Announcing IAR CE From Kitces And The Mid-Year State Of The Blog

Nerd's Eye View

JULY 25, 2022

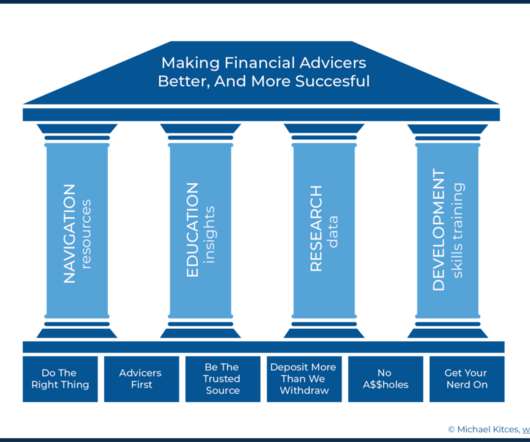

First and foremost, we’re excited to announce that, effective immediately, all of our Nerd’s Eye View blog and recorded webinar CE from 2022 (and all future CE) is now eligible for the new IAR CE requirements. A gap our Kitces Courses aim to fill!

Let's personalize your content