How Marketing With The CFP Marks Reduces Client Acquisition Costs And Accelerates Revenue Growth

Nerd's Eye View

MARCH 27, 2023

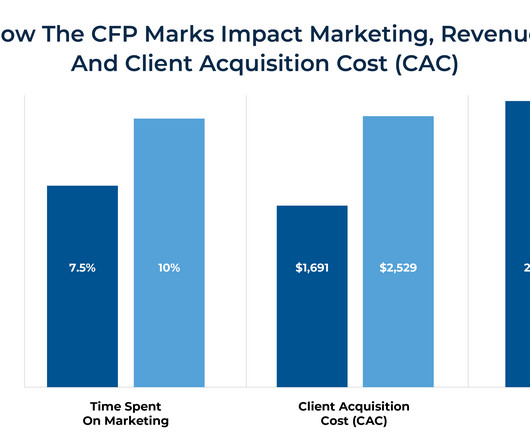

In the context of financial advisors, surveys have shown that CFP certification serves as an important branding signal for consumers seeking the services of a qualified advisor. Similarly, CFP practitioners were found to have a lower practice-wide Client Acquisition Cost (CAC) and greater revenue growth in 2021!

Let's personalize your content