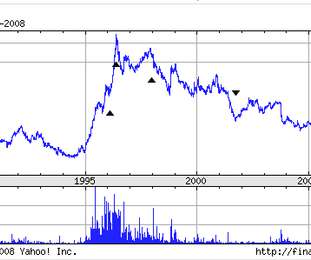

Market volatility: Reminder to prepare for downturns

SEI

AUGUST 2, 2022

We are currently experiencing one of the most volatile times in decades, on top of the start of the pandemic and the 2008-2009 recession. That’s why, when facing market volatility, stewards of long-term assets held at all types of nonprofit institutions recognize the importance of a well-thought-out investment process. .

Let's personalize your content