$6.5B RFG Advisory Launches Suite of Active ETFs

Wealth Management

JUNE 25, 2025

RFG Advisory introduces a suite of actively managed ETFs designed to address clients' entire asset allocation portfolios, available to all advisors.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 25, 2025

RFG Advisory introduces a suite of actively managed ETFs designed to address clients' entire asset allocation portfolios, available to all advisors.

Nerd's Eye View

MARCH 12, 2025

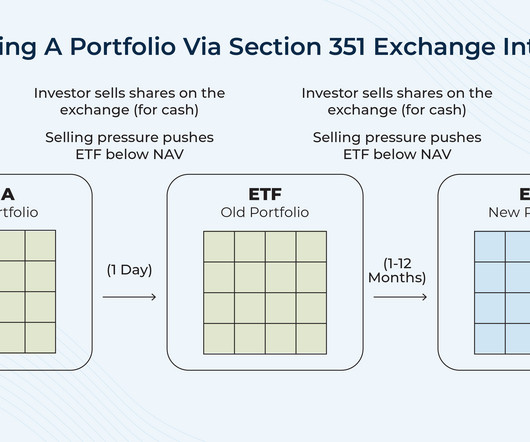

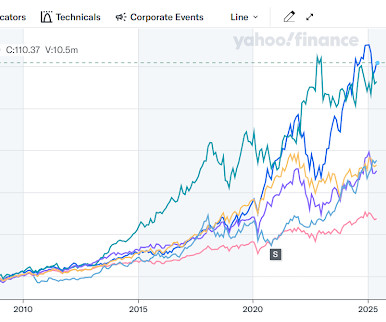

Following the long run-up in the US equity markets since the bottom of the 2008–2009 financial crisis, many investors with taxable investment accounts have likely found themselves with high embedded gains in their portfolios. While the gains signal portfolio growth, they also create challenges for ongoing management.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Validea

OCTOBER 28, 2024

We discuss: – The limitations of dividend-focused investing strategies – Asset allocation insights from the Talmud – A different perspective on the Fed’s recent performance – Meb’s view on wealth as a means to freedom – The case for significant trend following allocation in portfolios – The question Meb (..)

The Big Picture

DECEMBER 30, 2024

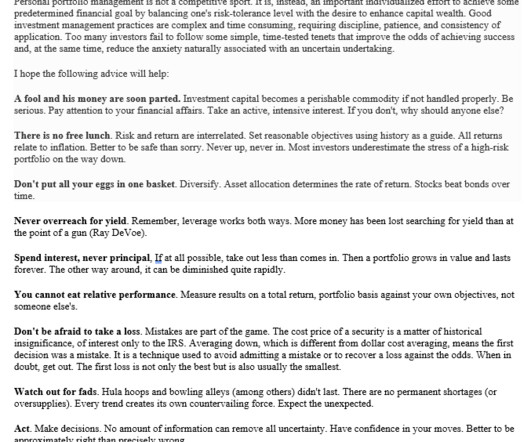

He co-authored Investment Analysis and Portfolio Management , now in its fifth edition. Zeikel famously shared his investing insights in a 1994 letter to his daughter: “Personal portfolio management is not a competitive sport. Most investors underestimate the stress of a high-risk portfolio on the way down.

Carson Wealth

JULY 8, 2025

It can be designed to accentuate your best features, made in a color and style that will both please you and be appropriate for the occasion in which it will be worn. The same is true of investment portfolios. A personalized portfolio enables you to consider more than just what generally works for most people.

Alpha Architect

JUNE 17, 2025

Modern Portfolio Theory (MPT) has long served as a foundational framework for asset allocation and portfolio construction. Can Modern Portfolio Theory Still Teach Us Any Lessons Today? This concept remains influential in both academic finance and practical investment management.

The Big Picture

JUNE 27, 2025

Be sure to check out our Masters in Business next week with Kate Moore , Chief Investment Officer of Citi Wealth ; responsible for overseeing investments, portfolio strategy and asset allocation for the trillion dollars Citi Wealth manages.

Darrow Wealth Management

FEBRUARY 9, 2025

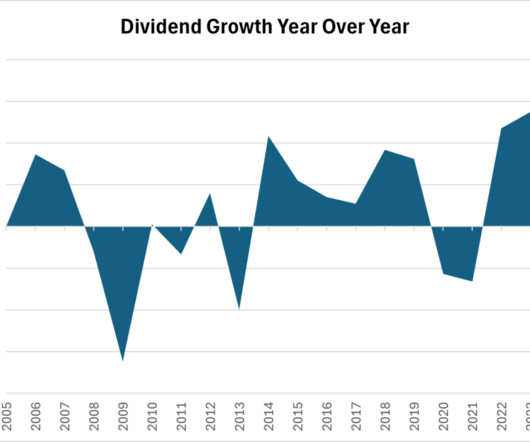

If you own 10,000 shares, you receive $40,000 in dividend income (before taxes) and have a portfolio currently worth $2M. You’ll receive the same $40,000 in dividend income and the value of your portfolio drops to $1.5M. Dividend paying stocks and funds can be a great addition to a portfolio.

The Big Picture

MARCH 28, 2025

Be sure to check out our Masters in Business next week with Lisa Shalett , Chief Investment Officer and head of Global Investment Office for Morgan Stanley Wealth Management , with more than $100 billion in assets under management.

A Wealth of Common Sense

MAY 15, 2025

Bill Sweet joined me on the show again to discuss questions from our audience about harvesting gains in your stock portfolio to diversify, remote work for less money versus going back to the office for more, mis-timing the market and picking the right benchmark for your investments.

Validea

NOVEMBER 9, 2024

The Ancient Wisdom of Asset Allocation Interestingly, Faber draws inspiration from a 2000-year-old investment principle found in the Talmud, which suggests dividing one’s portfolio into thirds: business, land, and reserves. This balanced approach to asset allocation has stood the test of time and remains relevant today.

Darrow Wealth Management

MARCH 3, 2025

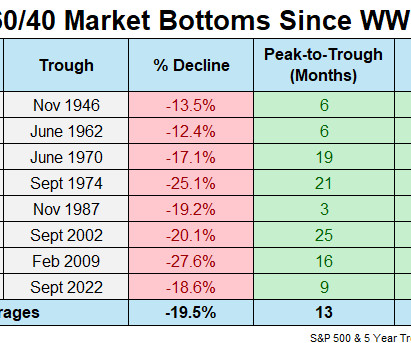

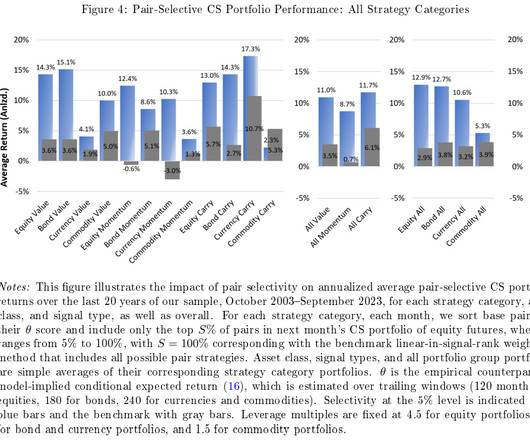

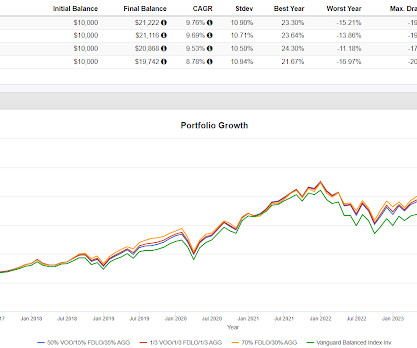

Because of these differences, stocks and bonds accomplish different things in an asset allocation. Bond Basics: How Bonds Work and Reasons to Add Bonds to Your Portfolio Stock vs bond historical returns by calendar year Investors dont hold bonds to outperform stocks over the long run. Thats not their job.

Abnormal Returns

FEBRUARY 26, 2025

tonyisola.com) Age is just one factor when it comes to your asset allocation. ofdollarsanddata.com) Invest time in your life, not in managing your portfolio. (podcasts.apple.com) Investing Targeted apathy as an investment philosophy. mrmoneymustache.com) Why you need to account for your Treasury income on your state taxes.

Discipline Funds

MARCH 10, 2025

It’s a long-term instrument that exacerbates that asset-liability mismatch in our lives. The investor who buys a 60/40 stock/bond portfolio isn’t just diversifying across assets. Of course, you can build multi-asset portfolios many different ways. You’re temporally diversified by your income.

The Big Picture

JULY 16, 2025

Um, and he’ll proudly say I only spend 2% of my portfolio per year, whatever the value is. Portfolio’s, high watermark to think, well, if it’s here, I never wanna see it go lower. So we’re talking about spending in retirement and, but we have yet to talk about drawing down portfolios. You can get, uh, a.

Carson Wealth

JULY 16, 2025

Asset allocation, ETFs, yield curves…What does it all mean? This glossary of investment terms to know can be your cheat sheet for spotting red flags (and opportunities) in your portfolio, talking shop with your advisor, and making investment decisions based on understanding, not just gut feelings.

MainStreet Financial Planning

MARCH 12, 2025

Reevaluate Your Asset Allocation If watching your investment portfolio fluctuate causes anxiety, your current allocation might be too aggressive. The less you dip into your portfolio during market downturns, the better your chances of recovering when the markets rebound.

The Big Picture

JULY 4, 2025

The Bulwark ) Be sure to check out our Masters in Business next week with Kate Moore , Chief Investment Officer of Citi Wealth ; responsible for overseeing investments, portfolio strategy and asset allocation for the trillion dollars Citi Wealth manages.

Trade Brains

JULY 17, 2025

Also read: Best Performing Multi-Asset Allocation Funds in 2025 – Is Your Fund on the List? Periodic Check: These are long-term kinds of investments, but a check of the performance of these investments and your portfolio allocation should be done regularly to make sure it suits your financial goals.

Truemind Capital

NOVEMBER 8, 2024

Looking closely at your portfolio allocation should be done at all times and not just when the market corrects. The one who is undeterred by greed (due to FOMO) or fear (due to loss aversion) gets the staying power and enjoys the fruits of investments in the long term.

WiserAdvisor

JULY 9, 2025

Many people have managed their own investment portfolios and have seen great results. You make all the decisions, choose the funds or stocks you are interested in, and build your financial portfolio solo. If you want to review your portfolio during your lunch break, go ahead! And honestly, you are not entirely wrong. No problem!

Trade Brains

JUNE 6, 2025

Parag Parikh Flexi Cap Fund AUM : ₹1,00,000+ crore 1-Year Return : ~36% Expense Ratio : ~0.80% (Direct Plan) Why it stands out : This fund has achieved a significant milestone by surpassing ₹1 lakh crore in Assets Under Management (AUM), making it the largest flexi cap fund in India. ICICI Prudential Multicap Fund AUM : ₹14,504.64

Wealth Management

JULY 2, 2025

From Point Solutions to Seamless Intelligence For decades, our industry has relied on integrations—APIs painstakingly connected across custodians, CRMs, planning tools and portfolio management systems. But those connections are brittle, proprietary and sometimes dependent on manual intervention. The rise of agentic AI changes that completely.

Yardley Wealth Management

AUGUST 20, 2024

Diversify Your Portfolio: Diversification is a key strategy for managing risk and reducing the impact of market volatility on your investments. By spreading your investments across different asset classes, sectors, and geographic regions, you can minimize the impact of downturns in any one area of the market.

Wealth Management

JULY 17, 2025

Minopoli, who is also a partner in the new RIA, had previously been the chief investment officer of a team managing a $30 billion portfolio for the Knights of Columbus Asset Advisors. With that background, he will offer alternative investment options both from third-party asset managers and his proprietary relationships.

International College of Financial Planning

JULY 9, 2025

We have a great deal of participation in high ticket size products like Portfolio Management Services (PMS) & Alternative Investment Funds (AIF). Some mind-boggling statistics at this point in time, the MF AUM is in excess of 70 Lakhs crores as of end May 2025. We do not have sufficient qualified advisors servicing this quantum of money.

International College of Financial Planning

MARCH 12, 2025

What to Do Instead: Stick to fundamentals: Learn about asset allocation, risk management, and diversification before investing. But many jump into stocks, crypto, or NFTs without understanding risk, diversification, or asset allocation.

Carson Wealth

JANUARY 22, 2025

But what does this mean for your portfolio, and how can you continue to protect and grow your assets during these times? How Volatility Affects Investment Returns Volatility can send the value of your portfolio on an uncomfortable roller coaster ride. You can also further diversify within an asset class.

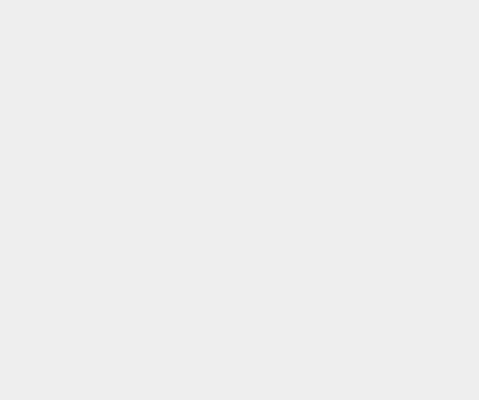

Alpha Architect

MAY 30, 2025

Christian Goulding and Campbell Harvey, authors of the study "Investment Base Pairs," proposed a groundbreaking framework for portfolio construction that challenges traditional approaches in modern finance. Unlocking Cross-Asset Potential: A New Approach to Portfolio Construction was originally published at Alpha Architect.

Darrow Wealth Management

MARCH 13, 2025

If one stock makes up more than 10% of your overall asset allocation, it’s probably too much. A diversified portfolio is the cornerstone of a risk-adjusted investment strategy. Diversifying Around It: Balancing the portfolio by investing in assets that offset the concentrated position’s risk.

Truemind Capital

APRIL 4, 2025

Even in India, many firms use algorithms to suggest investment options and portfolio allocation. Many wealth management outfitsin the US have started using AI in their operations and basic level of advice. However, when it comes to money, many are still not comfortable dealing with machines.

Yardley Wealth Management

FEBRUARY 18, 2025

Traditional Investment Strategies Traditional investment strategies focus on diversification, risk tolerance, and asset allocation across stocks, bonds, and real estate. Key Differences: Waterfall wealth management prioritizes financial obligations and allocates funds accordingly.

Yardley Wealth Management

SEPTEMBER 10, 2024

Diversify Your Portfolio Diversification is key to successful retirement investing. By spreading your investments across various asset classes, sectors, and geographic regions, you can reduce your portfolio’s overall risk. Learn more about retirement plan options here.

Yardley Wealth Management

DECEMBER 17, 2024

Investment Strategy Refinement The investment landscape continues to evolve, and your portfolio should reflect both current market conditions and your long-term objectives. This can significantly impact your retirement savings trajectory.

Trade Brains

JULY 16, 2025

is a diversified financial services company offering a wide range of solutions including online broking, mutual funds, ETFs, commodities, derivatives, financial planning, and asset allocation. It also provides SEBI-registered discretionary Portfolio Management Services with five unique portfolios tailored to different investor needs.

Harness Wealth

JANUARY 29, 2025

This type of strategy typically involves selling underperforming investments at a loss to offset capital gains (or ordinary income) to optimize portfolio returns. Portfolio rebalancing: Selling underperforming assets helps investors maintain an optimal asset allocation.

The Big Picture

JULY 5, 2025

New York Times ) Be sure to check out our Masters in Business next week with Kate Moore , Chief Investment Officer of Citi Wealth ; responsible for overseeing investments, portfolio strategy and asset allocation for the trillion dollars Citi Wealth manages. Insomnia has become a public-health emergency. (

Yardley Wealth Management

JUNE 11, 2025

The Downside of Missing the Market’s Best Days It is natural to wonder if you should change your portfolio during such times. For example, a portfolio concentrated in a single investment may deliver higher returns, but it also might carry higher risks. A diversified portfolio is designed to help manage risk during market cycles.

Truemind Capital

NOVEMBER 8, 2024

Looking closely at your portfolio allocation should be done at all times and not just when the market corrects. The one who is undeterred by greed (due to FOMO) or fear (due to loss aversion) gets the staying power and enjoys the fruits of investments in the long term.

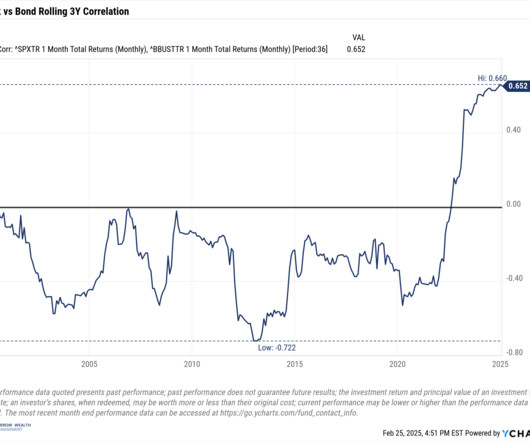

Alpha Architect

MARCH 3, 2025

This has critical implications for portfolio construction and risk management. With over nearly 150 years of data, the study finds that when inflation and interest rates rise, stocks and bonds tend to move together, reducing diversification benefits. Understanding the StockBond Correlation was originally published at Alpha Architect.

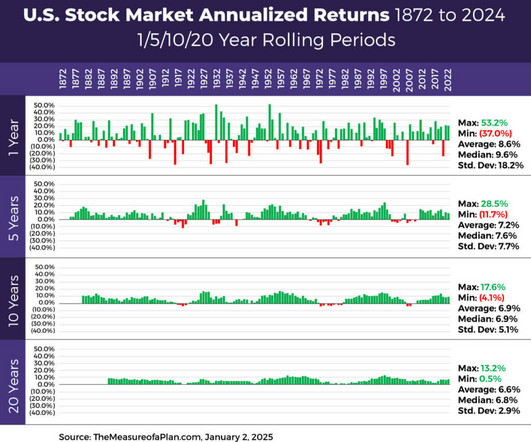

Random Roger's Retirement Planning

MARCH 20, 2025

Adaptability is a great word for portfolio construction and ongoing management. I don't believe adaptability has to mean very actively trading a portfolio but there will be occasional trades that need to be made. My version of HEAT doesn't cherry pick themes from the portfolio, it's all of the holdings that I think are themes.

Random Roger's Retirement Planning

NOVEMBER 28, 2024

I would describe the paper as seeking how to use low volatility equities in various ways to replace some or all of a traditional 60% equities/40% bonds portfolio. The first example to look at they call Leverage In The Strategic Asset Allocation via this table in the paper. The results here are consistent with the paper.

Random Roger's Retirement Planning

MAY 4, 2025

The more someone trades, the more they are fighting that natural inertia other than proper asset allocation targets and mitigating sequence of return risk when relevant. People used to view bonds, particularly long-end interest rates, as the ballast for and protection engine in a portfolio.

MainStreet Financial Planning

MARCH 7, 2025

Fee-Only, Flat-Fee Financial Planners: Transparent, Unbiased, and Cost-Effective A fee-only financial planner charges a fixed fee for financial planning services, regardless of the size of your portfolio. Unlike AUM-based advisors, they do not earn commissions or take a percentage of your investments.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content