Financial Market Round-Up – Oct’24

Truemind Capital

OCTOBER 18, 2024

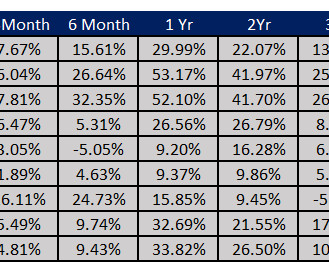

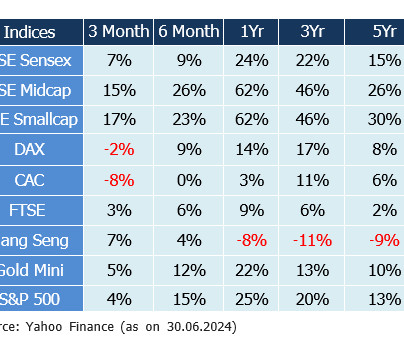

Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS! We maintain our underweight position to equity (check the asset allocation section) on the back of pricey markets.

Let's personalize your content