Endowment Style & Selling Volatility

Random Roger's Retirement Planning

FEBRUARY 28, 2025

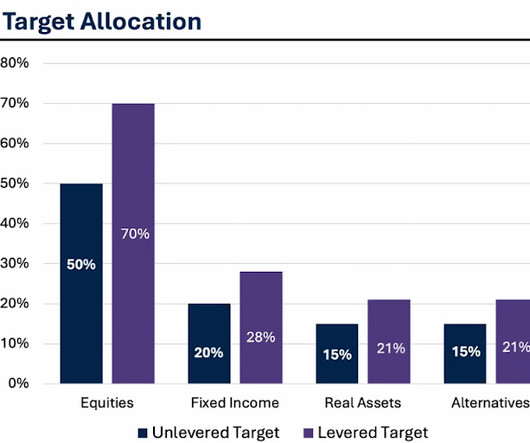

If you have a taxable portfolio of at least $1 million where selling or rebalancing would hit very hard tax-wise, you can exchange your portfolio for shares in a 351 ETF. Based on Cambria's other multi-asset funds, ENDW will probably have fixed income duration but that's a space I will continue to avoid. The results.

Let's personalize your content