Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Yardley Wealth Management

AUGUST 20, 2024

The post Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility appeared first on Yardley Wealth Management, LLC. Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility Introduction: Market volatility is a fact of life for investors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Carson Wealth

JUNE 9, 2025

Congrats again to the Dow on an amazing run and to all the investors over the years who have benefited by sticking to their investment plans. US LEI Deteriorates Right now, our proprietary US Leading Economic Index (LEI) is telling us that economic momentum is slowing and the economy is growing below trend.

Trade Brains

JULY 9, 2025

That means if your retirement plan underestimates medical costs, you risk serious shortfalls. over that period. If you planned to live on ₹1 lakh per month today, you might need ₹1.5 – ₹1.7 Building an Inflation-Resistant Retirement Plan Equities (30–50%) – Over the long term, equities typically beat inflation.

Wealth Management

JUNE 11, 2025

Whether clients support the policies with cash gifts or split-dollar, the discussion of options will necessarily involve a combination of insurance planning, tax planning, income and gift tax-oriented wealth transfer planning and investment planning. Charles L.

International College of Financial Planning

JULY 11, 2025

It calls for the ability to connect the dots – between economic events, investor psychology, personal goals, and long-term asset behaviour. The CFP® program isn’t just about mastering technical modules on investment planning, taxation, retirement, or insurance. That’s not just a skill – it’s a mindset.

Yardley Wealth Management

SEPTEMBER 10, 2024

The post Investing for Retirement: Strategies for Long-Term Success appeared first on Yardley Wealth Management, LLC. Investing for Retirement: Strategies for Long-Term Success Introduction Investing for retirement is a journey that demands careful planning, patience, and discipline. What lifestyle do you envision?

SEI

JULY 15, 2025

Economic development : Both channels encourage reinvestment and support economic activity, either broadly (1031s) or in targeted areas (opportunity zones). For clients with significant capital gains and long-term horizons, these strategies remain critical tools in tax-aware investment planning. Key differences.

Tobias Financial

MARCH 12, 2025

Economic uncertainty, shifting policies, and global events can make it difficult to know what comes next. You may be wondering how all of this impacts your financial future and the plans youve worked hard to build. With everything happening in the world right now, its natural to feel a bit unsettled.

Abnormal Returns

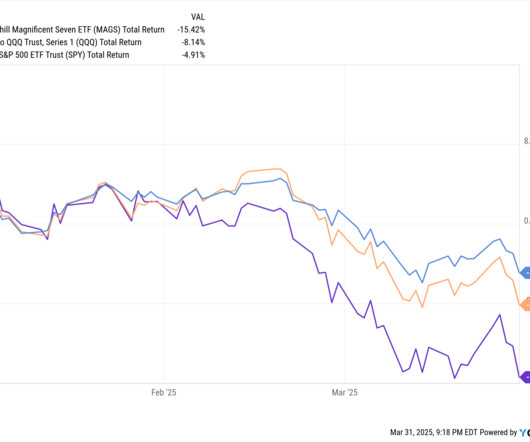

MARCH 31, 2025

Strategy How can you better stay the course with your investment plan? ritholtz.com) On the spike in economic policy uncertainty. optimisticallie.com) Fintwit is dead. Long live Fintwit. howardlindzon.com) Finance Why Rocket ($RKT) is buying mortgage servicer Mr. Cooper ($COOP).

Abnormal Returns

MAY 21, 2023

bilello.blog) Strategy Why so many Americans think their house is the best investment. awealthofcommonsense.com) Every investment plan needs some room for error. calculatedriskblog.com) The economic schedule for the coming week. (ritholtz.com) 10 charts this week including the surge in Nvidia ($NVDA).

Nerd's Eye View

SEPTEMBER 8, 2023

Also in industry news this week: Changes to CFP Board’s procedural rules went into effect September 1 and are intended to make the disciplinary process more efficient for respondents as well as CFP Board staff, and to expand the CFP Board’s ability to pursue more complaints against CFP professionals A NASAA model rule follows in the footsteps (..)

Nerd's Eye View

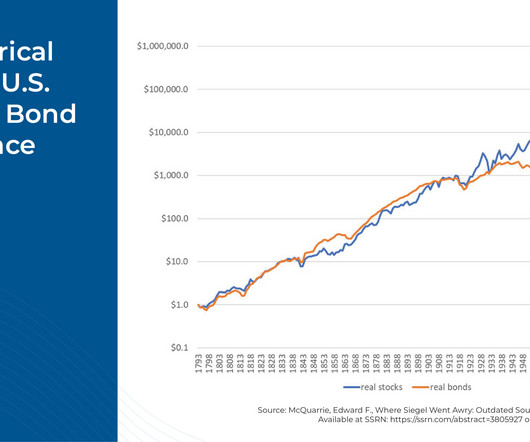

APRIL 10, 2024

Finally, over time, regime changes have also lowered the overall risk of equity investing. For example, the creation of the Federal Reserve in 1913 and the SEC in 1934 have helped to reduce economic volatility and increase corporate transparency.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. From there, they collaborate with you to develop a tailored financial plan.

Brown Advisory

DECEMBER 4, 2017

2017 Year-End Planning Letter. The outcome of the tax reform debate is likely to impact how we advise clients on tax planning, estate planning and a host of other topics. As we write this letter, Congress and the White House are working to develop and finalize a tax plan by the end of this calendar year.

Trade Brains

AUGUST 6, 2024

Specifically, if the Nifty drops to the 22,000-22,500 range, it could signal a favorable entry point for those looking to make aggressive investments. In conclusion, while the recent market dip presents a potential buying opportunity, investors should approach it with caution and a strategic plan.

Yardley Wealth Management

OCTOBER 7, 2020

The post Is COVID-19 affecting your Retirement Planning? Is COVID-19 affecting your Retirement Planning? Retirement Planning Financial Planning Risk. Over their lifetimes, most people have heard warnings and advice from retirement advisors about various aspects of their plans. Here’s what you should do.

Good Financial Cents

AUGUST 11, 2022

Ad Robo-Advisors move with the market to ensure your investments. Robo-advisors offer easy account setup, robust goal planning, account services, and portfolio management all at a reasonable price - start investing today by clicking on your state. Investing with a Plan. They didn’t have a plan.

Brown Advisory

DECEMBER 5, 2016

Dune Thorne is a partner, portfolio manager and head of the Boston office at Brown Advisory, where she helps families and nonprofits develop financial and investment plans to align with their long-term goals. Dune earned her BA at Dartmouth and MBA from Harvard Business School.

Nationwide Financial

DECEMBER 7, 2022

Economic headwinds and market fluctuations make the anxiety even worse for investors close to retirement. There’s value in staying invested in that asset allocation and not trying to time the market’s ups and downs or succumbing to fear when markets turn tumultuous.

Clever Girl Finance

OCTOBER 8, 2024

Prices can go from all-time highs to major lows in just a few days, all thanks to global economics, interest rates, and political happenings. I’m sharing some key investment insights to help you navigate your financial choices and calm any worries you might have about the stock market. When is a good time to invest in the stock market?

Trade Brains

JULY 4, 2024

Nuvama Wealth Management: Forget glowing wealth advisors and generic investment plans. By guiding the investments of the elite, the company shapes India’s financial future. Their expertise fuels innovation, injects stability and fosters social causes into the nation’s economic landscape.

Park Place Financial

MARCH 16, 2022

Economic Conditions. Investors look at inflation, gross domestic product (GDP) values, and consumer spending to determine economic health. If the results indicate a booming financial situation, people are often more inclined to invest in stocks. Follow Your Long-Term Investment Plan. RELATED BLOG POSTS.

Brown Advisory

MARCH 1, 2016

The key to weathering the volatility is staying true to a long-term investment plan. Stock market volatility has spiked in response to immediate market concerns about energy prices, weakening economic growth in China and changes to monetary policy, as well as momentous capital-market shifts during the past 20 years.

International College of Financial Planning

JULY 31, 2023

Importance of Education and Expertise: Education plays a vital role in becoming an investment advisor. They are professionals who hold specialized degrees or certifications in finance, economics, or related fields. Their knowledge extends to various investment products, risk management, tax implications, and financial planning.

Carson Wealth

FEBRUARY 12, 2024

What a ride it has been, but investors were once again rewarded for sticking to their investment plans. The reality is we haven’t seen the impact of AI yet on a broad economic level. After adjusting for inflation, investment in information processing equipment is running below the 2017-2019 trend. equities in particular.

Gen Y Planning

FEBRUARY 1, 2023

Our generation has lived through some of modern history’s most monumental economic and social events. Everyone has unique stressors, but the most common are saving money, managing debt, and planning for retirement. They range from simple lifestyle adjustments, mental mindset shifts, and financial planning tips.

Validea

OCTOBER 12, 2024

The emotional toll of these events often leads to behavioral mistakes that can derail long-term investment plans. The rapidly changing landscape of finance, influenced by technological advancements, evolving global economic dynamics, and shifts in investor behavior, ensures that there will always be more to learn.

International College of Financial Planning

JULY 30, 2022

Earning the CFP designation requires a rigorous course of study covering investment planning, income taxation, retirement planning and risk management. A Person who completes the CFP course is qualified to provide financial planning services to those with a high degree of financial responsibility.

Your Richest Life

JUNE 30, 2022

As we continue to deal with record-high inflation and economic instability, you might be wondering how you should manage your investments. Consider dollar cost averaging , which is where a fixed amount of money is invested regularly, regardless of what the markets are doing. Different asset classes are up at different times.

International College of Financial Planning

JANUARY 15, 2024

Let’s discuss financial planning courses online and get an insight into its ability and success. Embracing Financial Planning Courses Online versus On-Campus Learning The advent of online financial planning courses marks a pivotal shift in educational methodologies. Why is appointing a financial advisor a better choice?

Trade Brains

DECEMBER 7, 2023

The course covers an introduction to personal finance, credit cards, life insurance, health insurance, investment instruments, loans, income tax and planning, budgeting and building a strong portfolio. Also, you will learn how to plan your taxes, credit score importance and how to budget your income to create a portfolio.

WiserAdvisor

JANUARY 16, 2024

This data can serve as a baseline for tailoring your retirement plan, taking into account factors such as inflation, your current age, and your desired retirement age. This article also explores the average monthly spending habits of individuals aged 65 and older and offers practical insights to help structure your retirement plan.

Yardley Wealth Management

JUNE 8, 2022

Under normal economic conditions, investors expect to be compensated with a term premium for taking the incremental risk of owning longer maturities. The shape of the yield curve essentially reflects evolving investor sentiments about unfolding economic conditions. At least not in reaction to this single economic indicator.

WiserAdvisor

DECEMBER 15, 2023

For instance, they can guide you on leveraging employer-sponsored retirement plans, such as a 401(k) with employer matches, to optimize your contributions and harness the full benefits of the accounts. IRAs offer you the flexibility to contribute to your retirement savings independently, outside of employer-sponsored plans.

Your Richest Life

JANUARY 31, 2022

Friends and relatives can contribute to a 529 plan for college, for example. But sometimes, like when inflation is high, bonds can help cushion the blow of the economic instability that could impact your portfolio. Just make sure they fit in with your overall investment plan and money goals before you purchase.

Workable Wealth

SEPTEMBER 16, 2020

Adding another layer, the stocks in your portfolio can be across economic sectors like pharmaceuticals, finance, and petroleum. . Building on diversification, asset allocation is an investment strategy that builds your portfolio by weighing an adequate amount of risk for your goals. High-Level Investment Strategies to Keep in Mind.

Carson Wealth

MARCH 11, 2024

Yet, longer-term investors have once again been rewarded for sticking to their investment plans. That’s a solid foundation for additional economic gains that ultimately could push stock prices higher. This newsletter was written and produced by CWM, LLC.

Good Financial Cents

JANUARY 11, 2023

The banking industry includes banks, investment banks, commercial banking, personal banking, hedge funds, financial planning, and private equity firms. Financial managers are the captains of the financial industry, mapping out the course for a company’s future and guiding them through tough economic times.

Workable Wealth

JUNE 24, 2020

In your quest for financial wellness, you have probably heard countless times the importance of investing as part of a well-rounded financial plan. While this is true, most articles don’t tell you how to invest wisely, what role investments play in your wealth-building journey or even what the Market can tell you. .

James Hendries

OCTOBER 25, 2022

The National Bureau of Economic Research (NBER) is the official arbiter of U.S. business cycles, and they consider a wide range of economic indicators other than just the quarterly GDP metric. Depth refers to declining economic activity that is more than a relatively small change. The following paragraph explains one of them.

Good Financial Cents

SEPTEMBER 2, 2022

Whether you are hoping to start investing small amounts of money or you have a lump sum of cash to get started, you should know that investing isn’t necessarily a “set it and forget it” activity. Also remember that, like it or not, there is a real risk of losing some of your investment over the short-term.

WiserAdvisor

JANUARY 3, 2024

Consider consulting with a financial advisor who can help create a suitable investment portfolio for attaining your retirement goals. This article aims to offer insights into retirement investment planning that can empower you to build a nest egg that can pave the way to a financially secure and fulfilling retirement.

Zoe Financial

OCTOBER 12, 2023

If we ring-fence some assets in an AI-focused strategy, how might the long-term plan be affected? Is there another investment that would be a better fit to help them meet their goals? Its best use also depends on the investor’s investment philosophy, risk tolerance, time horizon, and objectives.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content