The Day the Treasury Topped

The Reformed Broker

JUNE 11, 2023

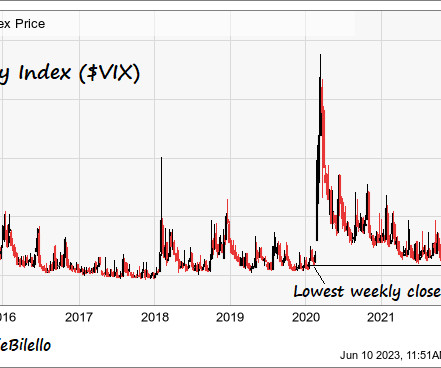

The parabolic spike in 2-year Treasury bond rates this winter ended with a crescendo on Thursday, March 9th and Friday March 10th. That week, the collapse of Silicon Valley Bank had thoroughly spooked the markets and convinced traders that the Federal Reserve would be forced to start downshifting its hiking cycle and the accompanying hawkish rhetoric.

Let's personalize your content