Steps Advisors Can Take Before Tax laws Change

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. For some, this may lead to more taxes paid on capital gains.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

APRIL 5, 2023

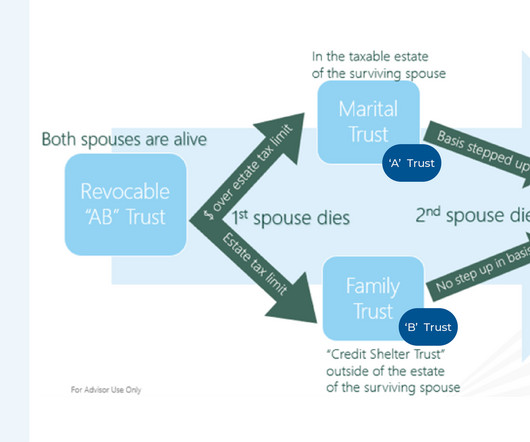

Given how frequently the tax code changes, advisors can add value for clients by ensuring their estate plans are aligned with current law to meet the clients’ objectives, and not with past rules that may no longer apply to them. However, the passage of TCJA resulted in the estate gift tax exemption nearly doubling (from $5.6M

Harness Wealth

MAY 2, 2025

The Tax Cuts and Jobs Act (TCJA)the 2017 tax code overhaul designed to boost economic growthis set to expire on December 31, 2025. Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect.

Let's personalize your content