Weekend Reading For Financial Planners (November 2–3)

Nerd's Eye View

NOVEMBER 1, 2024

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

AUGUST 21, 2024

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. the assets' original owner). Read More.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

SEPTEMBER 8, 2023

Also in industry news this week: Changes to CFP Board’s procedural rules went into effect September 1 and are intended to make the disciplinary process more efficient for respondents as well as CFP Board staff, and to expand the CFP Board’s ability to pursue more complaints against CFP professionals A NASAA model rule follows in the footsteps (..)

International College of Financial Planning

JULY 2, 2025

Rising incomes, complex tax rules, countless investment options, and growing aspirations have made personal finance decisions more challenging than ever. This is where competent, ethical, and client-first financial planners step in. What is the CFP Certification? What makes the CFP credential so respected?

Nerd's Eye View

JUNE 2, 2025

Zoe Financial has announced a $29.6M Zoe Financial has announced a $29.6M Zoe Financial has announced a $29.6M Zoe Financial has announced a $29.6M

Abnormal Returns

SEPTEMBER 18, 2023

kitces.com) Brendan Frazier talks with Samantha Lamas and Danielle Labotka about why clients hire and fire their financial advisers. theirrelevantinvestor.com) Taxes Why clients need to start planning now for the coming dip in the estate tax exemption. investmentnews.com) Part one of a series on how to pass the CFP exam.

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

NOVEMBER 18, 2022

Also in industry news this week: The CFP Board has proposed a series of changes to its disciplinary processes, including a two-year deadline for advisors subject to an interim suspension to file a petition for reinstatement. How advisors can help their clients turn their HSAs into wealth-building machines.

Nerd's Eye View

JULY 12, 2022

Kamila is the CEO and Founder of Collective Wealth Partners, an independent RIA based in Atlanta, Georgia, that oversees nearly $25 million in assets under management for almost 175 client households.

Nerd's Eye View

JUNE 30, 2025

Yet in recent months, the volatility has subsided, markets have rallied back near their highs, and advisory firms are back to dealing with the increasingly common challenge of how to continue to scale service in the face of growth as clients continue to accrue over time. In the meantime, our own Team of Nerds continues to expand.

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households.

Nerd's Eye View

SEPTEMBER 13, 2024

Which means that while many fee-only RIAs use the reduced conflicts that come with the fee-only model (as opposed to firms that receive compensation from commissions and other sources) as a key marketing talking point, the fact remains that being truly 'conflict free' is nearly impossible and such claims (which are hard to substantiate) appear to be (..)

Nerd's Eye View

FEBRUARY 2, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a Morningstar survey has found that financial advisory clients are more likely to stick with their advisor for emotional reasons rather than investment returns alone.

Nerd's Eye View

SEPTEMBER 19, 2022

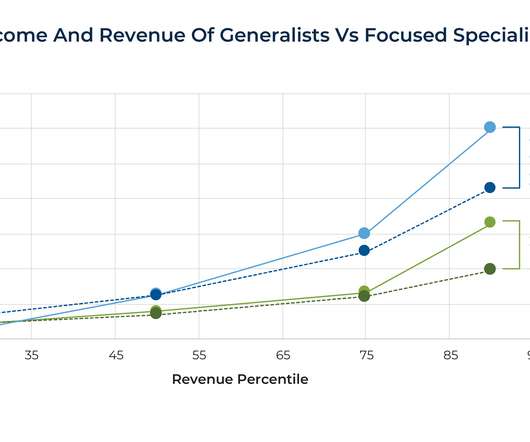

2022 marks the 50 th anniversary of the enrollment of students into the first Certified Financial Planner (CFP) course, and in the years since then, financial planning (and the process of creating a financial plan) has changed extensively. What’s notable, however, is that the most ‘productive’ (i.e.,

Nerd's Eye View

JULY 25, 2022

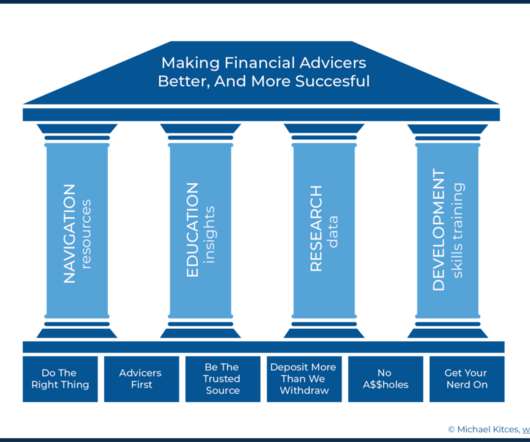

Yet despite this – and perhaps even because of it – advisory firms are putting an ever-greater focus on financial planning in 2022, as a way to both show value to clients in the midst of difficult market returns, and, more broadly, to help clients navigate the current environment. A gap our Kitces Courses aim to fill!

Nerd's Eye View

JULY 17, 2023

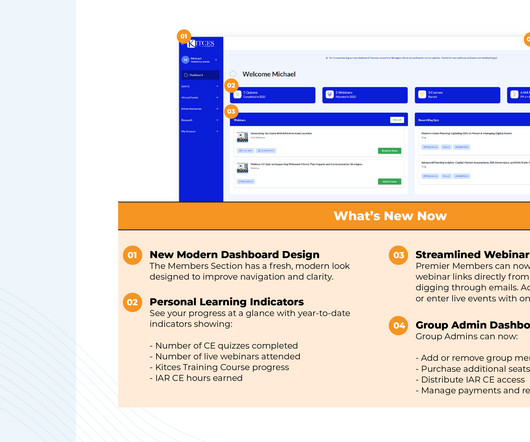

Our newest course on Life Insurance Policies adds to our existing programs on reviewing Tax Returns and navigating Estate Documents as well, and we're committed to continue to expand our financial advicer curriculum in the years to come!

MainStreet Financial Planning

OCTOBER 3, 2023

“MainStreet Chalk Talk” The MainStreet Financial Planning Discussion Club When: Tuesday 10-17-23 at 7:30pm Eastern; 4:30pm Pacific ~30-45 minutes Recorded and able to retrieve for one week How : Zoom Meeting Free for current clients, $10 for guests Register Here! It seems like everyone is getting into real estate investing these days!

Darrow Wealth Management

NOVEMBER 4, 2024

A fiduciary advisor is a financial professional who is legally obligated to act in the best interest of their clients. A fiduciary must always prioritize their clients’ needs above their own interests and mitigate or disclose any conflicts of interest that may arise. You can search for CFP® professionals here.

Nerd's Eye View

JANUARY 13, 2025

With another strong year in the markets, most advisory firms are near or at record highs for their revenue, their numbers of clients, and the headcounts of their teams. Which is surprising to some, given that a decade ago, the emergence of so-called "robo-advisors" was supposed to displace human financial advisors and compress advisory fees.

Tobias Financial

DECEMBER 15, 2024

When it comes to financial planning, working with an advisor who understands both tax law and financial strategy can offer significant benefits. Advisors who have knowledge of tax laws alongside financial planning can help avoid potential pitfalls, improve tax efficiency, and ensure each decision aligns with long-term objectives.

Million Dollar Round Table (MDRT)

MAY 16, 2023

Kifer, CFP, LUTCF It’s often challenging for prospects and clients to understand the value we as financial advisors can offer them. Clients get overwhelmed and confused by charts, numbers and myriad financial choices. This is one of my favorite ideas for simply explaining to clients how I can help them.

Nerd's Eye View

JULY 8, 2024

interest rates, and relatively little new tax legislation (yet). Additionally, the upcoming Kitces Value Summit, coming December 12 , 2024, will tackle how real advisors provide and communicate their ongoing value to their clients.

Nerd's Eye View

AUGUST 29, 2022

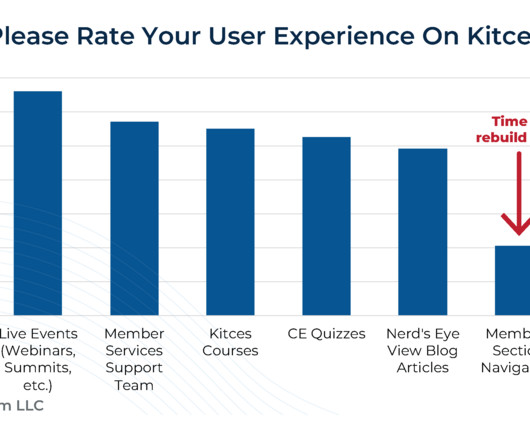

For most advisory firms, 2022 has been a year of relative stability, market volatility notwithstanding. Which means now it’s time once again to take at least a brief pause to get some feedback about how we’re doing.

Nerd's Eye View

JANUARY 10, 2023

Lisa is a Partner and Wealth Advisor for CI Brightworth, an RIA under the CI Financial umbrella with offices in Atlanta, Georgia, and Charlotte, North Carolina, that oversees nearly $5 billion in assets under management * for over 1,500 client households.

Yardley Wealth Management

AUGUST 27, 2024

The post Tax-Free Transfers from Your IRA to Charity: A Smart Financial Strategy appeared first on Yardley Wealth Management, LLC. Tax-Free Transfers from Your IRA to Charity: A Smart Financial Strategy At Yardley Wealth Management, we understand that many clients want to make a difference while also securing their financial future.

Abnormal Returns

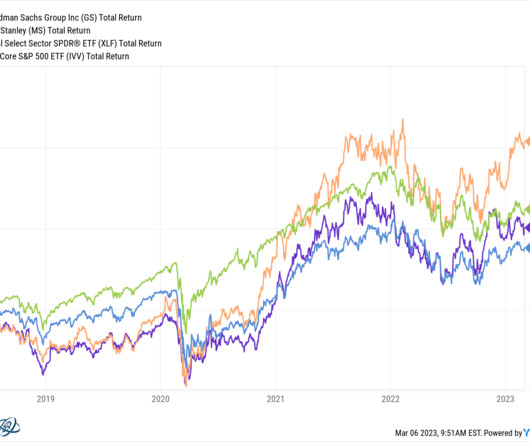

MARCH 6, 2023

Podcasts Christine Benz and Jeff Ptak talk with Stacy Francis who is president and CEO of Francis Financial about working with female clients. morningstar.com) Brendan Frazier talks with Ted Klontz about how to better motivate, communicate and connect with clients and prospects.

Abnormal Returns

DECEMBER 12, 2022

standarddeviationspod.com) Brendan Frazier talks with Jeremy Keil, advisor at Keil Financial Partners, about guiding client conversations. investmentnews.com) Tax planning Why financial advisers need to be careful when offering tax advice. kitces.com) Tax planning is an ongoing process.

Tobias Financial

JUNE 15, 2025

Our Wealth Advisor, Chad Williamson, CFP® , explains that while retiring as a single person can present certain hurdles, it can also streamline the planning process. However, single retirees must also prepare for certain financial disadvantages, especially when it comes to taxes.

eMoney Advisor

DECEMBER 20, 2022

A recent announcement regarding cryptocurrency from the CFP Board provided advice on crypto-related investments stating CFPs® are neither required nor prohibited from providing advice related to cryptocurrency, but “should do so with caution.” The CFP Board stated the risks as follows in its communication.

Yardley Wealth Management

DECEMBER 17, 2024

Garry Esquire, CFP®, MBA Founder & CEO of Yardley Wealth Management Setting meaningful financial goals in 2025 requires more than just wishful thinking – it demands a strategic, well-planned approach. Helping clients achieve their monetary aspirations, I’ve seen how proper goal-setting can transform financial futures.

International College of Financial Planning

DECEMBER 29, 2024

The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field. As markets evolve and client needs become more sophisticated, the demand for qualified financial planners continues to grow exponentially.

Abnormal Returns

JANUARY 23, 2023

Podcasts Christine Benz and Jeff Ptak talk taxes with Jeffrey Levine, chief planning officer for Buckingham Strategic Wealth. riabiz.com) Why advisers need a 401(k) solution for business owner clients. kitces.com) CFP candidates are becoming more diverse. Sign up for the next go-round. whitecoatinvestor.com)

International College of Financial Planning

SEPTEMBER 7, 2024

Whether you are already a professional in the financial sector or just beginning your journey, earning the Certified Financial Planner (CFP®) designation can be a game-changer. The CFP® Fast Track course offers a quick, efficient pathway to certification, allowing you to accelerate your career in the financial planning industry.

International College of Financial Planning

JUNE 5, 2025

Clients were all about one thing: performance. Show them the returns, highlight the tax breaks, and if you could, offer a little peace of mind. And if you haven’t changed with it, well your clients have already moved on. The client is overwhelmed. ” When you’re CFP®, your work speaks for you. Often fast.

Financial Symmetry

MAY 27, 2025

From our very first intern to one of our most trusted advisors, Chads contributions have helped shape the firm into what it is todayserving nearly 850 clients and managing $1.2 His dedication, leadership, and care for both clients and colleagues are felt in every corner of our organization. billion in assets.

International College of Financial Planning

OCTOBER 26, 2023

Their primary objective is to ensure that the assets are managed & distributed according to the wishes of the client. The Financial Planner will ensure that the Estate Planning strategy is curated in terms of client requirements, estate complexity and requirements of the legal heirs /other parties.

Alpha Architect

AUGUST 10, 2023

In this episode host Belle Osvath, CFP® talks with Dr. Wesley Gray the founder of ETF Architect and Alpha Architect, about how advisors can create their own ETFs which can be used to help manage client funds and taxes. Wes Talks with Belle about Creating Your Own ETF was originally published at Alpha Architect.

International College of Financial Planning

SEPTEMBER 23, 2024

One of the fastest and most respected ways to enter this field is through the CFP® challenge pathway. This program offers a streamlined route to earning the prestigious Certified Financial Planner (CFP®) certification, especially for experienced professionals or those with advanced qualifications in finance. Let’s dive in.

International College of Financial Planning

JULY 20, 2022

To become a certified financial planner (CFP), you must learn about risk analysis in-depth. Here are some of the key things you learn in risk analysis under CFP certification. The CFP examination program includes eight topics covering all aspects, from the program’s fundamentals to applying skills in the real world.

International College of Financial Planning

MARCH 9, 2024

This blog is designed to illuminate the path to becoming a CFP® professional, focusing on the critical steps involved in the admission process, exploring the myriad of career prospects, delving into the eligibility criteria, and the future of the CFP® certification.

eMoney Advisor

JANUARY 12, 2023

Best for: All financial professionals, though most of the pro bono counseling opportunities are for CFP® professionals. E&O insurance: Yes, for CFP® pros in good standing who have completed training. Best for: Professionals with CFP®, CPA, ChFC®, CLU®, EA, CSLP®, or CDFA® credentials who want to help women.

Million Dollar Round Table (MDRT)

MAY 7, 2023

By Adam Thomas Rex, CFP, AIF I think our best innovation recently has been related to the planning arc of our business. We found that our desire was to move up the market and serve higher-net-worth clients. She works with those clients who need the blocking and the tackling. So we have partnered with a financial planner.

International College of Financial Planning

OCTOBER 10, 2024

The CFP® Fast Track offers a time-efficient and cost-effective solution for becoming a Certified Financial Planner, especially for those in India where the cost and time associated with traditional certification methods can be daunting. Why is CFP® Certification Important for Financial Planners?

International College of Financial Planning

FEBRUARY 23, 2024

Understanding Financial Planner Certification or CFP® Financial Planner certification is a professional credential awarded to individuals who have met specific education, examination, experience, and ethics requirements in financial planning. From a client’s perspective, working with a CFP® offers a sense of security and trust.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content