Real Estate Newsletter Articles this Week: House Price Index Up 6.5% year-over-year in March

Calculated Risk

JUNE 1, 2024

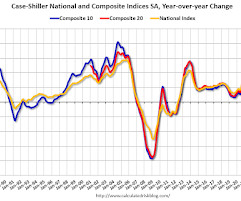

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Case-Shiller: National House Price Index Up 6.5% year-over-year in March • Inflation Adjusted House Prices 2.2% Below Peak • Fannie and Freddie: Single Family Serious Delinquency Rate Decreased in April, Multi-family Increased Slightly • Final Look at Local Housing Markets in April and a Look Ahead to May Sales This is usually published 4 to 6 times a week and provides more in-depth analysis of the housin

Let's personalize your content