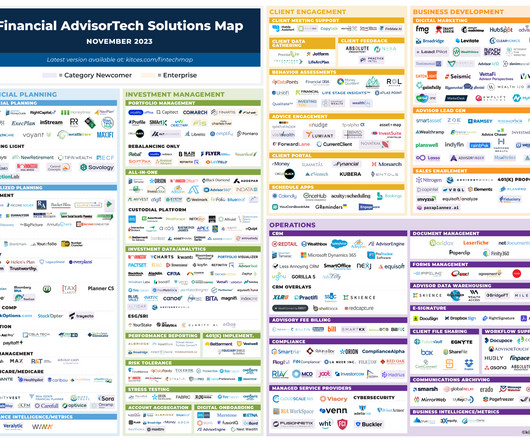

The Latest In Financial #AdvisorTech (November 2023)

Nerd's Eye View

NOVEMBER 6, 2023

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: FinanceHQ has launched as a new digital lead generation platform for financial advisors, which takes a more niche-focused approach to matching prospective clients with advisors – representing a bet that capturing prospects (..)

Let's personalize your content