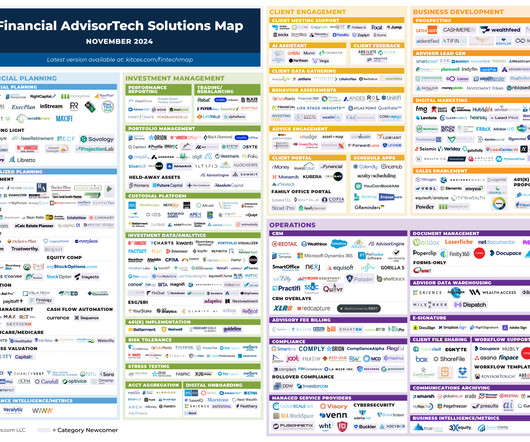

Holistiplan Launches Estate Plan Document Extraction Tool (And More Of The Latest In Financial #AdvisorTech – November 2024)

Nerd's Eye View

NOVEMBER 4, 2024

Welcome to the November 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Let's personalize your content