When All You Feel is Reward

The Irrelevant Investor

JUNE 20, 2019

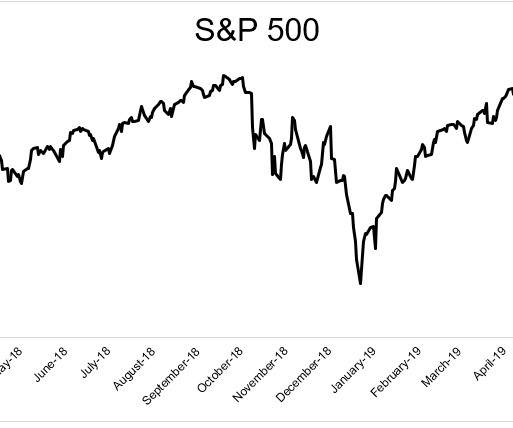

Think all the way back to the end of May. The S&P 500 had just experienced a 6% monthly loss for the third time in eight months. The stock market had made zero progress since January of the previous year. It was looking like tariffs would soon be raining down on Mexico. The global economy was decelerating. With all of this going on, there was little reason to expect what was about to happen next.In the thirteen trading days since the end of May, the S&P 500 is up almost 8%, and once agai

Let's personalize your content