Weekend Reading For Financial Planners (June 28–29)

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Wealth Management

JULY 23, 2025

Private Equity Is Coming to 401(k) Plans: Will You Be Ready? Fortunately, this ruling contributes to a growing body of guidance supporting tax-neutral trust mergers when properly implemented. His GST tax exemption also exceeded his trust’s value and was automatically allocated, also resulting in a fully GST-exempt trust.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JULY 11, 2025

Also in industry news this week: A recent survey finds that (unsolicited) client referrals are the top source of new clients for advisors this year, while networking, client appreciation events, and educational events have also proven to be fruitful for some advisors A survey suggests that some advisors might be underestimating their clients' interest (..)

Nerd's Eye View

NOVEMBER 29, 2024

Which could prove to be a boon for the financial advice industry as more consumers are willing to entrust their assets to an advisor (while at the same time possibly making it tougher for some advisors to differentiate themselves primarily by how they put their clients' interests first?).

Wealth Management

JULY 2, 2025

Handler is a partner in the Trusts and Estates Practice Group of Kirkland & Ellis LLP. He is a member of the Tax Management Estates, Gifts and Trusts Advisory Board, and an Editorial Advisory Board Member of Trusts & Estates Magazine for which he currently writes the monthly "Tax Update" column.

Wealth Management

JUNE 23, 2025

Forty-four percent cited both access to institutional-grade products and help navigating crypto tax regulations and reporting requirements. Forty-six percent said they wanted to learn through in-depth video tutorials or courses, and 44% preferred educational articles or blog posts.

WiserAdvisor

JULY 23, 2025

When the Tax Cuts and Jobs Act (TCJA) was enacted in 2017, it brought a lot of changes to the U.S. It modified deductions and tax credits and changed depreciation rules and corporate tax rates. The corporate tax rate was slashed from 35% to 21%, and the lifetime estate and gift tax exemption nearly doubled.

Harness Wealth

JULY 14, 2025

These alternative investments can offer distinct advantages in the shape of portfolio diversification and the potential for higher returns, but they can come with equally distinct tax complications that need to be carefully planned for. What are the key tax strategies for alternative investments in 2025?

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Tobias Financial

JUNE 2, 2025

Estate planning is one of the most important steps in securing your financial legacy, but its also among the most complex. Understanding how assets will be distributed, navigating tax implications, and aligning these decisions with your personal goals can feel overwhelming.

Wealth Management

JUNE 11, 2025

Ratner June 11, 2025 2 Min Read A client whose estate will remain non-taxable after 2025 has a policy in an irrevocable life insurance trust (ILIT) that was presumably purchased for estate tax liquidity. But these discussions will have to happen soon, as the premium notices may well be on their desks as I write this article.

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension? This is not the case.

The Big Picture

JULY 16, 2025

So I would urge planners and individuals pursuing their own retirement plans to think about building in some of those lifetime, uh, giving, uh, aspirations. And also, you know, there are really nice tax planning mechanisms that people can use to help them achieve, achieve those things as well. You can get, uh, a.

Yardley Wealth Management

FEBRUARY 18, 2025

In this article, we’ll break down the concept of waterfall wealth distribution, its benefits, and how it compares to traditional investment strategies. We’ll also explore the role of income tiers, provide real-world case studies, and highlight key considerations when implementing this strategy in your financial plan.

WiserAdvisor

JUNE 13, 2025

Yet even the best financial plans can stumble. In this article, we’ll walk through some of the most common investment mistakes retirees make. Mistake #2: Not having an estate plan in place Estate planning is essential for protecting what you’ve worked hard to build. Yet, many people put it off. The result?

Nerd's Eye View

APRIL 18, 2025

Also in industry news this week: According to a recent survey, 40% of financial advisory clients would switch to an advisor who offers estate planning services, with help with specific tasks like beneficiary designations or tax strategies as the most sought-after service among respondents RIA M&A activity set a first-quarter record to start the (..)

Darrow Wealth Management

MARCH 13, 2025

Charitable Contributions: Donating appreciated stock to charity while reducing capital gains tax. A complete discussion of the pros and cons and workings of swap funds is outside the scope of this article, but there are many things to consider before investing. Gifting: Transferring stock to family members or trusts.

WiserAdvisor

JULY 4, 2025

Did you know that the Internal Revenue Service (IRS) adjusts 2025 tax brackets to account for inflation? These changes can affect how much tax you owe and whether you are eligible for certain tax credits or deductions. That is why this article breaks it down into plain English. State tax a.

Tobias Financial

JUNE 16, 2025

These events may affect your investment approach, tax planning strategies, insurance needs, and estate planning documents. Without periodic evaluations, it’s possible for parts of your plan to become misaligned with your current circumstances.

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well. 4 key benefits.

WiserAdvisor

JULY 9, 2025

That is exactly what this article explores. Each comes with its own rules, returns, fees, lock-ins, and tax treatments. You will need to research investments, monitor your portfolio regularly, stay updated on market changes, and do your taxes correctly. Tax optimization! That is a lot, and yes, it can feel overwhelming.

MainStreet Financial Planning

MARCH 7, 2025

If youre searching for a fiduciary financial planner, flat-fee financial planning, or the best alternative to AUM-based advisors, this article will help you decide which model is right for you. Comprehensive Financial Planning is Included Many AUM advisors charge extra for estate planning, tax strategies, and retirement planning.

WiserAdvisor

JUNE 4, 2025

This article will discuss some of the most pivotal financial planning industry trends to watch out for this year. Comprehensive financial planning over fragmented advice These days, clients want comprehensive financial plans and not isolated solutions to singular problems. People want all these goals to work together.

Diamond Consultants

FEBRUARY 11, 2025

For the purpose of this article, we will refer to all of these as Supported RIAs. As clients are demanding more from advisors, many firms have added subject matter expertise in the areas of advanced financial planning, tax advisory, estate planning, tax preparation, and even life coaching.

Carson Wealth

MAY 7, 2025

Positioning Philanthropy as a Cornerstone of Legacy There are many reasons for giving during your lifetime, including supporting causes you care about, making a positive impact on the world, and accessing certain tax advantages. There are overall limits on charitable donation tax deductions, however.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement.

WiserAdvisor

JULY 21, 2025

Mistakes, such as missing deadlines or selecting the incorrect account, can trigger taxes and even penalties. This article can help you understand how to rollover a 401(k) in five simple steps. This can result in taxes, penalties, and more hassles down the line. This way, you can keep growing your money tax-deferred.

Nerd's Eye View

DECEMBER 30, 2024

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

FMG

JULY 9, 2025

You should get quoted in articles, join podcasts, write articles, and share your opinions in guest posts. Format Content Using Natural Language and Q&As People ask AI tools questions like: “Who is the best financial advisor in Memphis who also does estate planning and taxes?”

Midstream Marketing

NOVEMBER 6, 2024

When you share useful things, like white papers, blog posts, articles, and updates on social media, you can show that you are a thought leader in the financial industry. Or are you focusing on older people who are concerned about estate planning for retirement or retirement income planning? Who do you want to reach?

Nerd's Eye View

FEBRUARY 14, 2025

advanced tax and estate planning) and ensure that both members of client couples remain engaged in the planning process (to encourage a surviving partner to stay with the firm in case of a death of their spouse) could have more durable client satisfaction and, ultimately, higher client retention rates.

Darrow Wealth Management

JANUARY 16, 2025

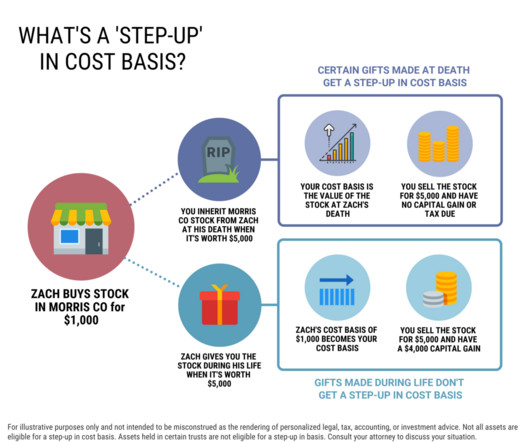

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Harness Wealth

FEBRUARY 4, 2025

However, unlike stocks and bonds, alternative investments, or alts as theyre commonly known, have unique tax treatments and complex reporting requirements that investors should carefully consider before investing. Well also go into some potential strategies to optimize tax efficiency. How Are Alternative Investments Taxed?

Yardley Wealth Management

SEPTEMBER 24, 2024

Learn more about when you might need a financial advisor from this helpful article on Investopedia. A financial professional can handle the day-to-day tasks of financial management, such as investment research, portfolio rebalancing, and tax planning, allowing you to enjoy greater efficiency and peace of mind.

Carson Wealth

DECEMBER 17, 2024

By Brady Marlow, CFP, AEP, CAP, CPWA, CExP , Director, Carson Private Client Wealth Strategy Although most people focus first on loved ones in developing their estate plan, you may also want your legacy to include continuing support of issues and organizations youre passionate about. million per individual for 2024.

The Big Picture

JANUARY 21, 2025

And I think you will also, if you are at all curious about estate planning or investing or personal finance, this is not the usual discussion and I think it’s very worthwhile for you to hear this and share it with friends and family. And I, I found it to be an absolutely fascinating conversation. And it was very formulaic.

Harness Wealth

JANUARY 28, 2025

In this guide, we’ll explore the key tax changes in effect for 2025, how theyll influence your filing status, retirement savings, investment, and estate planningand offer strategic advice to help high-income and high-net-worth individuals prepare more effectively for upcoming coming tax changes. That said, U.S.

The Big Picture

APRIL 8, 2025

And then the next step up seems to be full on wealth management, where you’re dealing with philanthropy, generational wealth transfer, a lot of bells and whistles including estate planning tax. You, you mentioned autonomous and defense, this giant New York Times article Yeah. 00:26:17 [Speaker Changed] Absolutely.

WiserAdvisor

JUNE 11, 2025

Tariffs are a type of tax imposed on imported goods and services by the government. This article will break down how these new tariffs might affect 401(k) investors across different age groups. A personalized retirement plan can help account for inflation, market volatility, and your shorter time horizon.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Unlock All Access Premium Subscription Get Trusts & Estates articles, digital editions, and an optional print subscription. Whats the Status of Jeffrey Epsteins Estate? Choose your subscription now and dive into expert insights today! Log in now.

Wealth Management

JULY 18, 2025

Resonant Capital Merges with Tax, Accounting Firm QBCo $2.2B Unlock All Access Premium Subscription Get Trusts & Estates articles, digital editions, and an optional print subscription. Whats the Status of Jeffrey Epsteins Estate? Choose your subscription now and dive into expert insights today! Log in now.

Darrow Wealth Management

MAY 6, 2025

This is due to how RMDs are calculated and prolonging tax deferred growth. Important Consideration: Due to the complexity of the rules and nuances, it is crucial to discuss your specific situation with a financial advisor, estate planning attorney, and tax professional.

Midstream Marketing

DECEMBER 10, 2024

This article will show you ten important marketing campaigns. These campaigns help build a strong marketing plan for financial advisors. By adding these campaigns to your plan, you can connect with more clients and increase the number of clients you onboard, growing your business over time. Follow a regular posting schedule.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content