Real Estate Newsletter Articles this Week: Low Level of Delinquencies and Foreclosures

Calculated Risk

JUNE 15, 2024

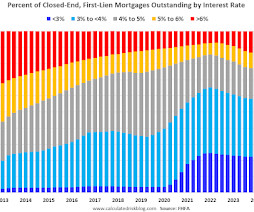

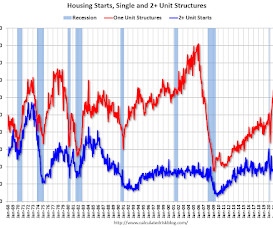

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Q1 Update: Delinquencies, Foreclosures and REO • Part 1: Current State of the Housing Market; Overview for mid-June 2024 • Part 2: Current State of the Housing Market; Overview for mid-June 2024 • 3rd Look at Local Housing Markets in May • 2nd Look at Local Housing Markets in May This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Let's personalize your content