83(b) Election: Tax Strategies for Unvested Company Stock

Darrow Wealth Management

JULY 30, 2024

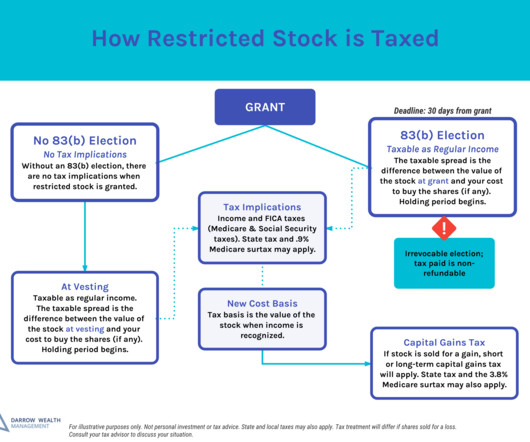

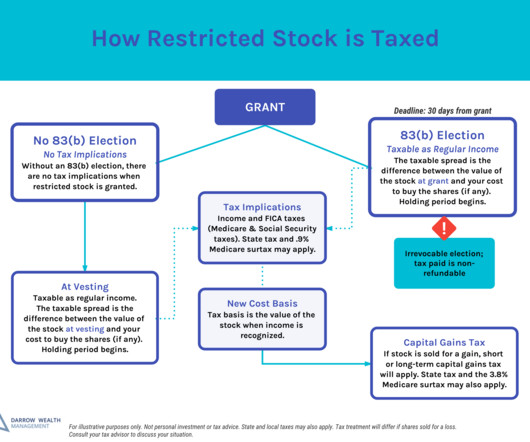

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. Most tax planning strategies focus on deferring tax, but an 83(b) election is all about accelerating it. Startup founders, early employees, executives, and other service providers can make an 83(b) election.

Let's personalize your content