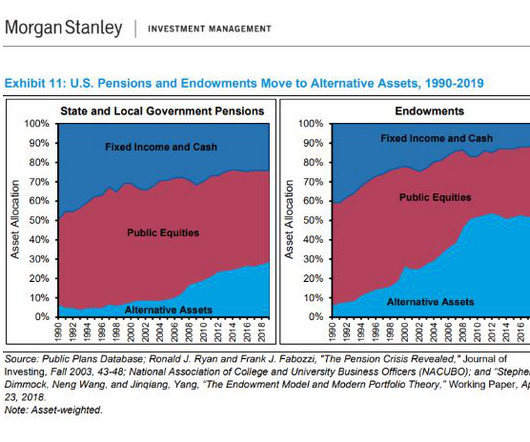

On this week's Animal Spirits, we talked about: Why the phrase "the smart money" has lost all meaning The rise of fractional trading And how alternative investments could benefit from low interest rates [link] The post There’s No Smart Money appeared first on The Irrelevant Investor.

Let's personalize your content