User Agreements: The Hidden Risks in Third-Party Integrations

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Wealth Management

AUGUST 30, 2024

Advisors need to be diligent when it comes to their third-party technology and terms of service.

Nerd's Eye View

AUGUST 30, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that a recent benchmarking study suggests that a number of RIAs are looking to move 'upmarket' and work with wealthier clients by expanding their service menu to include family office services, investment banking, and/or trust services.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

AUGUST 30, 2024

Advisory firms grew 5.7% last year, according to a new study by The Ensemble Practice. It’s a wakeup call for firms to make marketing a vital function.

A Wealth of Common Sense

AUGUST 30, 2024

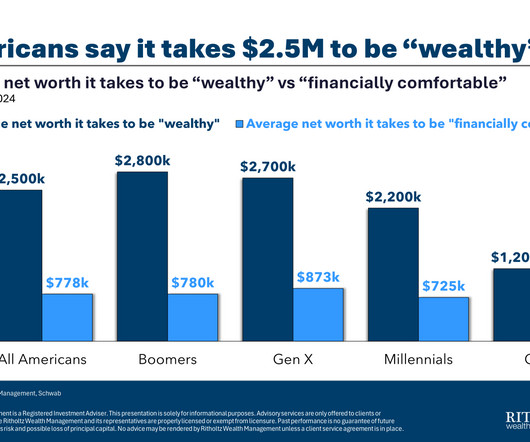

Finance definitions are tough to pin down because money is often in the eye of the beholder. The goalposts are always moving as you age and mature, and tastes change. Your perception of wealth can be impacted by: How you were raised. The wealth and material possessions of your peers. Your lifestyle. Your contentment with what you have. How your circumstances change over time.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

AUGUST 30, 2024

After a sluggish first six months of 2023, publicly-traded REIT total returns are up more than 10% in the third quarter and by double-digits year-to-date.

Advisor Perspectives

AUGUST 30, 2024

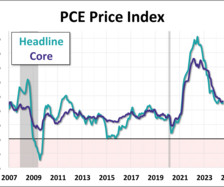

The BEA's Personal Income and Outlays report revealed inflation remained at its lowest level since early 2021. The PCE price index, the Fed's favored measure of inflation, was up 2.5% year-over-year, just below the forecasted 2.6% growth. On a monthly basis, PCE inflation was up 0.2% from June, as expected.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Advisor Perspectives

AUGUST 30, 2024

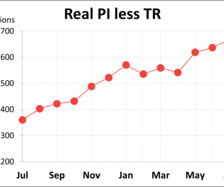

Personal income ( excluding transfer receipts ) rose 0.32% in July and is up 4.1% year-over-year. However, when adjusted for inflation using the BEA's PCE Price Index, real personal income (excluding transfer receipts) was up 0.16% month-over-month and up 1.6% year-over-year.

Wealth Management

AUGUST 30, 2024

Some technology people moves, Surge rolls out Fusion 1 suite, YCharts and Broadridge integrate.

Validea

AUGUST 30, 2024

NVIDIA (NVDA) reported strong financial results this week for the second quarter of fiscal year 2025, ending July 28, 2024, although the stock sold off some due to the high expectations embedded in it. The company achieved record quarterly revenue of $30.0 billion, representing a 15% increase from the previous quarter and a remarkable 122% year-over-year growth.

Alpha Architect

AUGUST 30, 2024

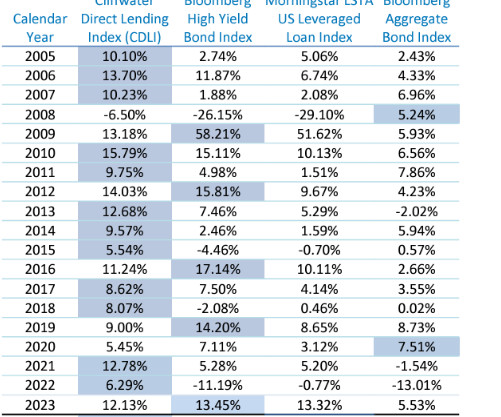

Private debt funds are a rapidly growing segment of the private capital market. Isil Erel, Thomas Flanagan, and Michael Weisbach, authors of the April 2024 study “Risk-Adjusting the Returns to Private Debt Funds,” evaluated those risk-adjusted returns. Applying a cash-flow based method to form a replicating portfolio that mimicked their risk profiles, they reached the [.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Advisor Perspectives

AUGUST 30, 2024

Valid until the market close on September 30, 2024 This article provides an update on the monthly moving averages we track for the S&P 500 and the Ivy Portfolio after the close of the last business day of the month.

SEI

AUGUST 30, 2024

SEC cyber regulations apply to a broad range of roles within public companies and the financial services industry specifically. These seven steps will help your organization build a strong cybersecurity structure.

Advisor Perspectives

AUGUST 30, 2024

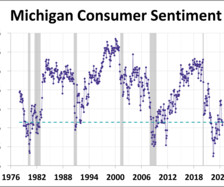

Consumer sentiment rose for the first time in five months, according to the final August report for the Michigan Consumer Sentiment Index. The index rose 1.5 points (2.3%) from July's final reading to 67.9. The latest reading was above the forecast of 67.8.

Random Roger's Retirement Planning

AUGUST 30, 2024

Let's start with a quote posted by Meb Faber attributed to Cliff Asness. No one is perfect, but I do think I've been pretty good at this for a long time. This is a skill, or maybe mindset is a better word, to cultivate and maintain. Here's a good article on catastrophe bonds from Bloomberg. The article seemed to focus on a rough spring for the category according to Fermat Capital Management, who is a big player in the space.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Prosperity Coaching

AUGUST 30, 2024

Financial Advisor Communication Skills: Around 3 in 4 employees view effective communication as crucial to the leadership skills they seek in a manager or CEO. However, only about 1 in 3 of those same employees consider their current leadership to communicate efficiently. Why is there a disconnect between these numbers? […] The post Financial Advisor Leadership: Why Communication Skills are Critical appeared first on The Prosperous Advisor Coaching Blog.

Advisor Perspectives

AUGUST 30, 2024

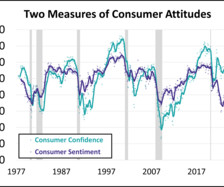

Consumer attitudes are measured by two monthly surveys: the University of Michigan’s Consumer Sentiment Index (MCSI) and the Conference Board’s Consumer Confidence Index (CCI). In August, the MCSI rose for the first time in 5 months, inching up to 67.94. Meanwhile, the CCI increased to 103.3, its highest level in 6 months.

Truemind Capital

AUGUST 30, 2024

Real Estate investment never leads to losses. I have heard this from many investors. Is it true? Generally, people look at losses with reference to their initial purchase price. If the investment is sold below the purchase price, it is a loss. If the investment is sold above the purchase price, it is a gain. So, when real estate prices go down, people tend to hold on to their investments and don’t sell them.

Advisor Perspectives

AUGUST 30, 2024

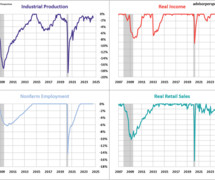

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. There is, however, a general belief that there are four big indicators that the committee weighs heavily in their cycle identification process.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Validea

AUGUST 30, 2024

The low volatility factor focuses on stocks exhibiting lower price fluctuations compared to the broader market. This approach is based on the observation that, contrary to traditional financial theory, low-volatility stocks have historically provided better risk-adjusted returns than high-volatility stocks over long periods. This phenomenon, known as the “low-volatility anomaly,” challenges the conventional wisdom that higher risk should be rewarded with higher returns.

Advisor Perspectives

AUGUST 30, 2024

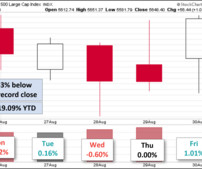

The S&P 500 capped off the month of August just below its record high, finishing up 0.24% from last Friday. The index is currently 0.33% off its record close from July 16th, 2024 and is now up 19.09% year-to-date.

Trade Brains

AUGUST 30, 2024

Have you ever wondered why some traders thrive in the forex market while others find their fortune in stocks? Understanding the differences between forex and stock trading is crucial for making informed investment decisions. This article will help you understand the key distinctions between these two markets and determine which option might be better suited to your trading style and goals.

Advisor Perspectives

AUGUST 30, 2024

The latest Chicago Purchasing Manager's Index (Chicago Business Barometer) edged up to 46.1 in August from 45.3 in July. The latest reading is better than the 45.0 forecast but keeps the index in contraction territory for a ninth straight month.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Leading Advisor

AUGUST 30, 2024

Brightrock Financial seeks an exceptional and experienced Executive Assistant to join our Team. We strive to be the best and provide a high level of… The post Executive Assistant – Brightrock Financial appeared first on Leading Advisor - Simon Reilly.

Advisor Perspectives

AUGUST 30, 2024

When you see that behavior at extreme valuations, it tends to be a sign of underlying skittishness and risk aversion. When valuations are setting record extremes because the news can’t get any better, even a slightly less optimistic outlook becomes a risk.

Abnormal Returns

AUGUST 30, 2024

The biz It's not your imagination. Podcasts are running more ads. (wsj.com) The Kelce brothers just signed a big deal for their podcast with Amazon's ($AMZN) Wondery. (variety.com) How Apple ($AAPL) has fumbled its lead in podcasting. (spyglass.org) Economy Cameron Passmore and Benjamin Felix talk with Kyla Scanlon, author of "In This Economy?: How Money & Markets Really Work.

Advisor Perspectives

AUGUST 30, 2024

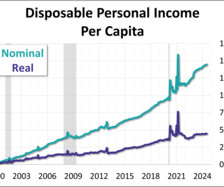

With the release of July's report on personal incomes and outlays, we can now take a closer look at "real" disposable personal income per capita. At two decimal places, the nominal 0.21% month-over-month change in disposable income comes to 0.06% when we adjust for inflation. The year-over-year metrics are 3.09% nominal and 0.58% real.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

AUGUST 30, 2024

The late Jack Bogle — father of the first index fund — famously loathed their exchange-traded offspring, warning that it only incentivize speculative trading among “fruitcakes, nut cases and lunatic fringe.” Fast forward to 2024, and critics warn a new generation of ETFs are designed to do exactly that.

Advisor Perspectives

AUGUST 30, 2024

Nvidia Corp., the world’s biggest chipmaker, has discussed joining a funding round for OpenAI that would value the artificial intelligence startup at more than $100 billion, according to people familiar with the matter.

Advisor Perspectives

AUGUST 30, 2024

There’s an adage in Silicon Valley: Hardware is hard. And expensive. And time-consuming. That’s the case even when you’re a company that’s really good at it — like Nvidia Corp., whose market value has grown to $3 trillion thanks to its extraordinary prowess in the trickiest hardware challenge today: building cutting-edge chips for artificial intelligence.

Advisor Perspectives

AUGUST 30, 2024

China's economic transformation presents both challenges and opportunities for global markets.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content