How Inflation Can Impact Your Retirement Plan – What You Must Know Now!

Trade Brains

JULY 9, 2025

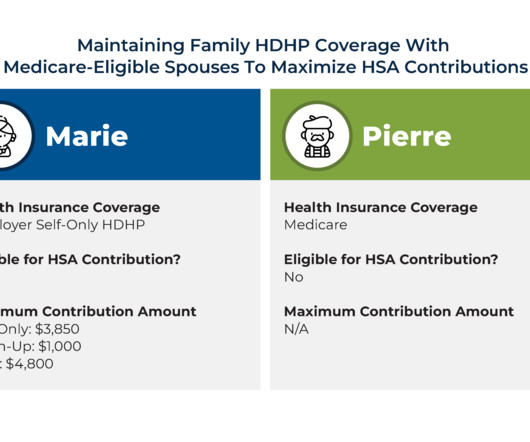

Healthcare Inflation: The Hidden Wildcard Unlike consumer goods, medical inflation in India runs 12–14% annually , the highest in Asia. That means if your retirement plan underestimates medical costs, you risk serious shortfalls. Geographic flexibility—higher-cost cities may push up living and medical costs faster.

Let's personalize your content